Want to invest in the S&P 500 index? Here are the top 50 companies listed in the S&P 500 by weight. Many investors use this index as a benchmark for their portfolio.

There are also some ETF (Exchange Traded Funds) and mutual funds that offer index funds mimicking the S&P 500 components allocation.

Beating the performance of this index is the goal of almost every investor, hedge fund, and equity portfolio manager. If you are interested to benchmark your portfolio using this index, get to know which companies make up the S&P 500.

What is S&P 500?

S&P 500 is a stock market index that tracks the performance of roughly the 500 largest companies in the United States of America. It is widely regarded as the representation of the US stock market because it covers over 80% of the total US stock market capitalization.

Top 50 Companies in the S&P 500 By Weight:

| Company | Symbol |

|---|---|

| Apple Inc. | AAPL |

| Microsoft Corp. | MSFT |

| NVIDIA Corp. | NVDA |

| Amazon.com Inc. | AMZN |

| Meta Platforms Inc. Class A | META |

| Alphabet Inc. Class A | GOOGL |

| Tesla, Inc. | TSLA |

| Broadcom Inc. | AVGO |

| Alphabet Inc. Class C | GOOG |

| Berkshire Hathaway Inc. Class B | BRK.B |

| JPMorgan Chase & Co. | JPM |

| Eli Lilly & Co. | LLY |

| Visa Inc. | V |

| UnitedHealth Group Inc. | UNH |

| Exxon Mobil Corp. | XOM |

| Mastercard Inc. | MA |

| Costco Wholesale Corp. | COST |

| Walmart Inc. | WMT |

| Home Depot Inc. | HD |

| Netflix Inc. | NFLX |

| Procter & Gamble Company | PG |

| Johnson & Johnson | JNJ |

| Salesforce Inc. | CRM |

| Bank of America Corp. | BAC |

| AbbVie Inc. | ABBV |

| Oracle Corp. | ORCL |

| Chevron Corp. | CVX |

| Wells Fargo & Company | WFC |

| Merck & Co. Inc. | MRK |

| Coca-Cola Company | KO |

| Service Now, Inc. | NOW |

| Cisco Systems Inc. | CSCO |

| Accenture | ACN |

| Thermo Fisher Scientific Inc. | TMO |

| Abbott Laboratories | ABT |

| Ge Aerospace | GE |

| International Business Machines Corp. | IBM |

| McDonald’s Corp. | MCD |

| Linde | LIN |

| PepsiCo Inc. | PEP |

| Intuitive Surgical Inc. | ISRG |

| The Walt Disney Company | DIS |

| Philip Morris International Inc. | PM |

| Goldman Sachs Group Inc. | GS |

| Adobe Inc. | ADBE |

| Qualcomm Inc. | QCOM |

| Caterpillar Inc. | CAT |

| Advanced Micro Devices Inc. | AMD |

| American Express Company | AXP |

| AT&T Inc. | T |

If you’d rather want to know the top 50 companies in the S&P 500 so that you can choose which companies to allocate your funds according to your risk appetite and interest, the list above can guide your strategy.

Some investors are trading with the top 10 companies, some prefer the top 25, while others want the whole 500 in one basket of index fund. If you are interested to invest in an index fund that mimics the performance of the S&P 500, check out the next guide below.

How to Invest in S&P 500?

1. Invest in S&P 500 through an online broker

In the modern world, we can already invest online using a trusted broker like Robinhood if you are in the US. The world’s top indices can be invested through ETFs available on most regulated trading platforms in the USA. You can start investing in any index like the S&P 500, NASDAQ 100, Dow Jones 30 and many more by investing in an ETF that tracks a specific index.

Many retail investor accounts lose money when trading indexes. You should consider whether you can afford to take the high risk of losing your money.

2. Invest in S&P 500 Index Funds

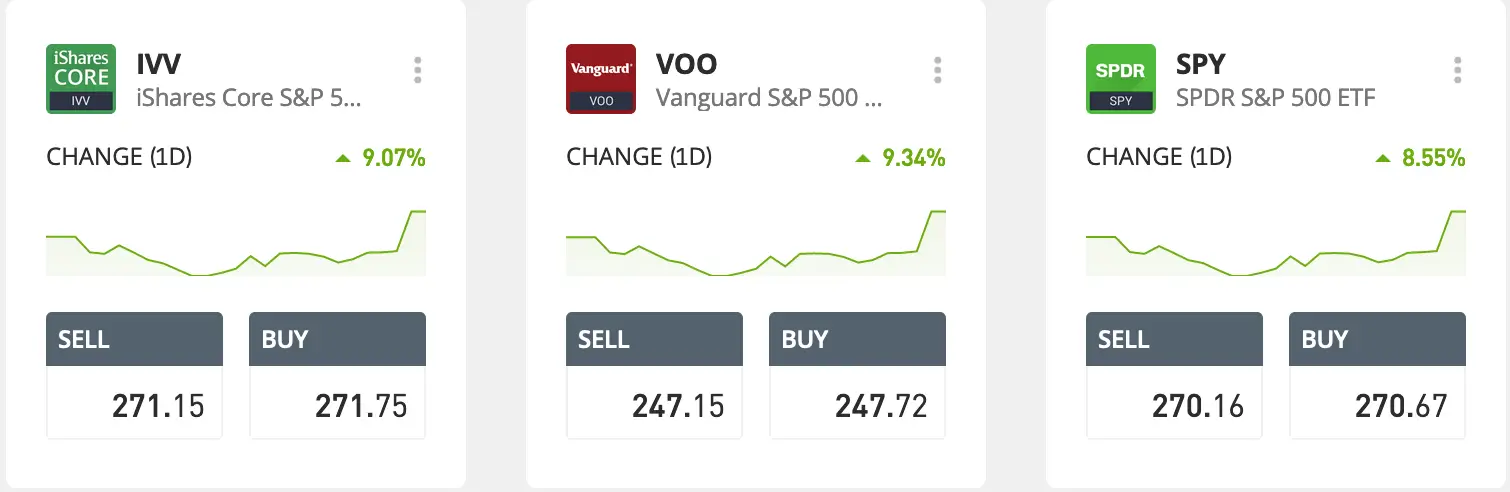

The best way to invest in S&P 500 index fund is by investing in an ETF, mutual fund or UITF with S&P 500 as their benchmark.

Some of the best S&P 500 index ETFs include iShares Core S&P 500 ETF (IVV), SPDR S&P 500 (SPY), and Vanguard S&P 500 ETF (VOO).

Benefits of Investing in S&P 500 Index Funds

According to Warren Buffett, the best retirement plan is to put 10% of your funds in short-term government bonds and 90% in an S&P 500-tracking ETFs.

S&P 500 Index Funds are ETF (Exchange Traded Funds) of mutual funds that track the performance of the S&P 500. One advantage of investing in index fund is diversification because your fund will be allocated among different high-quality stocks.

Another benefit of investing in index funds is they are managed by portfolio experts who already know how to grow your money with different equities.

Best Indexes in the World:

- List of Companies of NASDAQ 100 Index

- Top 30 Companies of the Dow Jones Index

- Complete Companies of GER40 (DAX) Index

- Top 35 Companies of UK100 Index

- EURO STOXX 50 Index Components

Disclaimer: This article is for information purposes only and should not be considered as a professional advice or endorsement of a particular investment. Every investor must evaluate his risk profile, financial status, and objectives before making an investment. All investments have risks. Risk only the capital you’re not afraid to lose. Always do your own research before investing.