Follow these 18 golden rules of investing in the stock market, and you will definitely develop your own effective strategy to grow your money and portfolio even if you are a beginner.

We invest in the stock market to make more income and compound our money. But because of the income potential, many people get so overwhelmed that they forget to develop their own efficient method. The result, they lose lots of money.

How do I begin to invest in the stock market? As long term active investors, we follow these 18 methods religiously, and we consistently close profits trading in the stock market.

18 Golden Rules to Grow Money in the Stock Market

1. Start Small and Think Big

Big things start from small beginnings. Whatever it is that you do, if it’s your first time doing it, do it slowly. You must first test the waters.

Start investing a small portion of your savings or monthly income. Don’t feel ashamed if it’s only $1000 or $500 or even $100 a month.

What is more important is that you’re doing it right (choosing the best companies), and you will get better and better each time you invest. This way, you’ll develop an effective technique of trading strategy until you reached your target equity.

How can I start investing with little money?

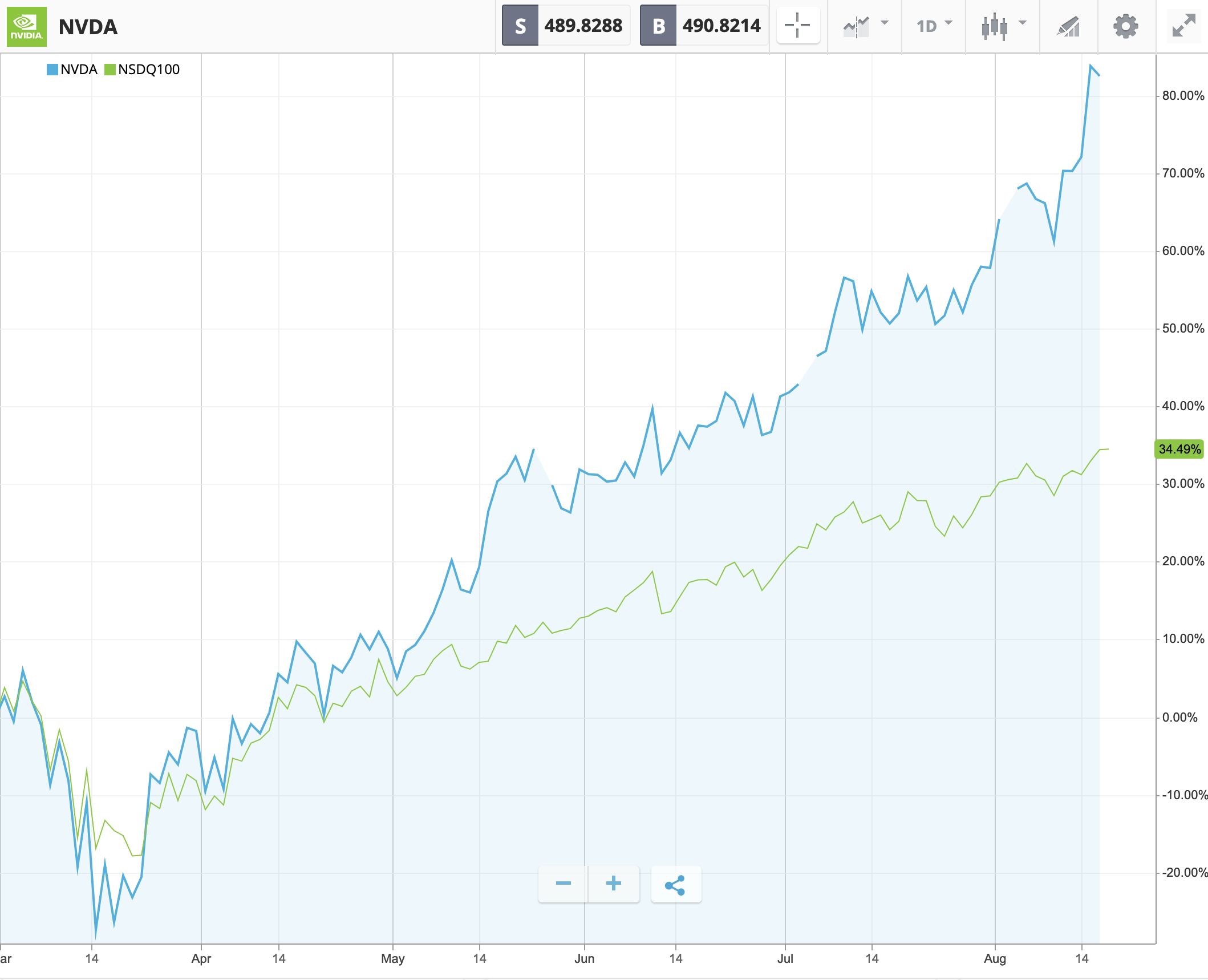

Buy small units of stocks and do it periodically. Check out how much we’ve made so far investing NVIDIA shares of stocks with only $50 bucks every month.

2. Have a Focused Mindset

Forget about Forex and stop thinking about cryptocurrencies for a while. Those instruments are too volatile. Remember that you are investing in stocks. Focus on the companies where you want to invest. Know their potential because they will bring you potential profit.

3. Invest in Good Named Stocks

Select some of the big blue-chip companies to start your portfolio. We want to do this because those companies are well-established already, and we also want to establish a strong foundation for our portfolio. Forget about those companies launching their IPO; they’re not your priority at this time.

You can also start by listing down 5 or 10 companies with the following criteria:

- Large market cap

- Companies we can’t live without

- Must belong to an index

- Has a strong Balance Sheet

- Makes consistent Yearly Earnings

That is so true. Investing and trading in the stock market is already risky and complicated. Why make it more dangerous if you invest in companies you don’t know much about. The best stocks to invest are always the ones you’re comfortable putting your money into because you believe their business will operate for more years to come.

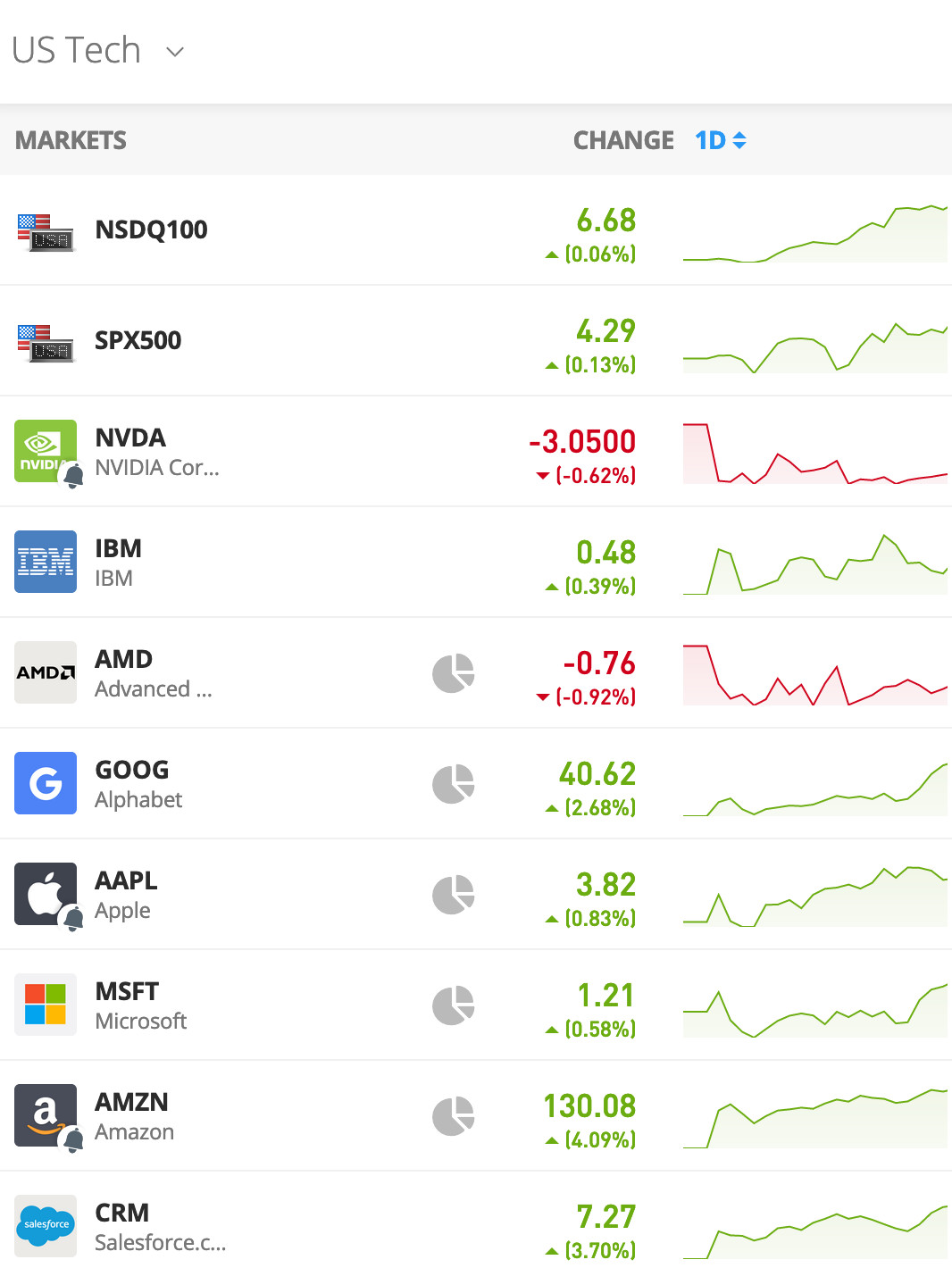

4. Track your Watchlist

Having an organized watchlist helps so much when trading in the stock market. We see many people create messy watchlist here and there. You can avoid that by creating your watchlist per category.

Tip: Add your benchmark at the top of the list to track the movement of related stocks.

For example, we want to create a watchlist for US tech stocks. We will add NASDAQ 100 and S&P 500 at the top of the list then followed by each tech stock we want to monitor.

NASDAQ 100 tracks the performance of the best tech companies in NASDAQ while S&P 500 tracks mostly large companies in the US. When you see these two indices in green, more likely, many US stocks will follow the same.

Having a neat and organized watchlist will help you to execute your trades better because you can see clearly how they perform, and you can set up some price alerts to trigger your entry and exit actions.

5. Buy and Go Long

One of the easiest and simplest methods of investing in the stock market is “buy and hold strategy.” If you have carefully chosen your stock picks, buying some shares, and holding them until you reached your target profit is the main concept of this technique.

The challenge of this part is filtering the right stocks where to invest your money, which was already discussed on Rule #3.

How long should you hold your shares to make money investing?

It depends upon your TP (Target Profit or Target Period). If your target profit is 10%, close your trade when you achieved that profit already. Likewise, if your target period is one month and you see some earnings already, close your position and find another excellent opportunity.

Every person has a different investment horizon. Some investors have goals of 1 week, 1 month, 6 months, 1 year, 3 years, or more. The major factor in generating wealth is the company where you have invested your funds.

6. Pick Stocks with High Trade Volume

Stocks volume is an essential market indicator because it affects a stock price movement. It can also indicate liquidity, how fast you can buy and sell stocks without affecting the price. That means your buy or sell orders can be executed quickly.

Why stock trading volume matter?

Because without volume, stocks price will not move actively. You don’t want to be trapped in trading idle stocks. Trading volume is vital with liquidity. It is how you can enter and exit quickly trading stocks. It can also help you with your trading decisions and strategies by evaluating breakouts and momentum.

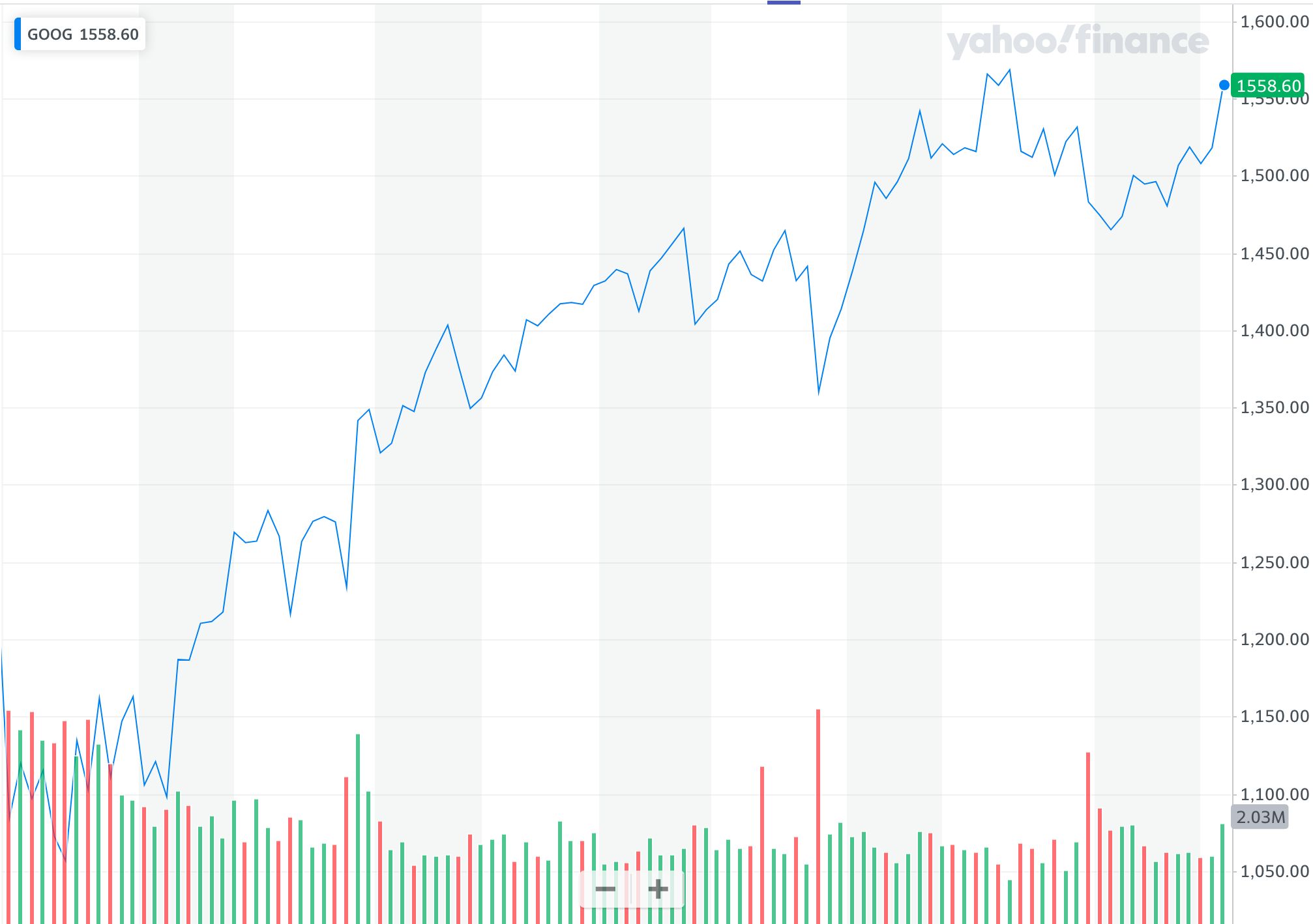

7. Track the Momentum

When it comes to trading the stock market, it always helps to track the momentum of stocks because the trend is our friend. This is very useful when analyzing the performance of the stock. It can guide both traders and investors in creating an entry and exit point.

We do this by analyzing the stock price performance, moving average, and relative strength. We know this sounds a bit of technical but we’re going to discuss how we do it as easy as possible.

Determine Stock Performance vs. Your Benchmark

To start, compare your chosen stock between your benchmark or the main index. If you want to beat the market, you have to know if your stock always outperforms the main index. It’s a positive indicator when a stock always beats the market in 1 month, 6 months, 1 year, 5 years, or more.

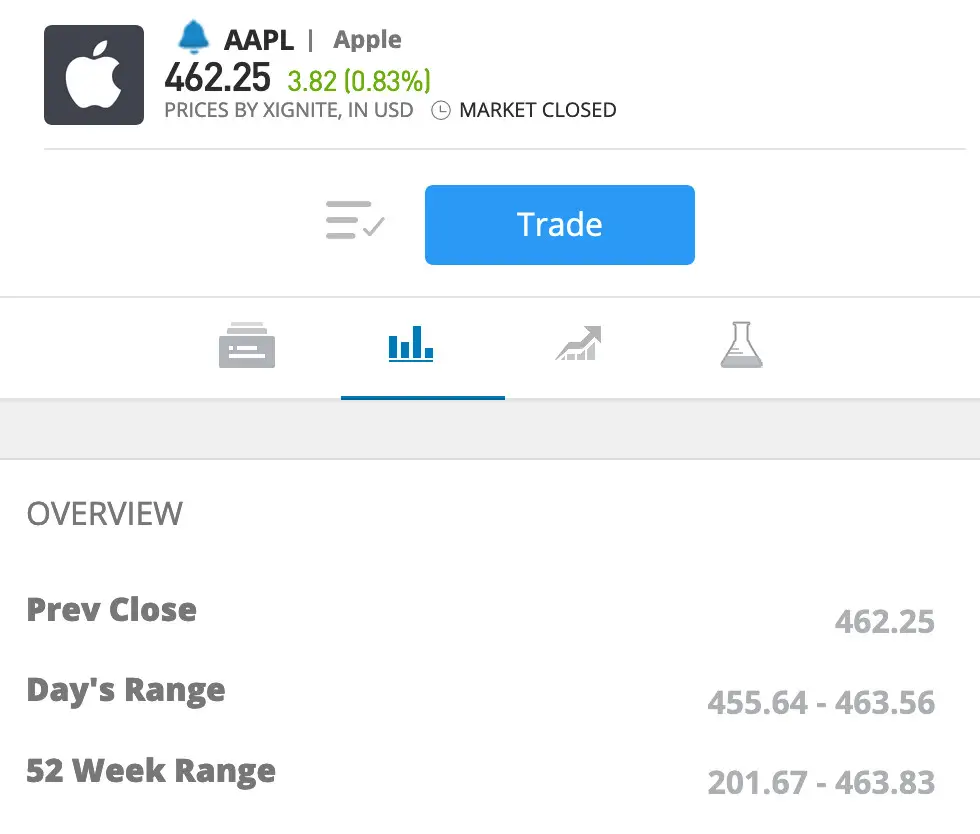

Analyze its 52-week High and Low

The 52-week high and low are also useful technical indicators because when a stock price breaks out above or below the 52-week level, there must be something really going on to cause such momentum. Your job is to know what exactly caused that movement so that you’ll know your entry and exit price better.

Use Simple Moving Average

Simple Moving Average is the average price of the stock over a specified period of time. We like using this technical analysis tool because it is simple. It’s like looking at an info-graphic chart. Investors use moving averages to evaluate support or resistance levels.

You can do this by launching a chart using your online trading platform. Set an SMA indicator. For starters, use SMA 50 and 200 SMA. It’s usually a buy signal for us when SMA 50 went below the candlesticks chart, and there is an uptrend. Otherwise, a sell signal when SMA 50 went above the candlesticks chart, and there is a downtrend.

8. Pick Dividend-Paying Stocks

Another way to grow money in the stock market is by investing in dividend-paying stocks. There are numerous companies that reward generous dividends quarterly, semi-annually, and annually. Check out their 5-year dividend payment history to learn if they have been paying out dividends consistently.

What are the best stocks to buy to earn dividends? Remember to choose your stocks by considering rule #3 above.

9. Use Dollar-Cost Averaging Technique

Dollar-Cost Averaging technique is a time tested strategy where investors spend a fixed amount of cash to buy shares of stocks on a regular basis. The method is beneficial in a way that traders can minimize losses by averaging down the price of the stock.

Another advantage of the dollar-cost averaging technique is it allows the investor to afford buying shares of stock according to their own budget. It is an effortless strategy because it doesn’t require technical skills to make money in the stock market.

10. Do not be Greedy

The stock market offers plenty of investment opportunities. Many great investors become millionaires in the stock market. On the other hand, many people lose a lot of money trading stocks because of greed. They would apply too much leverage expecting to double, triple, or X10 their income.

Stocks are very volatile and it is always risky to trade stocks. If you can minimize risks, do it as much as you can. One of the ways to lessen risks is investing without leverage. X1 leverage can still be profitable. Besides, it doesn’t charge daily fees.

11. Forget About Your Emotions

Investing in the stock market is not for everyone. You should be patient, focused, and well-disciplined whenever you execute and close your trades. If you let your emotions get the best of you, you could feel fear, and then you could panic. You could lose track of your trading strategy.

12. Diversify Your Investment

It’s always an excellent approach to diversify your investment. Do not focus on just a single asset. Allocate your funds to invest in different companies under different sectors such as technology, financial, healthcare, utilities, conglomerates, industrial goods, services, retail, and consumer.

The rationale behind diversification is to spread your risks and returns that when one sector suffers, you will not lose a large portion of your equity because you invested in other industries that are performing well.

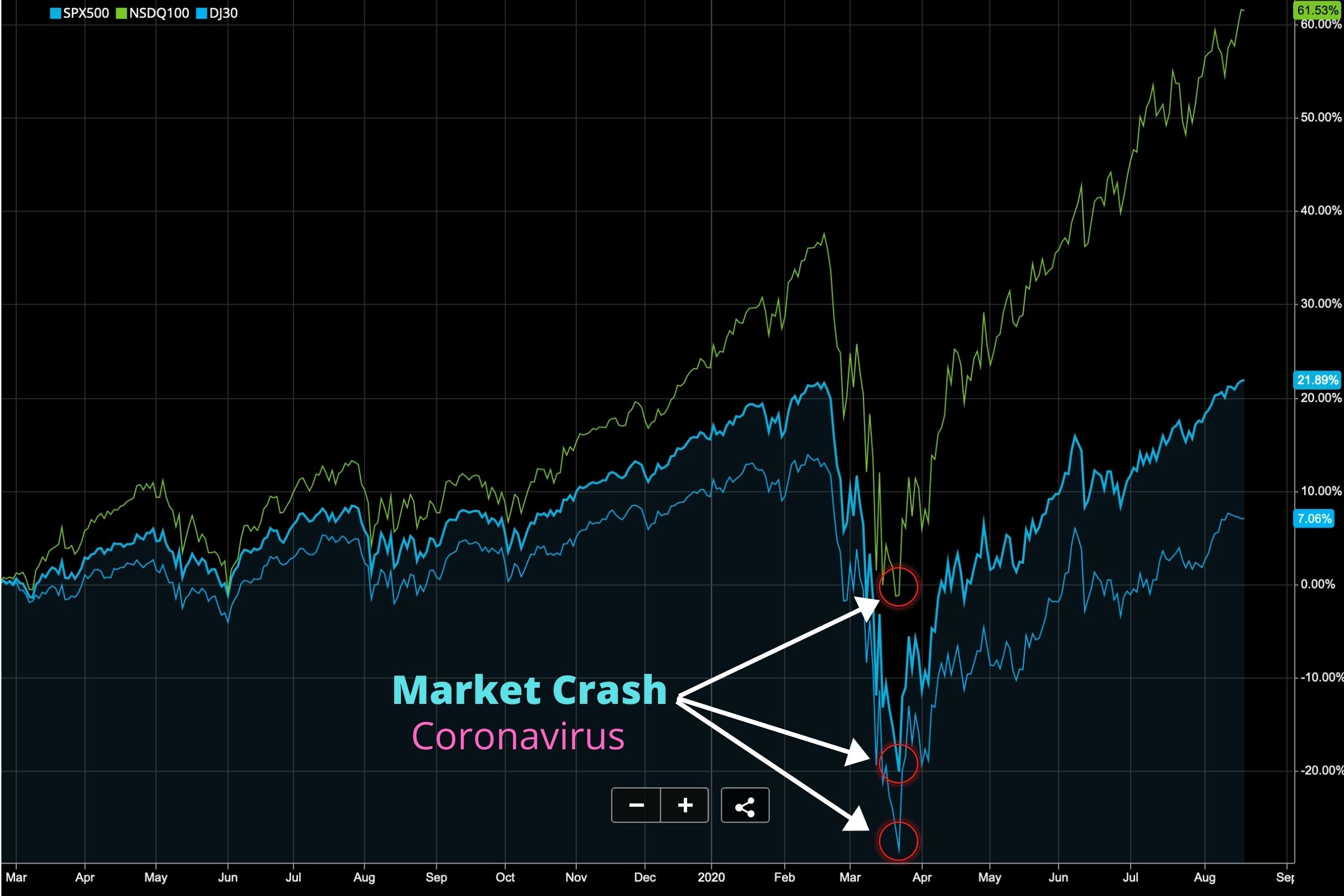

13. Buy During Market Crash

Another way to grow money in the stock market is buying during the dips and market crash is a better opportunity to gain more in the future because a significant market crash does not happen often. For every recession, there is always a recovery.

Here’s a historical chart showing S&P 500, NASDAQ 100, and Dow Jones have recovered during the pandemic.

14. Invest in ETF

Exchange-Traded Funds (ETF) are also traded on stock exchange. You can allocate some a portion of your portfolio with ETFs, especially if you want to mix some investments like bonds, commodities, and indices.

Many ETFs track specific investments. For example, instead of investing in Gold, you may invest in an ETF that tracks gold, like SPDR GLD. Some ETFs aim for the opposite performance of certain asset classes like SQQQ; it seeks three times the inverse exposure of the NASDAQ 100 index.

15. Lock in Profit Regularly

You should lock in your profit regularly to earn a regular income. The stock market moves up and down. You should allocate some small funds to trade actively and to realize some profit now and then.

We know that we set aside some funds for long term investment. Likewise, we should also set aside some funds for active trading.

16. Use the News to your Advantage

Much of the news in the trading world is just noise, but you should consider some to your advantage. Just like when analysts downgrade a particular stock, the price of the stock is expected to fall for the day.

Other events, like missed earnings, scandals, and geopolitical news also affect the market. Always remember that news has a short term effect. Trade wisely.

17. Monitor your performance

Even companies monitor their performance; you should do it, too. Did you beat the market? How much did you earn for the recent year? It’s now easier to monitor one’s portfolio performance because the majority of trading platforms and online brokers have that feature already.

We usually do this by comparing our benchmark vs. our portfolio. We also study monthly stats, trading history, max drawdown, portfolio allocation, and latest chart.

18. Do not Stop Learning

One of the best parts of investing in the stock market is learning more financial knowledge and leveling up your trading skills. Don’t trade stocks for the money; make sure you learn simple things every day. Those simple things and lessons could make you an expert someday.

Proceed to the NEXT TUTORIAL:

“9 Tips How to Avoid Losing Money in the Stock Market“

Disclaimer: This content is for information purposes only and should never be considered as professional advice. The stocks mentioned are from the USA and not all countries can invest in them. Every investor has different risk tolerance and goals. Always do your own research before investing. All investments have risks. Risk only the money you’re not afraid to lose.

Subscribe to receive our latest investment tips and updates for FREE!