Here are the top 7 reasons why you should invest in SPY ETF (SPDR S&P 500 Trust ETF), the very first Exchange-traded fund in the United States and the largest ETF in the world by market cap.

With over $376 billion assets under management (AUM), SPY ETF is among the most popular and most invested ETFs on the market. With over 500 premium stocks, who couldn’t consider SPY ETF to their portfolio?

Perhaps, you’re among those investors who own SPY ETF shares. But if you’re still one of those investors pondering why you should invest in SPY ETF, we share our insights on why we like to include this asset among our favorite exchange-traded funds.

What is SPY ETF?

SPY ETF is also known as SPDR S&P 500 Trust ETF. It tracks the performance of the S&P 500 index. SPY ETF is created as a unit investment trust and offered by State Street Global Advisors. SPDR S&P 500 Trust ETF is the oldest exchange-traded fund listed in the USA.

7 Reasons Why Invest in SPY ETF (SPDR S&P 500 ETF)

1. SPY ETF has High-Quality Holdings

Since the benchmark of SPY is the S&P 500 index, it invests in over 500 excellent companies. As of May 2, 2022, SPY ETF has 505 holdings. They have carefully selected the components of leading and highly liquid companies with consistent positive earnings.

About 27.65% of the fund is allocated to the information technology sector. SPY ETF’s top 10 holdings include Apple, Microsoft, Amazon, Alphabet, Meta Platforms (formerly Facebook), Tesla, NVIDIA, Berkshire Hathaway, and UnitedHealth Group.

The fund also invests in the health care, consumer discretionary, financials, communication services, industrial, consumer staples, energy, real estate, materials, and utility sector.

2. The Performance of SPY ETF is always Outstanding

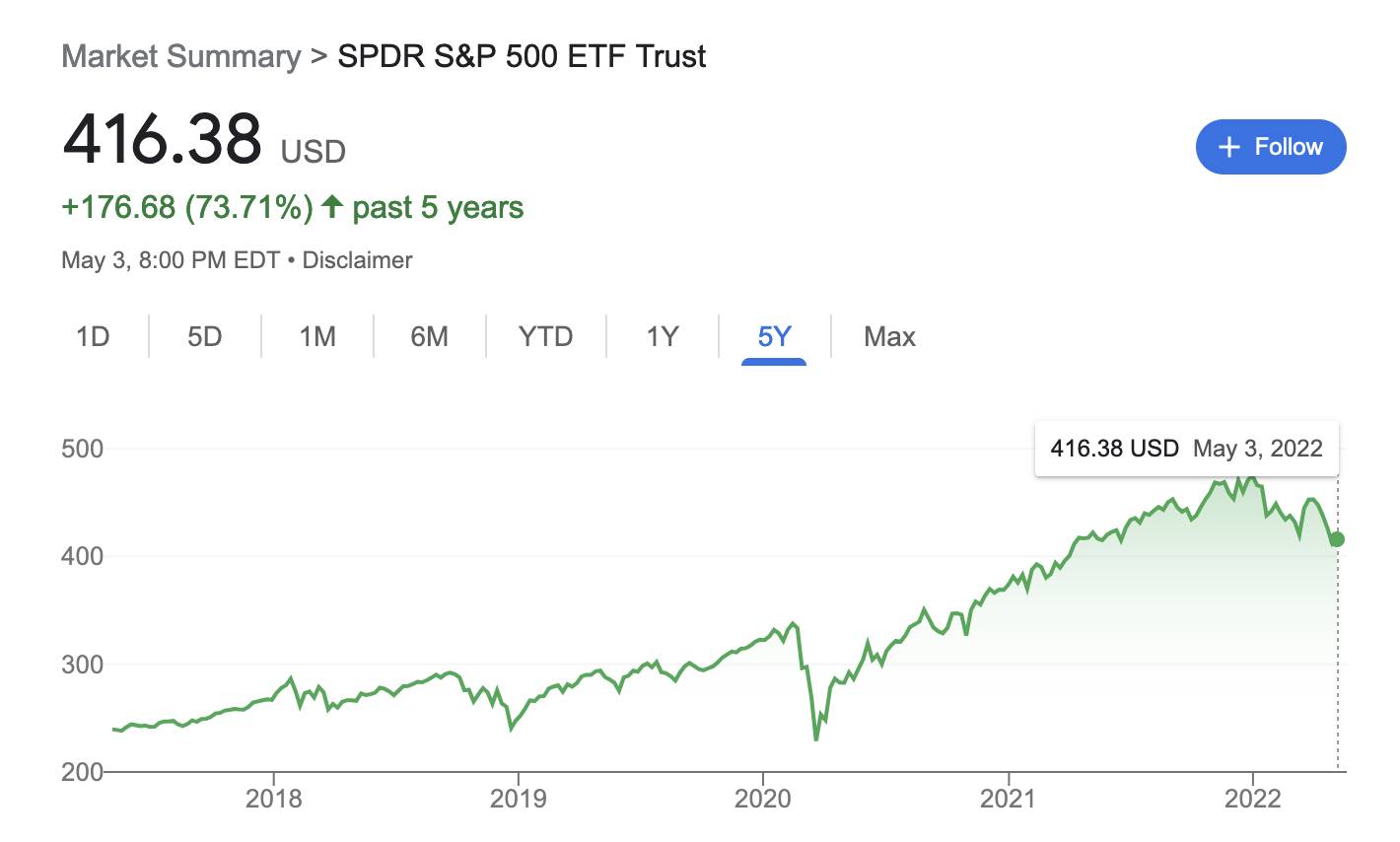

The performance of SPY is always outstanding and consistently beat the average return of other huge investment funds.

According to Seeking Alpha, the total price return of SPDR S&P 500 Trust ETF in 3 years is 49.53%, and 89.43% in 5 years. Historical performance doesn’t guarantee future performance.

3. Investing SPDR S&P 500 Trust ETF is Very Affordable

The easiest way to invest in the S&P 500 index is by investing in an index fund or ETF (exchange-traded fund). Investing in SPY exchange-traded fund is very affordable. Some brokers and trading platforms even accept fractional shares of many ETFs like SPY.

Even the legendary investor Warren Buffett recommends investing in an S&P 500 low-cost index fund regularly.

4. Investing in SPY ETF Provides Diversification

Investing in SPY ETF is less risky than investing in individual stocks because you’re allocating your capital to more than 500 of the USA’s largest and most dominant companies.

It provides diversification as the fund is invested in eleven prominent business sectors. The risk is not concentrated in just one or a few industries.

Besides diversification, you can also apply SPY ETF as a hedge if you have significant capital in individual stocks.

5. SPY ETF Pays Dividends Every Quarter

If you are fond of receiving dividends every quarter of the year, consider investing in SPY exchange-traded fund. The dividend yield is 1.41%, and the annual dividend is $5.81. The 3-year compound annual growth rate is 3.50%.

6. It is Very Convenient to Trade SPY ETF

Unlike mutual funds, ETFs are very convenient to trade. You can buy or sell your shares of SPY ETF on any trading day. Just like stocks, you can apply your own trading strategies. Buy, hold, sell at your own pace. If you’re a skilled tactical trader, you would like the flexibility of trading SPDR S&P 500 Trust ETF.

7. SPY ETF is Good for Long Term

The S&P 500 index will always be a significant part of the global financial market. We believe it will continue to grow amid economic challenges and will recover after every recession.

Investing in a fund like the SPDR S&P 500 Trust ETF always provides passive income opportunities for long-term investors because the basket’s components are chosen based on consistent earnings, market capitalization, and stability.

Top 25 Holdings of SPY ETF By Weight

SPY ETF mimics the performance of the Standard & Poor’s 500 index. The top 25 constituents of SPY ETF as of May 2, 2022, are:

- Apple Inc. (AAPL)

- Microsoft Corp. (MSFT)

- Amazon.com Inc. (AMZN)

- Tesla Inc. (TSLA)

- Alphabet Inc. Class A (GOOGL)

- Alphabet Inc. Class C (GOOG)

- Berkshire Hathaway Inc. Class B (BRK.B)

- NVIDIA Corp. (NVDA)

- Meta Platforms Inc. Class A (FB)

- UnitedHealth Group Inc. (UNH)

- Johnson & Johnson (JNJ)

- Procter & Gamble Co. (PG)

- Exxon Mobil Corp. (XOM)

- JPMorgan Chase & Co. (JPM)

- Visa Inc. Class A (V)

- Home Depot Inc. (HD)

- Mastercard Inc. Class A (MA)

- Chevron Corp. (CVX)

- Pfizer Inc. (PFE)

- AbbVie Inc. (ABBV)

- Bank of America Corp. (BAC)

- Coca-Cola Company (KO)

- Broadcom Inc. (AVGO)

- Costco Wholesale Corp. (COST)

- PepsiCo Inc. (PEP)

Source: State Street Global Advisors

What are the Risks of Investing in SPY ETF?

Although SPY ETF is very attractive for beginners and experienced investors, it is not exempted from market volatility and risk. Stock market indices, including the S&P 500 may suffer from a sudden market crash, periodic correction, economic status, short sell-off, trade war, and FED hike.

Many traders think SPY is overpriced as it just reached its all-time high recently, and they believe a correction will occur any moment now. The admirable yields and returns of SPY in the past are never a guarantee of future results.

Exchange-traded funds like SPDR S&P 500 Trust ETF is not suitable for an investor who doesn’t understand the risk and vulnerability of the stock market.

How to Invest in SPY ETF?

- Get to know your risk profile

- Have an investment objective

- Have an investment strategy

- Open an online trading account

- Search for the ticker SPY

- Open a trade position

- Follow your strategy and objective

Other Stock Market Index Investments You Should Know:

- How to Invest in Index Funds (Complete Guide)

- Best Vanguard ETFs to Invest for Long Term Growth

- 102 Holdings of QQQ ETF

What is the expense ratio of SPY ETF?

The gross expense ratio of SPDR S&P 500 Trust ETF (SPY) is 0.0945%. Expense ratio is an important factor to consider when choosing an investment like SPY ETF because a lower expense ratio contributes to higher profitability.

Which is the better ETF? SPY ETF vs. VOO

Both SPY and VOO ETF track a similar index, the S&P 500; thus, their performances are the same. However, VOO’s expense ratio of 0.03% is slightly cheaper than SPY’s 0.0945%. It boils down to the size of your capital because you would feel the difference when you used a six-figure fund.

Disclaimer: This article is based on the author’s opinion and should not be taken as investment advice or recommendation of a particular investment. ETFs and stocks have risks. Past performance is not a guarantee of future results. Always do your own research or hire an expert before making any investment that fits your objective. The author has no business relationship with any of the companies mentioned above.