Here are the best blue-chip stocks to invest in the USA in 2025. We are excited to welcome a healthier and wealthier year. We manifest our 2025 as another profitable year investing in the stock market.

Last year, we saw an excellent performance of our selected stocks. Although the stock market started a bumpy ride in the past few years, investors are still very optimistic going forward.

Sharing opens more blessings, so we share our top 15 best blue-chip stocks list that we would like to invest and trade in 2025.

What are blue-chip stocks?

Blue-chip stocks are large-cap well-established companies with healthy financials that have been in the industry for many years. Blue-chip companies usually have billions of market cap and are among the top and most dominant companies. The term “blue chip” originated from the chips with the highest value in poker games.

Advantages and Benefits of Investing in Blue-chip Stocks

Stability

Blue chip companies have been operating their businesses for a long time and have established a solid foundation to operate for many years. Most blue-chip stocks have withstood market crashes and recovered over time.

Growth potential

They can grow even further with their excellent track records, robust financials, and trustworthy reputation.

Liquidity

They are usually the most popular and most traded in the stock market; hence, you can buy and sell them easily because you’re confident your trades will be executed quickly.

Less likely to close business

Because of their consistent earnings and stability, blue-chip stocks are considered by most investors to be less risky and less likely to go bankrupt than other companies in the stock market.

How do we choose the top blue-chip stocks in 2025?

Our criteria in choosing the best blue-chip companies in the US are market capitalization, strong fundamentals, positive performance, index inclusion, and future growth potential. Blue-chip stocks represent stability, a good track record, and economic significance. Hence, the following stocks possess all those characteristics.

Best Blue-Chip Stocks in US to Invest in 2025

1. NVIDIA (NVDA)

The number one spot belongs to NVIDIA (NVDA). The two pillars of success of NVIDIA are hardware and software. Yet it introduced another important innovation this time – the Omniverse. If you heard about the Metaverse and how it’s rocking the internet, NVIDIA’s Omniverse would be a powerful platform in building the Metaverse.

Gaming, Artificial Intelligence, data centers, autonomous systems, and Omniverse drive NVIDIA to incredible growth. Their Q3 FY25 recorded a revenue of $3.3 billion from their gaming segment, $30.8 billion from data center, $486 million from professional visualization, and $449 million from automotive.

NVIDIA remains the top leader in accelerated computing. It holds more than 90% share worldwide. Its Omniverse platform could still increase its total addressable market (TAM) in 2025 and beyond.

2. Microsoft (MSFT)

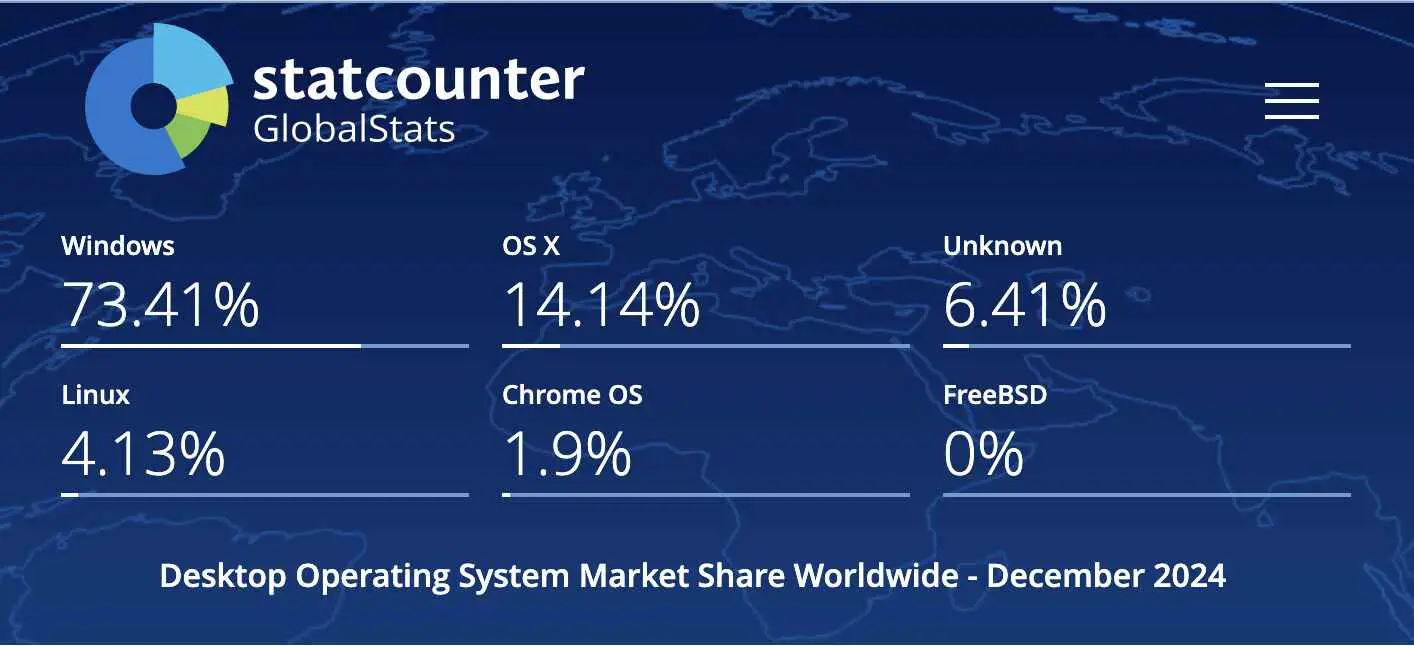

73.41% of the world uses Windows desktop operating system. Microsoft is one of the top 3 largest company in the world right now in terms of market cap. The dominance of Microsoft doesn’t stop in 2025. A huge driver of their revenue also comes from their cloud services. From its Fiscal Year 2025 Q2, Microsoft reported a net income of $24.1 billion, up by 10%.

Currently, Microsoft has a $3.2 trillion market cap and has a strong buy based on analysts rating at TipRanks. The average target price is $512.

MSFT earnings are forecast to grow 12.54% per year. The stock’s performance is always excellent. The total return in 3 years is 47%. MSFT is a favorite stock of long-term investors because of its strong fundamentals, dividends, and bullish momentum.

3. Broadcom (AVGO)

Broadcom (AVGO) stock price surged in 2024 because of substantial growth in its artificial intelligence (AI) sector and strategic acquisition (VMware). The performance has propelled Broadcom’s market cap past the $1 trillion mark, placing it among the elite group of technology stocks.

Analysts project a 30% increase in earnings per share (EPS) for FY 2025. I’m confident that Broadcom stock will continue growing, despite the significant pullback following DeepSeek AI’s launch in January. I’m watching closely for developments regarding this challenge and view pullbacks as opportunities.

4. Berkshire Hathaway (BRK.B)

An intelligent way to diversify our portfolio is by investing in Berkshire Hathaway because it comprises numerous reputable companies chosen by the legendary investor Warren Buffett and his excellent team.

The famous conglomerate operates in the insurance, manufacturing, service, retail, railroad, utility, and energy businesses. Berkshire Hathaway made operating earnings of $10.1 billion in its third quarter 2024 report.

Berkshire Hathaway is a diversified portfolio of high-quality blue-chip companies popular in the market. Besides, BRK.B is one of the best defensive stocks, especially during market crashes.

5. Alphabet (GOOG, GOOGL)

Alphabet is among the biggest tech companies in the stock market today. It joined the ranks of Apple and Microsoft in the trillion market cap club.

We don’t see ourselves stopping from using Google Search, YouTube, and Android in 2025. Likewise, we continue investing in one of the best blue-chip stocks right now, Alphabet (GOOG and GOOGL).

The tech giant makes money from advertising in Google Search, Google Network, and YouTube. Google Cloud business also contributed $11.4 billion in Q32024. It reported $88.3 billion consolidated revenue. $2.12 earnings per share (EPS) also topped expectations.

Alphabet is on the list of our best blue-chip stocks in USA in 2025 because we believe that the company’s innovation and “bets” will continue to make more impact in the tech world until 2030.

6. Visa (V)

Visa is among our favorite fintech stocks, and it deserves a rank among our best blue-chip stocks this year. The giant digital payment company is always focused on accelerating growth and transforming payment technology for the future.

According to its Full-Year 2024 report, Visa made a net revenue of $35.9 billion. Total processed transactions, which represent transactions processed by Visa in 4Q2024 were 61.5 billion.

We trust the Visa brand, and we also trust this company’s bright future. Visa also pays consistent dividends to its stock holders.

7. Advanced Micro Devices (AMD)

AMD is another semiconductor stock we like to keep investing until 2030. We believe that its innovation-driven culture will continue to produce cutting-edge processors, next-gen graphics, and visualization technologies.

We always admire Dr. Lisa Su, the Chair and CEO of AMD. AMD now has a $190 billion market cap. AMD recorded an impressive $6.8 billion revenue in 3Q 2024, gross margin of 50%, and net income of $771 million.

The inspiring CEO said, “We are on-track to deliver record annual revenue for 2024 based on significant growth in our Data Center and Client segments.”

8. Amazon (AMZN)

Like other technology stocks, Amazon impressed many investors once again, outperforming the S&P 500 index.

Amazon has profitable, diversified business segments. The company reported $158.9 billion net sales in Q32024, an increase of 11% compared to the previous year. Net income also increased by $15.3 billion.

The tech giant makes money from its online store, physical store, subscription services, cloud services, and third-party seller services. It’s only a matter of time before Amazon launches another disruptive business segment.

9. Apple (AAPL)

Apple remains the largest company in the world by market capitalization (as I write this post). It holds the top spot with an approximate market cap of $3.6 trillion. Apple has maintained its leadership position for several years, driven by strong sales in its product lines (iPhone, Mac, and wearables) and significant growth in its services division, including the App Store, iCloud, and Apple Music.

The dominance of Apple in the market is so powerful. It is listed on the three major stock market indices, S&P 500, NASDAQ 100, the Dow Jones 30. Likewise, it is also one of the most actively traded stocks.

As traders and investors, we like AAPL stock for short- and long-term investments. $243 is the average target price for AAPL stock by analysts, while its peak range reached $239.

10. JPMorgan Chase & Co. (JPM)

I’m including JPMorgan Chase & Co. stock among the best blue-chip stocks I’m keen to invest in this year. JPM is the largest financial firm in the world by market cap and the most diversified financial institution today.

What I like most about JPM is its solid track record. It remained strong during economic downturns and has consistently weathered market challenges. It pays good dividends, has strong financials, strategic management, innovative expansion, and a diversified business. What’s not to like about JPM? It’s a great choice for long-term investors.

11. Cisco Systems (CSCO)

Cisco (CSCO) designs and sells a broad range of technologies that power the internet. It is now among the top software companies in the world. It made $53.8 billion total revenue in FY2024.

The company has a strong balance sheet and outstanding net income. Operating cash flow is $10.9 billion. Net income (TTM) is $10.3 billion.

It’s attractive to invest in Cisco because of its good financials and fundamentals. Likewise, the stock price pulled in January. The dividend yield is 2.69%.

12. Walmart (WMT)

Walmart hit its all-time high and is back in its bullish trend Yet, we like to hold our shares to earn more dividends. Walmart has robust financials. Its gross profit has consistently grown every year.

I like to trade this stock for medium to long term. So far I closed all profitable positions for Walmart when they hit my objective already. I’m still watching for a good entry for WMT stock.

Walmart is the second biggest online retail company in the USA in terms of market share. Its competitive advantage will always provide opportunities to traders and investors.

13. Merck & Co. (MRK)

Merck (MRK) is another blue-chip stock we like to watch in 2025 because of its excellent track record, dividend safety, stable balance sheet, business structure, and long-term potential.

We’re impressed with Merck’s historical revenue, operating income, free cash flow, and dividend growth rate. The company has a favorable pipeline and diversified portfolio.

Even though Merck is a healthcare stock that is always volatile, the company has established strong growth and maintains healthy financials. Both value and growth investors take opportunities in buying the stock during market corrections.

14. Mastercard (MA)

Mastercard has always been one of my best fintech stocks to buy and hold for long term. It has a strong moat and positive outlook. Mastercard’s innovation will maintain its position in the digital payment realm.

The fintech company reported a $3.2 billion net income in Q32024 and diluted EPS of $3.39. Net revenue increased by 13%. Switched transactions were 200 billion from Q4 2023 to Q3 2024.

Mastercard is always moving forward. We are confident it will achieve a brighter outlook in 2025.

15. The Coca-Cola Company (KO)

Coca-Cola is a blue-chip defensive stock that we added to our watchlist in 2025. The current chart is encouraging for a buy, and there is always room for growth. Coca-Cola will always be a high-quality brand preferred by many investors.

KO stock may be overvalued right now but it’s still worth trading when opportunities knock. Besides, the company’s stock performance, profit margin, and dividend growth are good reasons to consider holding the stock.

Other Stock Market Guides:

- How to Invest in Index Funds

- Top 18 Best Vanguard ETF to Invest for Long Term Growth

- 29 Signs You Will Become a Millionaire Someday

Disclaimer: This article is an opinion piece only and should not be construed as professional investment advice. Stocks and equities carry risks. Always perform due diligence or seek an expert’s advice before investing. I wrote this article myself and it expresses my own opinion. I have no business relationship with any company whose stock is mentioned in the article.

Receive FREE updates!