Wondering how to buy shares of stock in the Philippines but don’t know how to start? I know it can feel overwhelming. Many Filipinos want to invest in the stock market but find the process confusing.

I’ve been investing and trading in the stock market for over a decade, and I’m eager to share the simple methods and ways to help beginners and future investors.

This guide will explain how to buy shares of stock on the Philippine Stock Exchange (PSE). Are you ready to start growing your wealth? I’ll explain the process clearly.

Understanding the Philippine Stock Market

The Philippine Stock Exchange (PSE) is where you can buy and sell shares of publicly listed companies in the Philippines. It’s a way to invest and grow our money over time, but it comes with risks.

What are stocks?

Stocks are shares that represent part-ownership in a business. Companies sell stocks to raise money for growth or other needs. As a stockholder, you can make money if the company does well and its stock price goes up.

You might also get dividends, which are payments or rewards from the company’s profits.

There are two types of stocks: common and preferred. Common stocks let us vote on company matters and may pay dividends. Preferred stocks usually pay set dividends but don’t have voting rights.

You can buy stocks through a broker on the Philippine Stock Exchange. It’s a way to invest in the country’s economy and potentially grow your wealth over time.

Benefits of investing in stocks

Now that we understand stocks let’s explore their benefits. Stocks provide several advantages. First, they allow you to own part of a company. You can sell your stocks when any time you need your funds again.

Many stocks distribute dividends, providing additional income. Moreover, if the company performs well, your stock value may increase, potentially leading to long-term financial gains.

I’ve observed significant stock growth over time. The PSE Index, which tracks the top 30 Philippine stocks, has consistently performed well and offers higher returns compared to keeping cash in a bank.

However, stocks carry risks. Prices can decrease, potentially resulting in losses. For this reason, it’s prudent to gain more knowledge before investing.

Risks involved in stock investing

I’ve seen stocks go up and down. Yes, it’s not always smooth sailing. Market swings can hit your wallet hard. Economic shifts, company problems, or global events can tank stock prices fast.

I’ve learned to expect the unexpected, so you should, too. But don’t worry because when the market is vulnerable, that’s when we see a lot of opportunities to invest.

Risk management is key. Experienced investors spread their money across different stocks. This helps cushion the blow if one stock tanks. Also, keep some cash on hand. It’s wise to have a safety net. The stock market can be wild, but with care, it can pay off big.

How to Buy Shares of Stock in the Philippines (Step-by-step Guide)

Ready to buy stocks in the Philippines? I’ll show you how. It’s easier than you think – just follow these simple steps.

1. Choose a reputable stockbroker

The top three banks in the country have their stock trading platforms.

- BDO Securities (BDO)

- BPI Trade (BPI)

- First Metro Sec (Metrobank)

But for beginners, I recommend using COL Financial because it’s user-friendly and serves other assets like REITs and mutual funds.

You must pick a trusted stockbroker to start your stock market investing journey. BDO Securities is a good choice for BDO clients. If you already have a BDO account, it simplifies opening your trading account and BPI Trade for BPI clients and First Metro Sec for Metrobank account holders.

Trading fees, commissions, and service fees are mostly the same regardless of the platform. So, before signing up, pick a broker that fits your needs and accessibility.

Check out the list of best stockbrokers in the Philippines accredited by the SEC (Securities and Exchange Commission).

2. Open an online trading account

Open your online trading account. It only takes a few minutes. It’s quick and easy, especially if you already have a bank account. Prepare the following when opening your trading account:

- Valid email address

- Valid mobile number

- Bank account details

- Tax Identification Number (TIN)

- Initial Funds

3. Fund your trading account

After opening your online trading account, you need to fund it. Depending on your capital or budget, you must deposit some money before you can buy your first stocks.

Most stockbrokers offer various funding options like bank transfers, online banking, or over-the-counter deposits. The minimum investment is usually PHP 5,000. Make sure to have enough cash in your trading account before placing any buy orders.

4. Learn to navigate the trading platform

Once you funded your account, dive into your online trading platform. Most platforms have key features like real-time quotes and order entry. You can check out the order types – market, limit, and stop orders.

You can also practice reviewing the charts and company info and adding your watchlist. Getting familiar with these tools will help you feel ready to make your first trade. The platform will look complex at first, but you can get the hang of it with some practice.

5. Buy your first stock

Buying the first stock will always be exciting. Perhaps unforgettable to some investors. But you can avoid losing money if you’re smart when choosing your first stock. I’m sharing my tips here:

Choose a blue chip stock

A blue-chip stock is among those listed in the PSEI (Philippine Stock Exchange Index). The index consists of carefully selected companies that are the largest in the PSE. Here are the list of best blue-chip stocks in the Philippines.

Why does it matter? As a beginner, you must invest in well-established and profitable companies rather than risk your money in speculative stocks.

Start buying small and diversify

Don’t spend your whole money or capital on buying shares of a single company. Instead, start buying a few shares across different excellent companies. This way, you can minimize risk.

For demonstration purposes:

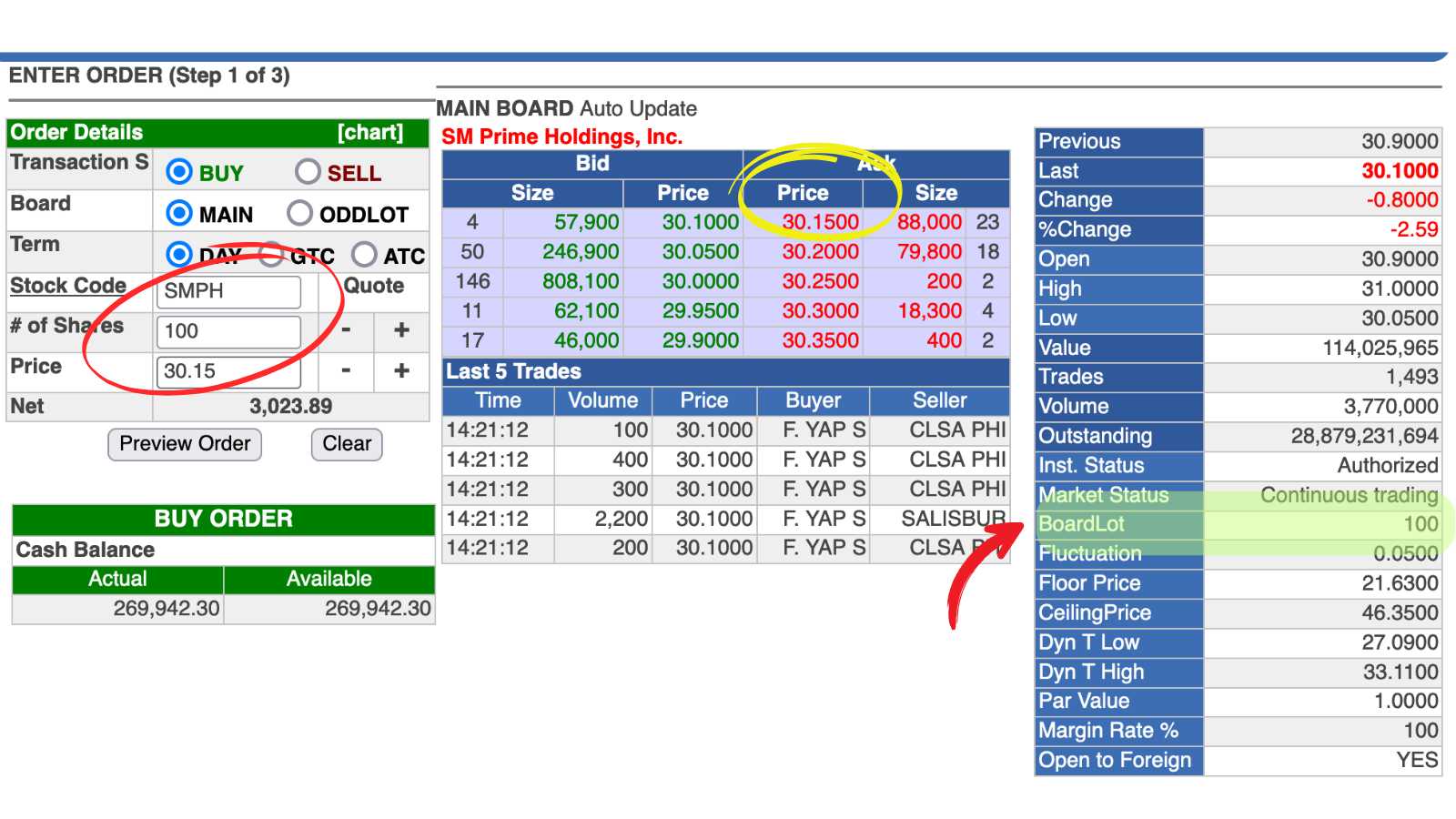

I’m buying some shares of stock of SM Prime Holdings so I’m typing the ticker: SMPH. It’s a blue chip stock, and the price is fair right now. I checked its performance and its fundamentals. I think it’s great for long-term investing and it pays dividends, too. So I’m buying 100 shares for now, and then I’ll buy again next month.

My BUY Order will look something like this:

Tip: ✅ Always buy following the BoardLot

The process took just a few clicks. Make sure to have enough money in your account to cover the cost of shares plus fees. The number of shares will show up in your portfolio after a few minutes or when the trades are executed. It’s always exciting to own a piece of a business and building different types of investments.

Buying stocks involves some risks, but it can be rewarding. I started small with just 100 shares of a stable company. This let me learn the ropes without risking too much cash. As I got more comfortable, I bought more shares of different companies.

It’s important to spread out investments to lower risk. Now, I check my stocks daily and even receive dividends every quarter.

Important Considerations When Investing in Stocks

Investing in stocks isn’t just about buying and selling. There’s more to it – like fees, taxes, and spreading your money around. These things matter a lot when you’re trying to grow your cash.

Understanding the board lot system

The board lot system sets rules for buying shares. It tells us how many shares we can buy based on the stock’s price. For example, if a stock costs less, we might need to buy more shares. This system helps keep trading fair and organized.

Awareness of transaction fees and taxes

I pay close attention to fees and taxes when I buy stocks. They can eat into my profits if I’m not careful. The Philippine stock market charges a 0.005% transaction fee and a 0.01% clearing fee on trades.

My broker also takes up to .25% commission of the gross trade amount. I pay a 0.006% sales tax plus other small charges when I sell stocks. These costs add up fast, so I factor them into my investment decisions.

I always make sure I have enough money in my account to cover these extra expenses.

The importance of investment diversification

After considering fees and taxes, I focus on spreading my investments. Diversification helps protect my money. I don’t put all my eggs in one basket. Instead, I buy different types of stocks.

This lowers my risk if one company or industry struggles.

I mix blue chip stocks with other investments, too. For example, I might add REITs like Ayala Land REIT (Ticker: AREIT) or a mutual fund like COL Strategic Growth Fund to my portfolio. The latter invests in top Philippine companies and aims to outperform the PSEI.

By diversifying, my goal is for steady growth over time. It’s an intelligent way to build wealth while managing risk.

FAQs for New Stock Investors:

New investors often have questions. I’ll answer common ones here. Read on to learn more about getting started in stock investment.

How much money is needed to start investing?

I started investing in stocks with just PHP 5,000. That’s the minimum amount most brokers require to open an account. It’s enough to buy shares in good companies like Jollibee Foods Corp. (Ticker: JFC) and SMPH.

Although there are small fees, my goal is to invest long-term. There’s no need for a lot of cash to start. What matters is we invest regularly. Even PHP5,000 a month lets us slowly build our portfolio over time.

Do I need a physical stock certificate?

You don’t need a physical stock certificate to invest in Philippine stocks. The Philippine Central Depository uses a computerized system that tracks ownership electronically. This scripless trading method is faster and safer than paper certificates.

It cuts risks linked to lost or stolen papers. You can still ask for a physical certificate if you want, but it’s not standard practice. The electronic system works well for most investors, especially in this digital era.

Final thoughts:

Buying stocks in the Philippine Stock Exchange (PSE) is easier than you think. I’ve shown you the steps to get started. Pick a good broker, open an account, and learn the basics. Start small and grow your knowledge over time as you also grow your long-term investments.

With patience and smart choices, you can build wealth through the stock market.

Watch the video version of this guide:

Don’t miss reading:

Top 5 Best REITs to Invest in the Philippines

How to Sell Shares of Stock in the Philippines Stock Market

Disclaimer: This article is for information purposes only and should not be taken as professional advice or investment recommendation. The author is not affiliated with any broker or company whose stock has been mentioned. All investments have risks. Always practice due diligence or hire an expert before investing your money.

Subscribe to receive our latest investment tips and updates, it’s FREE!