Are you looking for the list of penny stocks in the Philippines priced below 1 peso? If the potential returns of penny stocks tempt you more than their risks, check out the latest list on this page.

Penny stocks are popular in the stock market worldwide, and Filipino traders also get their attention. Some experienced traders make significant profits with penny stocks, while many conservative investors remain curious about these speculative options.

If you’ve been trading on the Philippine Stock Exchange for a while, you’re probably interested in knowing the cheapest stocks to buy for under one peso. On this page, you’ll also learn about the advantages and risks of trading penny stocks.

What are Penny Stocks in the Philippines?

Penny stocks on the Philippine Stock Exchange typically refer to stocks priced below one peso per share. These are usually shares of small companies with a market capitalization of less than ten billion pesos. Their low prices attract traders despite the high volatility and limited liquidity.

Benefits of Trading Penny Stocks

Lower Share Price

One of the most compelling reasons for buying penny stocks is their low price per share. A trader who has a spare budget to purchase shares from a small, underrated company with a decent balance sheet and X10 income potential would consider buying some shares.

Possible Surge in Profit

That penny stock today could exponentially grow in value in the future, especially if it’s a disruptive company or a company that could change the world innovatively. For example, Amazon (AMZN), which is now worth $1.5 trillion, was traded under $2 in 1997 during its IPO.

Thrill of Trading

Some traders get bored trading growth stocks and those blue-chip stocks in the stock market. They want to explore the “road not taken” by many long-term investors. They trade speculative stocks like penny stocks. The big risk and high volatility of losing some money don’t bother them anyway. It’s the thrill it brings that matters and the possible upside and downside results.

Sizable Number of Shares

Some investors like the feeling of owning a large number of shares. Since penny stocks have a low price per share, you can buy 100,000 shares following the board lot. You can even buy 1 million shares of other small firms.

If the company’s stock surged in value, your profit could also skyrocket. For example, you bought 100,000 shares of a company at 0.40 per share. Then, there was a good catalyst in the news, so the price jumped to 0.80 per share. The gross value of your shares is now 80,000.

Disadvantages of Trading Penny Stocks

Higher Volatility

Penny stocks fluctuate more quickly than other stocks on the market. When the prices rally, you must move faster while the momentum goes in your favor because penny stock prices drop worse than other stocks. The fall is always like a market crash.

Rapid Loss of Money

While penny stocks have possible quick money potential, they could also cause a rapid loss of money in a short time. The higher the risk, the higher the reward in the stock market. The same is true with the higher the expectation, the painful the disappointment.

Low Trade Volume

Most penny stocks are not popular stocks and are not traded actively. Thus, they have low trade volume and liquidity. Investors may find it hard to sell penny stocks because of insufficient buyers.

Bankruptcy and Delisting

Penny stocks are primarily low-quality companies or those companies that are not yet stable. They join the stock market to gain capital and access funding from the public.

If their business doesn’t produce profit and fails to meet investors’ expectations, the company could lose enough capital and destabilize. As a result, it could go into bankruptcy and delisting on the stock exchange.

Top 47 Penny Stocks to Buy in the Philippines in 2025 (Priced Below 1 Peso)

| Company | Code | Price Per Share |

|---|---|---|

| Manila Mining Corp. | MA | 0.0031 |

| Apollo Global Capital | APL | 0.0066 |

| The Philodril Corp. | OV | 0.0075 |

| Swift Foods, Inc. | SFI | 0.052 |

| Lepanto Consolidated Mining | LC | 0.064 |

| Millennium Global Holdings | MG | 0.075 |

| Boulevard Holdings | BHI | 0.085 |

| Empire East Land Holdings | ELI | 0.120 |

| Allday Marts | ALLDY | 0.123 |

| Basic Energy Corp. | BSC | 0.126 |

| Transpacific Broadband Group | TBGI | 0.131 |

| Medco Holdings Inc. | MED | 0.132 |

| Premiere Horizon Alliance Corp. | PHA | 0.172 |

| Greenergy Holdings. Inc. | GREEN | 0.187 |

| Xurpas Inc. | X | 0.190 |

| East Coast Vulcan Corp. | ECVC | 0.300 |

| Medilines Distributors Inc. | MEDIC | 0.310 |

| Arthaland Corp. | ALCO | 0.330 |

| Balai ni Fruitas | BALAI | 0.355 |

| Century Properties Group | CPG | 0.405 |

| Oriental Peninsula Res Group | ORE | 0.410 |

| PH Resorts Group Holdings | PHR | 0.430 |

| Nihao Mineral Resources Int'l | NI | 0.450 |

| Agrinurture, Inc. | ANI | 0.485 |

| AbaCore Capital Holdings | ABA | 0.53 |

| Araneta Properties | ARA | 0.53 |

| A Brown Company, Inc. | BRN | 0.54 |

| AllHome Corp. | HOME | 0.57 |

| Merrymart Consumer Corp. | MM | 0.57 |

| Vitarich Corp. | VITA | 0.59 |

| Now Corp. | NOW | 0.60 |

| Harbor Star Shipping Services | TUGS | 0.60 |

| First Abacus Fin. Holdings | FAF | 0.61 |

| Fruitas Holdings, Inc. | FRUIT | 0.62 |

| CTS Global Equity Group | CTS | 0.63 |

| National Reinsurance Corp. | NRCP | 0.64 |

| Marcventures | MARC | 0.65 |

| City & Land Developers, Inc. | LAND | 0.68 |

| Upson Int'l Corp. | UPSON | 0.68 |

| Filinvest Land | FLI | 0.71 |

| Metro Alliance Corp. | MAH | 0.77 |

| Lorenzo Shipping Corp. | LSC | 0.77 |

| MRC Allied Inc. | MRC | 0.78 |

| Figaro Coffee Group | FCG | 0.83 |

| Suntrust Resort Holdings Inc. | SUN | 0.88 |

| Ionics, Inc. | ION | 0.90 |

| Raslag Corp. | ASLAG | 0.99 |

(Prices may change any second)

How to Trade Penny Stocks in the Philippines and Make a Profit

Step 1: See the list of penny stocks

The first thing you must do is have a list of the penny stocks to buy now in the Philippines. We already did this hard work by posting the list on this page. You may bookmark this page for your reference and check the updated price in real time when you trade.

Step 2: Consider the huge risk before trading penny stocks

Trading penny stock is for very aggressive investors who can tolerate high risk. It’s not for the faint-hearted or trader who suddenly gets nervous about losing money in the stock market in a short time.

Step 3: Select a company with potential to grow

Penny stocks are very unpredictable and highly volatile, so you must choose a company that has the potential to make money. When the company is profitable, investors will rise in numbers, and the stock could be bullish. As a result, you can always sell your shares for a profit.

Step 4: Check out the company’s track record

Always investigate before investing. It helps to check the company’s financials like their balance sheet and income statement. They are available to the public. Company profiles can also be found on the Philippine Stock Exchange (PSE) website.

Consider the following factors before investing in penny stocks in the Philippines:

- Business sector – the mining sector is riskier than the property sector

- Age of the company – or the corporate life of the company (the longer than 30 years, the better)

- Future potential – do you think the company will still be here in the next ten years or more?

- Track record – balance sheet and net income of the company in the last 5 years

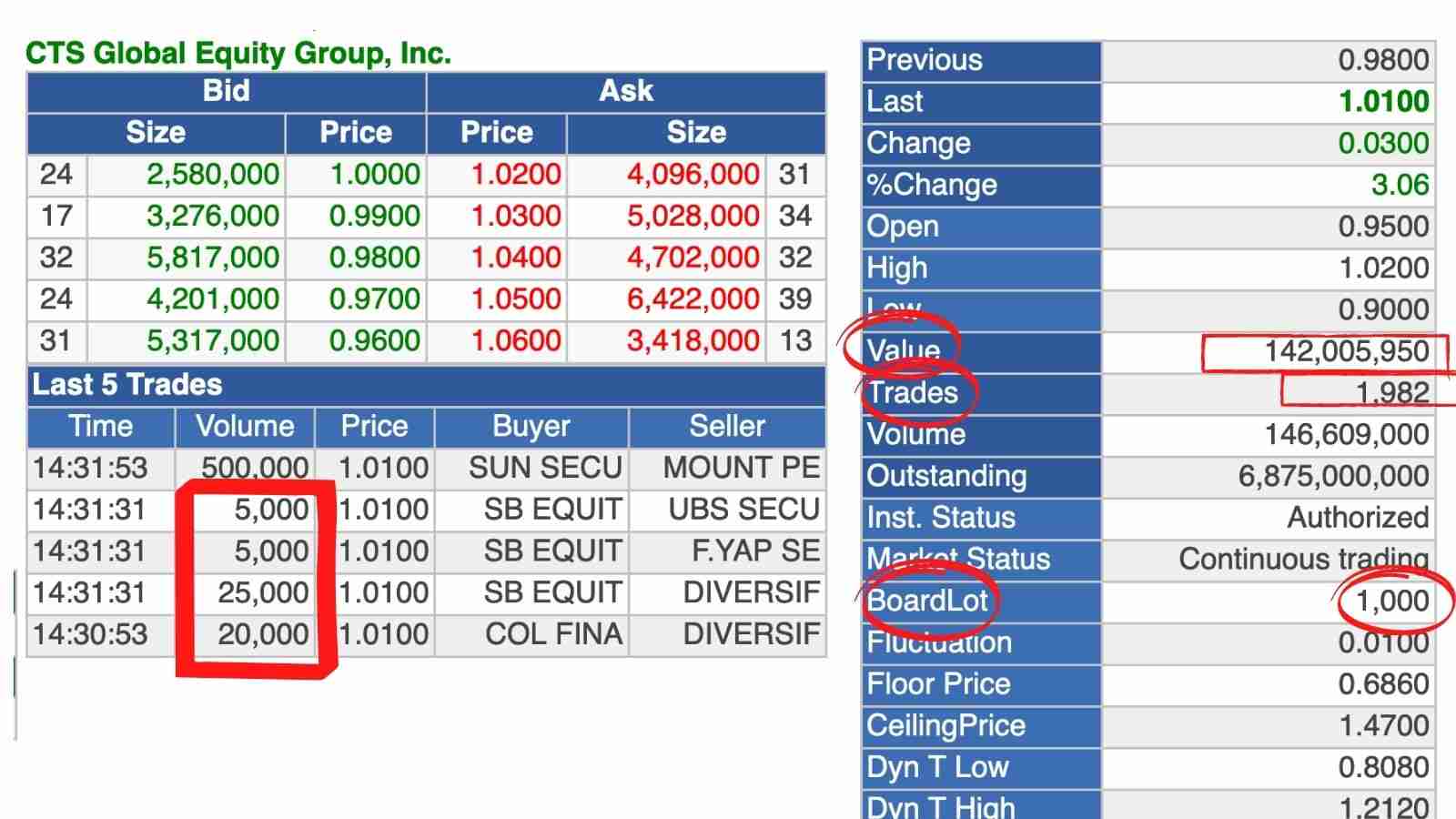

- Trade volume – trade the average volume (example: 5,000, 10,000, 20,000 shares) to sell quickly

- Trade value – the higher than 10 million, the better

Step 5: Buy your shares of penny stock

After you have decided about your investment, buy your shares of penny stock by making a BUY order using your online trading platform. Provide the number of shares (following the board lot) and your chosen penny stock price.

Step 6: Sell your shares at your target price

Remember that penny stocks fluctuate quickly. Sell your shares when you reach a profit already. Lock in your gains as fast as you can. Otherwise, you’ll miss the chance of achieving that profit in a short time, or you might have to cut your losses when the chart reverses.

FAQ About Philippine Penny Stocks

How to buy penny stocks online in the Philippines?

To buy penny stocks online in the Philippines, open an online stockbroker account accredited by the Philippine Stocks Exchange. Then fund your account to start trading penny stocks. Buy shares following the board lot associated with your trade.

What are basura stocks?

Basura stocks refer to speculative stocks and stocks with poor fundamentals or those companies that lack a good track record. Some people also consider them as penny stocks, but not all penny stocks are basura stocks, and not all basura stocks are irrelevant.

Can You Make Money Fast with Penny Stocks?

You can make money faster in the stock market, but you can also lose money in a very short time. To make money trading, you need to gain enough knowledge, experience, and successful trading technique to grow your portfolio.

Can You Lose Money Trading Penny Stocks?

Yes, traders who don’t have an adequate strategy for trading penny stocks can instantly lose money because penny stocks surge and drop quickly due to high volatility, less liquidity, and unsatisfactory performance.

Other Trading Tips and Guides:

- Best Dividend Stocks in the Philippines in 2025

- Best Philippine Stocks to Invest for Long Term

- Top Financial Companies in the Philippines in 2025

Disclaimer: This article is for information purposes only and should not be taken as professional advice or endorsement of a particular investment. Penny stocks carry huge risks. Always trade with due diligence or ask an expert before trading your money.

Subscribe for free for more updates!