Here is a basket of the top 25 best US stocks to invest in 2024. These are the best stocks to buy right now if you are looking for the best companies in the USA to grow your portfolio for long term. These companies have solid track records and are expected to continue growing year by year.

We compiled these US stocks picks with the following criteria: strong fundamentals, great profit return, index inclusion, and innovative potential. Many of the stocks from our picks also pay out dividends. That’s a big bonus!

Note that we included the TP (Target Price) and BBP (Buy-Below-Price) of each stock at the end section of the article. The target price is based on price movement, momentum, and average financial analysts’ target. The BBP is the margin to buy the stock to earn a profit of 10% or more. The table is not a recommendation, prediction nor an investment advice.

Top 25 Best US Stocks to Invest Right Now:

1. Amazon

Amazon (Ticker: AMZN) is among the largest companies in the US in terms of revenue. This retail giant and cloud services company net sales for the full year of 2023 increased 12%. Amazon was founded by Jeff Bezos, who was also its CEO and the owner of The Washington Post.

AMZN is listed in the Nasdaq 100 and S&P 500 index. It is also one of the Big Four Tech Companies alongside Google, Apple, and Microsoft. Amazon is the second US company to have reached the trillion market cap.

2. Microsoft

Microsoft (Ticker: MSFT) is also one of the Big 4 Trillion Market Cap companies in the USA. Having a 3 trillion market cap, Microsoft is also the Top 1 from Forbes Just 100 Companies. It truly deserves a spot among the Best US Stocks to Invest in 2024. MSFT pays out regular dividends to its stockholders four times a year. Yay!

Microsoft was founded by Bill Gates and Paul Allen, two of the richest men in the world. The company is also one of the most successful software companies in the world with many famous subsidiaries, including Skype, LinkedIn, Xbox Game Studios, GitHub, and many more tech companies.

3. Alphabet

Alphabet (Ticker: GOOG) is a holding company and mainly known as the parent company of Google and its many businesses and product lines including Android, Google Search, YouTube, apps, maps, ads, Nest, Google Ventures, Google Capital, cloud, healthcare, and many more.

Don’t miss reading: Google Stock Target Price and Stock Analysis

Simply put, choose Alphabet if you want a “bet” on “Alpha” investments. Alphabet is one of the largest companies in the USA in terms of revenue. It is the fourth US company that achieved 1 trillion market capitalization.

4. Apple

Apple (Ticker: AAPL) is one of the most iconic brands in the world. It is a giant tech company that invented the Macintosh, iPhone, iPad, Mac, Apple Watch, Apple TV, and many more innovative products and services.

It created notable software platforms including iOS, macOS, watchOS, tvOS, and online services App Store, Apple Music, iCloud, and Apple Pay.

Apple Inc. is the first US company that reached the trillion market cap in history. Just recently, it crossed the 2.6 trillion market cap. It ranked Number 2 among the Most Innovative Companies in 2024. AAPL stock is currently among the top stocks listed in the Dow Jones, Nasdaq 100, and S&P 500.

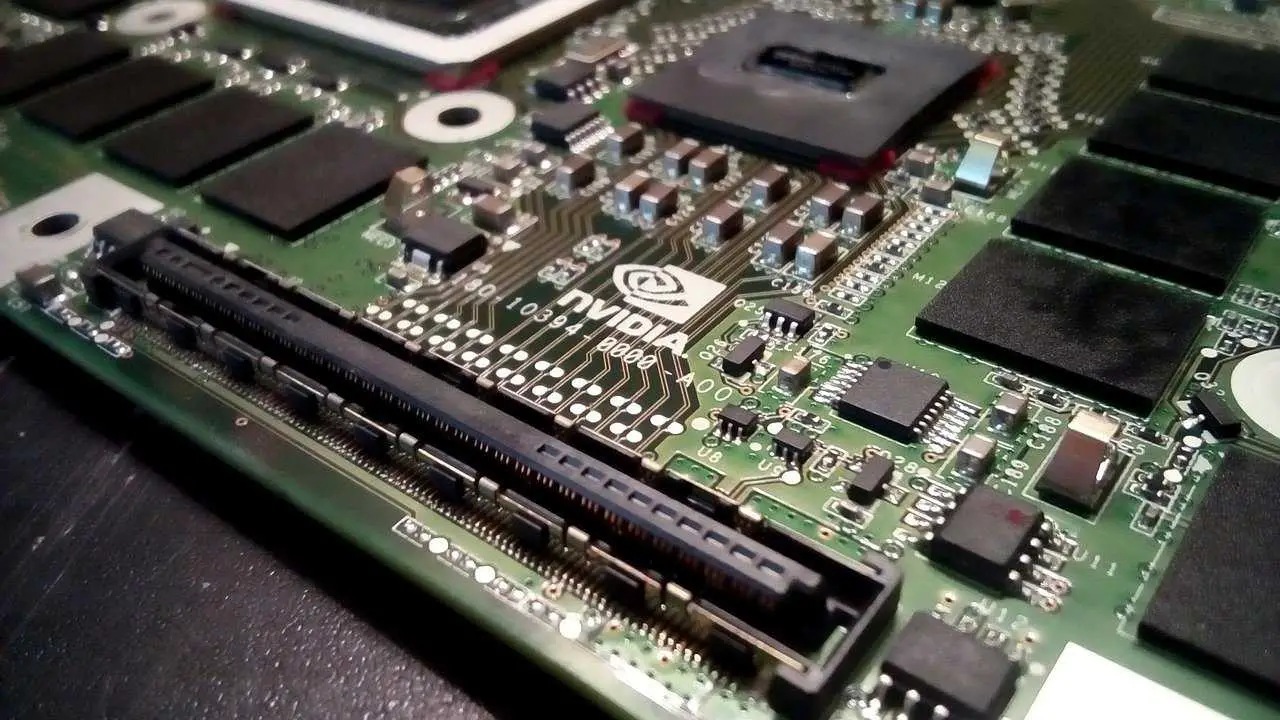

5. NVIDIA

NVIDIA (Ticker: NVDA) is a cutting-edge computer company that designs, manufactures, and markets graphics processing units (GPUs) used in gaming, data centers, and artificial intelligence (AI). The company was founded in 1993. For decades, NVIDIA led the field of visual computing by reinventing and transforming computer graphics.

Don’t miss reading: “Top 8 Reasons Why You Should Invest in NVIDIA”

NVDA stocks also pay dividends four times every year. NVIDIA is currently among the top stocks listed in the NASDAQ 100. The growth potential of this stock is as positive as to how cloud computing is forecast to grow in the years to come.

6. Tesla

Tesla (Ticker: TSLA) is the highest valued car manufacturer in the world. This earth-friendly company specializes in the production of all-electric vehicles and sustainable energy ecosystem. Tesla is currently listed in the Nasdaq 100 and S&P 500 index and has over 515 billion market capitalization.

Is it too late to invest in Tesla? It’s not too late if you’re into long term investing and if you’re thinking about the potential of EV in the next 10 years.

Tesla is one of the most controversial stocks. Its skyrocketing trend could dive any time its CEO Elon Musk makes an awkward tweet. TSLA once became the most shorted stocks in the US, taking the place of Apple. Nonetheless, buying on the dip and market crash could be profitable while applying some trailing stops.

7. Mastercard

Mastercard (Ticker: MA) is one of the best global payment technology companies in the world. The company provides financial solutions in more than 210 countries around the world—Mastercard processes around $3.6 trillion transactions per year.

This credit card giant continues to innovate technology to serve faster digital payments. Mastercard has over $440 billion market capitalization. It is listed in the S&P 500 index. Mastercard has a dividend yield of 0.55%. We love this stock as it rewards dividends consistently every quarter every year.

8. JPMorgan Chase

JPMorgan Chase & Co. (Ticker: JPM) is one of the oldest financial institutions in the US and one of the largest banks in the world. With a history dating back over 200 years, its assets under management are now worth more than $2.9 trillion. JPM’s hedge fund unit is also one of the biggest hedge funds in the world.

With over $560 billion market cap, JPM stock is among the top components of the S&P 500 and Dow Jones Industrial Average index. JPM pays dividends quarterly.

9. Walmart

Walmart (Ticker: WMT) is the one of the largest retailers in the world. The giant market chain recorded consolidated revenue of $648.1 billion in FY2024. It forecast to achieve 3% to 4% growth for its FY2025 operating income. Currently, it has more than $480 billion market capitalization.

Walmart is also generous in terms of dividends. The company pays its stockholders dividends every quarter of each year. Walmart has been steadily growing, and the potential of eCommerce is a significant venture.

10. Visa

Visa (Ticker: V) is the No. 1 payment processor in the world. Dating back to 1958, Visa has become a reputable payment brand providing digital currency solutions in more than 200 countries worldwide.

Visa processed 276.3 billion transactions. V stock is included in the S&P 500 and Dow Jones Industrial Average index. Visa is one of our favorite fintech stocks for long term because of its continuous payment innovation, the growing volume of Visa cardholders, and increasing partner networks.

11. NextEra Energy

NextEra Energy (Ticker: NEE) is the world’s largest producer of wind and solar energy, with 72 gigawatts in operation The company is one of America’s largest capital investors in infrastructure, with $85-95 billion planned investments through 2025.

With over $131 billion market cap, NEE stock is among the components of the S&P 500. The company also pays quarterly dividends. The annual dividend of NEE stock is $2.06.

12. UnitedHealth

UnitedHealth Group (Ticker: UNH) is the largest healthcare company in the world in terms of revenue. The company offers health care insurance, software, and data consultancy services. UNH has over $420 billion market cap. It is among the top stocks listed in the S&P 500 and Dow Jones index.

The giant healthcare firm rewards quarterly dividends to its shareholders. The annual dividend is $7.52. Sweet!

Unitedhealth’s outlook for 2024 is looking very good. It is expecting $400 billion to $403 billion revenue. Cash flows from operations are expected to range from $30 billion to $31 billion.

13. Salesforce.com

Salesforce.com (Ticker: CRM) is one of the top-notch cloud-based companies. It is the world’s number 1 Customer Relationship Management (CRM) platform. More than 150,000 companies worldwide use Salesforce to grow their businesses.

The company is among the components of the S&P 500 and Dow Jones Industrial Average. Salesforce’s 3-year total price return is more than 37%. Beginners and long term tech investors like CRM stock.

14. Adobe

Adobe (Ticker: ADBE) is an American company founded in 1982. It creates multimedia and creativity software products, including Photoshop, Acrobat Reader, Creative Cloud, Document Cloud, and Experience Cloud.

According to Adobe, more than 400 billion PDFs opened and 16 billion documents edited using Adobe Acrobat last year. The company made $19.41 billion revenue in FY2023.

Adobe is among the top stocks listed on the NASDAQ 100 and S&P 500. The company has over $217 billion market capitalization. Adobe makes recurring income from paid subscriptions to its products. It is also showing a growing trend in the charts year by year.

15. Advanced Micro Devices

Advanced Micro Devices (Ticker: AMD) is a leading tech company that innovates both high-performance graphics and high-performance computing technology. Founded in 1969, AMD is now one of the world’s leading semiconductor companies. AMD stock belongs to both NASDAQ 100 and S&P 500 index.

AMD has over $275 billion market cap. The high-end chip maker recorded a full-year 2023 revenue of $22.7 billion and a net income of $854 million. We think that AMD stock has big potential for long term investment.

16. Meta Platforms

Meta Platforms (Ticker: META) is a social-technology company founded in 2004. With more than 1 billion daily active users, Meta owns successful platforms and apps, including Facebook, Instagram, WhatsApp, Messenger, Oculus, Workplace, Portal, and Novi.

Facebook’s parent company has around 1.3 trillion market cap and listed among the top stocks in the NASDAQ 100 and S&P 500.

17. Starbucks

Starbucks (Ticker: SBUX) is a prominent coffee company and the world’s largest coffeehouse chain with over 30,000 stores worldwide. It is one of the World’s Most Admired Companies and one of the World’s Most Valuable Brands. Starbucks has more than $98 billion market cap and currently listed among the S&P 500 constituents.

Why should you invest in Starbucks stock? Number reason, it’s because it has a solid dividend yield (currently 2.6%). SBUX is one of the top dividend-paying blue-chip stocks in the USA. The company pays dividends to its shareholders four times a year.

18. Block

Block Inc. (Ticker: SQ) is an online payment technology company that offers point-of-sale solutions, analytics, and reporting tools. Square Inc. changed its brand to Block Inc. in December 2021. Founded in 2009, the creator of Square brand has more than $47 billion market cap.

We think that Block will benefit from the growing cashless transactions and the future of digital payment ecosystem.

19. Home Depot

Home Depot (Ticker: HD) is the world’s largest home improvement retailer. Founded in 1978, the company has more than 2,300 stores across North America. With over $354 billion market cap, HD is listed among the selected stocks in the S&P 500 and Dow Jones Industrial Average index.

The company reported sales of $152.7 billion in FY2023. Home Depot also pays quarterly dividends to shareholders. The annual dividend is $9.00.

20. McDonald’s

McDonald’s (Ticker: MCD) has been here since 1940. It is one of the world’s leading fast-food chain company with more than 36,000 restaurants in more than 100 countries, serving over 69 million customers daily. The food chain giant has more than $190 billion market capitalization.

MCD is among the best dividend-paying stocks in the US. With a dividend yield of 2.5% and an annual dividend of $6.68, it’s indeed one of the favorite stocks of dividend investors.

21. PayPal

PayPal (Ticker: PYPL) is a digital payment platform with over 277 million active account holders in more than 200 markets around the world. It has product segments, including Braintree, Venmo, and Xoom. PayPal lets consumers and merchants receive money in more than 100 currencies, withdraw funds in 56 currencies, and hold balances in their PayPal accounts in 25 currencies.

PYPL has over $69 billion market cap and is listed both on the S&P 500 and NASDAQ 100 index. This digital and mobile payment platform continues to expand its payment services.

22. Berkshire Hathaway

Berkshire Hathaway (Ticker: BRK.B) is the giant holding company of legendary investor, Warren Buffett. It is one of the favorite stocks of millennials. The company ranked No. 4 in World’s Most Admired Companies and is among the largest companies in the USA in terms of revenue.

Berkshire Hathaway also has a stock portfolio of popular companies like Apple, Coca-Cola, American Express, Bank of America, Snowflake, among others. So if you’re looking for the best Warren Buffett stocks, investing in BRK.B is a good option.

BRK.B has over $900 billion market cap and is among the finest stocks listed in the S&P 500. Berkshire Hathaway also manages well-known brands, including Dairy Queen, Fruit of the Loom, NetJets, GEICO, Helzberg Diamonds, Pampered Chef, and Kraft Heinz and many more.

23. Boeing

Boeing (Ticker: BA) is the world’s largest aerospace company and leading manufacturer of commercial jetliners, defense, space, security systems, and service provider of aftermarket support. The company has more than $111 billion market cap and is among the top components of Dow Jones and S&P 500.

In every crisis, there is an opportunity. That’s what long term investors of BA stocks always do when the price of BA stock drops.

24. Netflix

Netflix (Ticker: NFLX) is the world’s leading streaming entertainment service, with 260 million paid memberships in over 190 countries. The company reported added subscribers of 13.1 million in the December quarter 2023.

The streaming entertainment giant currently ranked 23rd in Fortune’s World’s Most Admired Companies. Netflix is very close to reaching it all-time high price level.

25. ServiceNow

ServiceNow (Ticker: NOW) was founded in 2004. It offers digital cloud-based solutions and serves more than 8,100 enterprise customers around the world. 85% of the Fortune 500 companies use ServiceNow.

From its FY2023 report, ServiceNow already made $8.68 billion subscription revenue. That is 25.5% YOY growth. Cloud computing is a very resilient business, and it continues to grow. NOW is currently listed in the S&P 500. It has more than $160 billion market cap.

| Stock | Buy-Below-Price | Target Price |

|---|---|---|

| Amazon (AMZN) | 186 | 205 |

| Microsoft (MSFT) | 409 | 450 |

| Alphabet (GOOG) | 150 | 165 |

| Apple (AAPL) | 182 | 200 |

| NVIDIA (NVDA) | 864 | 950 |

| Tesla (TSLA) | 195 | 214 |

| MasterCard (MA) | 455 | 500 |

| JPMorgan Chase (JPM) | 184 | 202 |

| Walmart (WMT) | 59 | 65 |

| Visa (V) | 273 | 300 |

| NextEra Energy (NEE) | 64 | 70 |

| UnitedHealth (UNH) | 477 | 525 |

| Salesforce.com (CRM) | 291 | 320 |

| Adobe (ADBE) | 545 | 600 |

| Advance Micro Devices (AMD) | 177 | 195 |

| Meta Platforms (META) | 481 | 529 |

| Starbucks (SBUX) | 91 | 100 |

| Block (SQ) | 77 | 85 |

| Home Depot (HD) | 355 | 390 |

| McDonald's (MCD) | 273 | 300 |

| Paypal (PYPL) | 60 | 66 |

| Berkshire Hathaway (BRK.B) | 386 | 425 |

| Boeing (BA) | 205 | 225 |

| Netflix (NFLX) | 573 | 630 |

| ServiceNow (NOW) | 727 | 800 |

Disclaimer: This content is for information purposes only and should never be considered as professional advice or endorsement of a specific company. Every investor has different risk tolerance and goals. Always do your own research to meet your goals. All investments have risks. Risk only the capital you’re not afraid to lose. I have no business relationship with the companies whose stocks have been mentioned.