Sharing spreads more blessings. Today I share with you how to earn monthly dollar dividends in the Philippines without trading in the US stock market.

I always like earning fixed income, and one of my Retail Treasury Bonds (RTB) investments has matured already. So I asked my reliable banker any related investment product where I could re-invest my money and earn income regularly.

Thus, I found out about Allianz PNB Life Dollar Income Growth Dividend Paying Fund. With this investment, I won’t be getting a fixed income every quarter. Instead, I will be getting MORE every month because I could be earning monthly dollar dividend income and more profit potential once my net asset value grew over time.

What is Allianz PNB Life Dollar Income and Growth Dividend Paying Fund?

Allianz PNB Life Dollar Income and Growth Dividend Paying Fund is an investment fund with a goal to generate regular dividend income and long-term capital appreciation by investing primarily in US stocks, US high yield bonds, and US convertible bonds.

Why I Invested $20,000 in Dollar Income and Growth Dividend Paying Fund?

Monthly Dollar Dividend Payouts

I invested $20,000 in the Dollar Income and Growth Dividend Paying Fund because I think it would generate more profit for my savings through monthly dividend payouts and asset value appreciation.

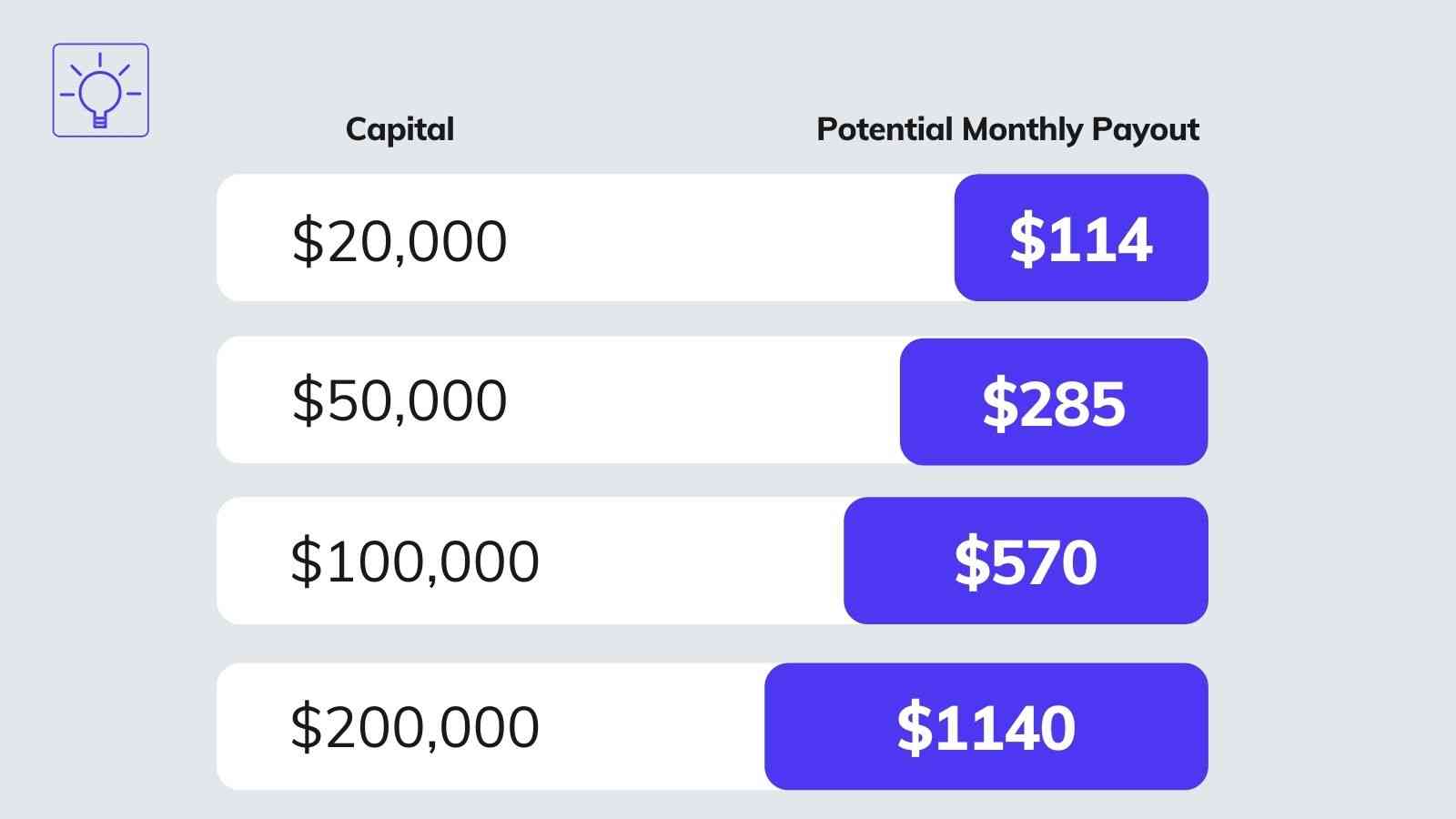

The average monthly dividend yield of my investment is 0.57%. For my $20,000 investment, it lets me earn an average of $114 every month. Cash is credited to my PNB USD account, which I can withdraw anytime.

It’s like earning a rental income every month, even without an apartment. For 12 months, my dollar dividend income will have an average of $1,368 (PHP 79,000).

This is what I could be making as monthly dividend if my capital is as follows:

Smart Asset Composition

The fund is strategically allocated in three assets: high yield bonds, convertible bonds, and US equities.

The composition of the investment is allocated more in bonds than stocks which I prefer at this time with the capital I set aside. I won’t be touching this capital in three to five years for regular passive income, although it is not a requirement.

Dollar Exchange Rate

Another reason why I decided to invest in this fund is the current dollar rate. It was below the PHP 50 level when I opened my investment. I anticipate that USD will climb back to its PHP 50+ level.

The dividends I receive every month are in USD. I can withdraw them anytime or hold them, or grow them as long as I want.

The US dollar has been weak due to the pandemic and rise of inflation when I started my investment, but the US has recovered now.

Net Asset Value Performance

The NAVPU (Net Asset Value Per Unit) performance of the fund is impressive. I entered below its all-time high, and I get dividends every month. I expect a moderate risk, but I’m confident with the rewards I would be getting with this investment in the long run.

Benefits of Dollar Income Growth Dividend Paying Fund:

Monthly Dividends (Tax-Free)

As I mentioned, one of the top benefits of Allianz PNB Life Dollar Income Growth Dividend Paying Fund is the monthly dividend income which will be credited to your PNB dollar account tax-free.

The annual dividend yield when I started is 6.84%, and the monthly dividend yield is 0.57%. It is indeed an effortless way to earn passive income.

Cut off for dividends is every 10th of the month. The credit of dividend income is within 20 business days after the dividend declaration (usually happens every month end or the first week of the following month).

Expert Management

Financial experts professionally manage the investment. The fund manager is Allianz Global Investors, a prestigious financial management firm owned by Allianz SE, a giant asset management and insurance company in Germany. Allianz has partnered with the Philippine National Bank, one of the largest commercial banks in the Philippines, to offer this investment fund.

When experts manage your fund, you don’t need to study the market, the economy, the best companies, assets, and strategies to beat the market or achieve capital growth. Your fund manager will do the complex and challenging stuff to reach the fund investment goals.

Invest in the USA while in the Philippines

Allianz PNB Life Dollar Income Growth Dividend Paying Fund will let you invest in US bonds and stocks without trading the US stock market or opening a stockbroker account while you are in the Philippines.

You will have exposure to companies in the United States since your fund will be allocated in US equities, US high yield bonds, and US convertible bonds. It’s a great way to have investment exposure in the US while you are a resident of the Philippines.

Top 10 Stock Holdings of Allianz Income and Growth Fund:

- Apple Inc.

- NVIDIA Corp.

- Microsoft Corp.

- Amazon.com Inc.

- Meta Platforms Inc.

- Wells Fargo & Company

- Mastercard Inc.

- Tenet Healthcare Corp.

- PG&E Corp.

- Welltower OP LLC

Free Insurance

You will get a life insurance policy when you open an Allianz PNB Life Dollar Income Growth Dividend Paying Fund. Amidst the risks of the fund, you will be protected and insured.

Excellent Performance

Aside from the regular dividend payouts, the investor can also have profit potential when his investment value grows over time. Allianz PNB Life dollar income growth dividend-paying fund has been performing well since the pandemic.

No Lock-in Contract

Of course, past performance is not an indication of future results. You can still decide when to redeem your entire investment and realize your profit.

How to Earn Dollar Dividends in the Philippines Without Trading in the US Stock Market?

1. Know your risk profile

Allianz PNB Life dollar income growth dividend-paying fund is suitable for moderate to aggressive type of investor. If you want to grow your capital for long term and accept the risks and volatility of the market, you can start investing in this fund.

If you’re afraid of sudden market crashes or unpredictable market trends, then this type of fund may not be for you.

2. Open a PNB Dollar Account

Since your investment is in USD, you will need a PNB dollar account because that is where your dividend income will be credited. It is straightforward to open a USD account in the Philippines. You can connect with an official PNB employee like Ms. Yhang Dungo. She will gladly assist your needs or inquiries.

3. Open a Dollar Income Growth Dividend Paying Fund

The next thing you need to do is open your investment. It’s also easy to open an account. You need to be a resident of the Philippines. Primary requirements are valid IDs and Tax ID Number (TIN).

More importantly, you need to fill out a Client Suitability Assessment form and Investor Profile Questionnaire to help you and your fund manager understand what type of investments are suitable for your risk tolerance.

The minimum fund to invest in Allianz PNB Life Dollar Income Growth Dividend Paying Fund without a premium charge is $20,000. You can invest more than that amount if you prefer.

4. Invest for long term

The dollar and income growth dividend-paying fund is suitable for medium to long-term investment because it is allocated to high yield bonds, convertible bonds, and common stocks. Some bonds mature in one year or more. Blue-chip stocks also need some months to grow in value.

5. Redeem your funds

When you reached your target profit and target holding period, you can redeem your entire investment. You can re-invest again whenever you want.

What are the risks of investing in the Dollar Income Growth Dividend Paying Fund?

Bonds and stocks carry volatility and risks just like other funds and assets in the market. An investor must be comfortable with market uncertainties and numerous factors that can affect the movement of interest rates and prices of stocks.

Factors like US Federal Reserve (Fed) decisions and commentaries, economic outlook, companies’ earnings, politics, inflation, consumer sentiment, market trends, stock market news, pandemic, and investors’ interests can affect the movement of the stock market.

Disclosure and Disclaimer: This article is for information purposes only and should not be considered as professional advice or endorsement of a particular investment. The author has units of Allianz PNB Life Dollar Income Growth Dividend Paying Fund. The article is written from her investment perspective. Past performance is not an indication of future results. All investment have risks and may cause loss of money. Always do your own research or hire an expert before investing.