We’re sharing here the best ETFs to invest in the Philippines in 2025. Exchange-Traded Funds (ETFs) are among the best types of investments for both newbies and expert traders because of their earnings potential, affordability, liquidity, and diversification.

In this page, we are sharing with you the best ETF (Exchange Traded Funds) to invest in the Philippines right now. Before you read this post, make sure you understood and read our previous post, “Everything You Need to Know Before Investing an ETF.”

ETFs allow investors access to a wider market at an affordable expense ratio. Many traders and investors also consider exchange-traded funds to be a cost-efficient way to diversify their portfolios.

Benefits of Investing ETFs (Exchange Traded Funds:

Exchange-Traded Funds are like mutual funds, so if you like the latter, we’re positive you would also like ETFs. Unlike mutual funds, ETFs are traded on the stock exchange. That means you can buy or sell them just like stocks.

The benefits of investing in ETFs are the following:

- Easy to invest

- Diversification

- Affordability

- Income potential

- Professional Management

- Liquidity

Best ETFs to Invest in the Philippines Right Now

1. First Metro Exchange Traded Fund (FMETF)

First Metro Exchange Traded Fund (FMETF) is the first ETF in the Philippines and the only ETF available to trade on the Philippine stock exchange right now. The fund is managed by First Metro Asset Management, Inc. (FAMI).

In 2013, First Metro Investment Corporation (by Metrobank Group) launched First Metro Exchange Traded Fund in the Philippines. FMETF aims to provide returns that would replicate the Philippine equities market’s performance by investing in stocks listed on the PSE index (PSEI).

Top 10 Components of First Metro ETF:

- SM Investments (SM)

- International Container Terminal Services (ICT)

- BDO Unibank (BDO)

- Bank of the Philippine Islands (BPI)

- SM Prime Holdings (SMPH)

- Ayala Corp. (AC)

- Ayala Land (ALI)

- Metropolitan Bank & Trust Company (MBT)

- Manila Electric Company (MER)

- Jollibee Foods Corp. (JFC)

How to Invest in First Metro ETF in the Philippines?

You can start investing and trading FMETF on your online broker accredited by the PSE using the ticker FMETF. Yes, if you have an online trading platform like First Metro Sec Pro, BDO Securities, BPI Trade, and COL Financial, you can trade this ETF.

2. iShares MSCI Philippines ETF (EPHE)

iShares MSCI Philippines ETF (EPHE) targets to track the investment results of a broad-based index composed of Philippine equities. It also began to benchmark the performance of the MSCI Philippines IMI 25/50 net index.

The fund holds 32 Philippine established companies. iShares, a subsidiary of BlackRock, manage iShares MSCI Philippines ETF. iShares is one of the world’s biggest ETF providers.

Top 10 Components of iShares MSCI Philippines ETF:

- International Container Terminal Services (ICT)

- BDO Unibank (BDO)

- SM Prime Holdings (SMPH)

- SM Investments (SM)

- Jollibee Foods Corp. (JFC)

- Ayala Land (ALI)

- Manila Electric Company (MER)

- Metropolitan Bank and Trust Co. (MBT)

- Bank of the Philippine Islands (BPI)

- Ayala Corp. (AC)

How to Invest in iShares MSCI Philippines ETF?

You can invest and trade their ETFs at an index feeder fund from the Philippines’ best banks feeder funds. Unfortunately, commercial banks’ index feeder funds in the country don’t always offer this specific ETF. However, you can contact your bank if they offer this investment.

3. Invesco QQQ ETF (QQQ)

Invesco QQQ ETF tracks the companies included in the Nasdaq 100 index. It is the second most traded ETF in the US based on average daily volume. Therefore, it provides more liquidity to investors.

QQQ exchange-traded fund offers Filipinos exposure to the US market. So, if you want to invest in the 100 largest non-financial companies in the United States while you’re in the Philippines, QQQ ETF is the best fund we recommend.

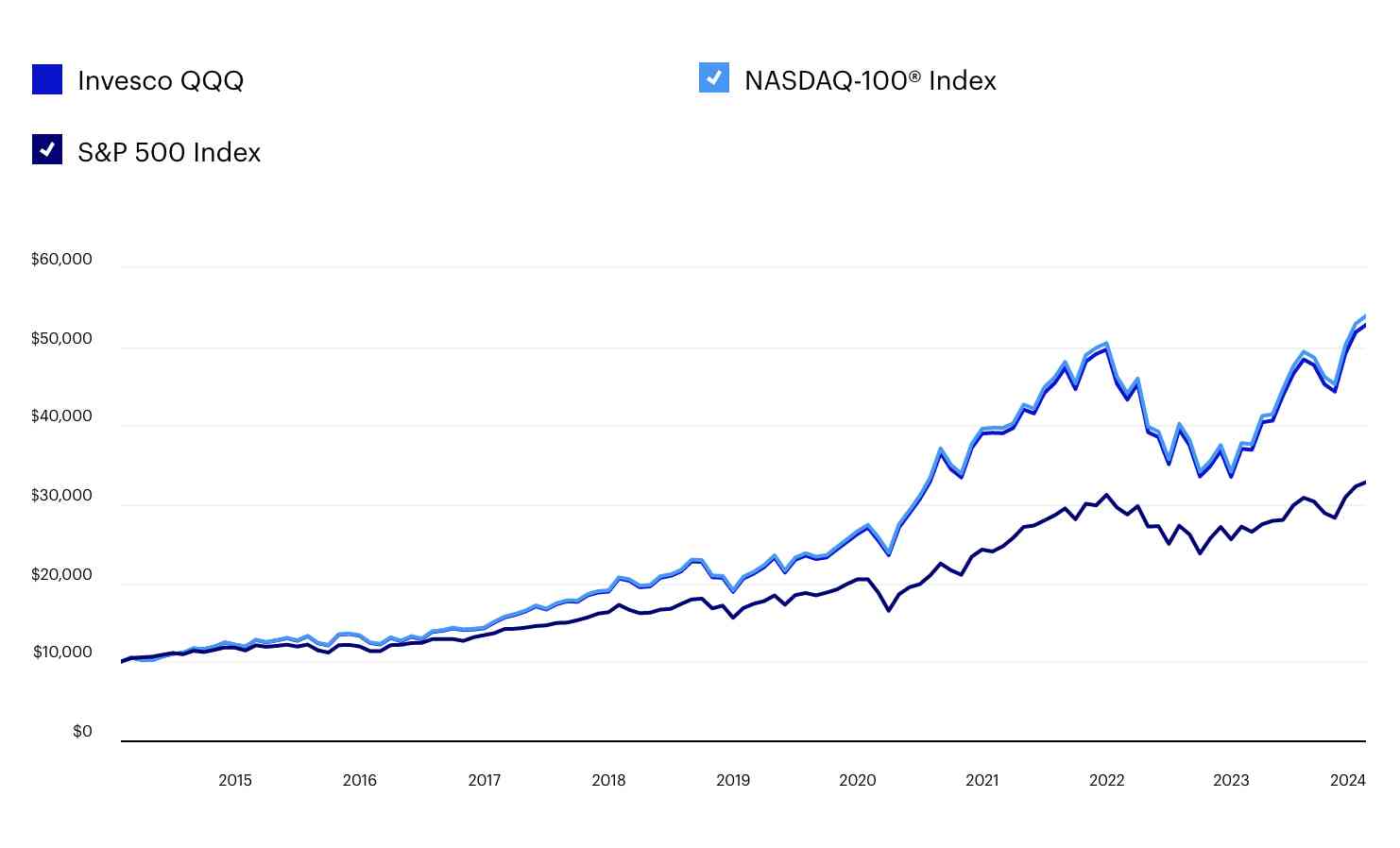

Take a look at the 10-year performance of QQQ and how much it has grown over the years. Investing in QQQ will give you a broader exposure to numerous revolutionary companies. It’s definitely among the best ETFs to buy now and hold for long term.

The Nasdaq 100 index is one of the top-performing indexes in the world. The majority of its holdings are tech companies. QQQ ETF outperformed the S&P 500 index many times. QQQ’s one-year price return is 29.68%, while S&P 500 one-year price return is 26.98%.

Top 10 Components of QQQ ETF:

- Apple Inc. (AAPL)

- NVIDIA Corp. (NVDA)

- Microsoft Corp. (MSFT)

- Amazon.com Inc. (AMZN)

- Broadcom Inc. (AVGO)

- Tesla Inc. (TSLA)

- Meta Platforms Inc. Class A (META)

- Alphabet Class A (GOOGL)

- Alphabet Class C (GOOG)

- Costco Wholesale Corp. (COST)

How to Invest in QQQ ETF in the Philippines?

It’s possible to invest and trade QQQ ETF even if you’re in the Philippines. Find any UITF or Feeder Funds that mimics the movement of QQQ from the top banks or financial firms like AIA, Sun Life and Manulife.

4. ARK Innovation ETF (ARKK)

ARK Innovation ETF (ARKK) is one of the best performing ETFs before the pandemic. Its low price is attractive right now. ARKK is an actively managed ETF focused on “disruptive innovation” and seeks long-term capital growth.

ARK Invest ETF picks cutting-edge companies across North America, Europe, Asia Pacific, Africa, and the Middle East.

The fund aims for thematic multi-cap exposure to innovation across numerous sectors, including health care, information technology, communication services, consumer discretionary, financials, industrials, and real estate.

ARKK is one of those ETFs that we’re interest to invest in because its price is at the bottom. Cathie Wood and her team are doing a fantastic job in searching for disruptive and futuristic companies. Take a look at the performance of ARKK ETF through the years and you’ll see some opportunities. Be warned though, the price movement of ARKK is very volatile.

Top 10 Components of ARK Innovation ETF:

- Tesla Inc. (TSLA)

- Roku Inc. (ROKU)

- Coinbase Global Inc. (COIN)

- Roblox Corp. (RBLX)

- Palantir Technologies Inc. (PLTR)

- Robinhood Markets Inc. (HOOD)

- Shopify Inc. (SHOP)

- Block Inc. (SQ)

- Crispr Therapeutics (CRSP)

- Archer Aviation Inc. (ACHR)

How to invest in ARK Innovation ETF in the Philippines?

ARK Invest ETFs are available on online trading platforms that are licensed to offer ETFs. As of now, there is no platform that offers ARKK ETF in the Philippines. Overseas Filipino Workers (OFWs) can invest in this ETF though via online broker like Robinhood.

5. Vanguard S&P 500 ETF (VOO)

Vanguard S&P 500 ETF (VOO) is among the world’s most popular ETFs because of its low expense ratio, just 0.03%. Vanguard ETFs are among the most excellent ETFs globally, and VOO offers attractive growth potential.

VOO ETF tracks the performance of the S&P 500 index, which represents 500 of the largest companies in the United States. Investing in VOO ETF will give you the privilege of investing in more than 500 US large-cap stocks and will add diversification while you maintain a long-term portfolio.

VOO also pays dividends every quarter of the year. The annual dividend payout is estimated to be $6.95 per share.

Top 10 Components of VOO ETF:

- Apple Inc. (AAPL)

- NVIDIA Corp. (NVDA)

- Microsoft Corp. (MSFT)

- Amazon.com Inc. (AMZN)

- Meta Platforms Inc. (META)

- Alphabet Inc. Class A (GOOGL)

- Tesla Inc. (TSLA)

- Berkshire Hathaway Inc. (BRK.B)

- Alphabet Inc. Class C (GOOG)

- Broadcom Inc. (AVGO)

How to invest in Vanguard S&P 500 ETF in the Philippines?

You can also invest in Vanguard ETF like VOO while in the Philippines if there are ETFs or funds that tracks the performance of S&P 500 from any UITF (banks in PH), mutual fund, or funds offered by investment firms like AIA, Sun Life, Manulife, and BPI Wealth.

Disclosure and Disclaimer: This article is for information purposes only and should not be considered as a professional advice or endorsement of a particular investment. All figures are updated as of the given date. Past performance doesn’t guarantee future result. All investments have risks. Risk only the capital you’re not afraid to lose. Always do your own research before investing.