I’m sharing some proven ways how to earn fixed income in the Philippines. Grab your notepad and start jotting down these effective investing hacks.

Looking for a reliable way to build your wealth in the Philippines? You’re not alone. In fact, around 70% of Filipinos have little to no investments, but fixed income could be the game changer for many.

As investors, we are always aware of uncertainties. That’s why when we’re offered treasury bonds and special deposit accounts with attractive interest rates, we immediately grab the opportunity.

That is a wise decision if you’re thinking about generating a steady flow of monthly passive income by investing in fixed income securities. Join us as we start that exciting financial journey!

Key Takeaways:

- Government bonds and corporate bonds are reliable sources of passive income for investors.

- Fixed deposit accounts offered by banks are a popular choice for generating steady returns while protecting your capital.

- Factors to consider when investing in fixed income in the Philippines include interest rate trends, credit ratings, inflation rates, and foreign exchange risks.

What is fixed income?

Fixed income investments refer to financial products that provide a fixed income stream over a predetermined period. These investments are usually attractive because they offer established returns to investors. The term “fixed” stems from their ability to pay income on fixed interest rates and set terms.

Benefits of Fixed Income Investments in the Philippines

Lower risk profile – they are generally considered less risky than stocks and equities because of their known rate of return. They are often backed by governments or giant corporations, reducing the risk of default.

Steady and predictable income – due to their structured nature, you will know already how much you will receive as the interest rate is already set and predetermined. Many conservative investors prefer fixed income securities for their stress-free advantage besides earning a regular income.

Additional retirement funds – fixed income instruments are reliable means to increase our retirement funds. Retirees always seek low-risk investments and stable income-generating assets to cover living expenses and old-age necessities.

Capital preservation – their asset composition aims to preserve capital and is mainly backed by government funds. When you invest in fixed income securities, your principal amount is typically returned to you upon maturity. Aside from that, you receive guaranteed monthly or quarterly income from your investment.

Defense to volatility – if you want to shield or protect your money from the stock market’s volatility, you can diversify your portfolio by allocating your capital in fixed income funds. They provide more stability than risky assets like stocks and cryptocurrencies.

Straightforward – it’s not complicated to understand the terms and nature of fixed income securities because they are clear. It’s essential to know the rate of return, the maturity of the fund, the payment schedule, and the withholding taxes involved.

Don’t miss reading: “Best Investments for Beginners in the Philippines“

Disadvantages of Investing in Fixed Income Securities

Highly competitive – due to their popularity and attractive benefits, it’s always challenging to open fixed-income investments. The demand is so high. However, the available offerings are limited. Make sure you open your investment before the bank, or the broker closes the offer.

Lower returns – when it comes to investments, the lower the risk, the lower the returns. Don’t expect to earn income higher than 9% or the prevailing market rates set by the BSP (Bangko Sentral ng Pilipinas).

Withholding tax – fixed income investments in the Philippines are not exempted from tax. They are subject to a 20% withholding tax. The tax amount will already be taken from your gross income from investment and will be reported by the bank or broker to the BIR (Bureau of Internal Revenue).

Types of Fixed Income Investments in the Philippines

Various fixed-income products to invest in the Philippines are available for both beginner and experienced investors. You may avail of them through commercial banks, financial firms, or brokerage firms in the Philippines.

Treasury Bills (T-Bills)

Treasury Bills are low-risk, negotiable, and short-term debt instruments of the government issued by the Bureau of Treasury. These are offered in tenors of 91, 182, and 364 days. Investors pay less for the T-Bills and profit from the difference when they mature.

Fixed Rate Treasury Notes (FXTN)

FXTNs are medium to long-term, low-risk government debt instruments issued by the Bureau of Treasury. They mature in up to 25 years with coupon payments made semi-annually. Because these instruments are traded in the secondary market, they can be bought and sold at any time at market rates.

Retail Treasury Bonds (RTB)

Retail Treasury Bonds are medium to long-term debt securities issued by the Bureau of Treasury. Unlike FXTN, RTBs pay investors a fixed income every quarter. They are quite popular among the safest types of investments in the Philippines because of their low-risk and government support. RTBs are offered with a 2 to 25 years tenor and traded in the secondary market based on prevailing market rates.

| Treasury Bills | FXTN | RTB | |

|---|---|---|---|

| Minimum Investment | PHP 100,000 | PHP 100,000 | PHP 5,000 |

| Tenor | 91 to 364 days | 2 to 25 years | 2 to 25 years |

| Rate | Prevailing market rates | Prevailing market rates | Prevailing market rates |

| Coupon Payment | Sold at a discount | Semi annually | Quarterly |

| Settlement | Next banking day | Next banking day | Next banking day |

| Withholding Tax | 20% | 20% | 20% |

Corporate Bonds

Corporate bonds are fixed income securities issued by giant companies in the Philippines, often to raise funds for special projects or business expansion. They offer potentially higher fixed rates of return than government securities.

Long-Term Negotiable Certificate of Deposits

Long-term negotiable certificates of deposits are fixed-income investments offered to depositors with a tenor of 2 to 25 years. Their interest rates are also attractive and are usually higher than time deposit accounts.

| Corporate Bonds | Long Term Negotiable Certificate of Deposit | |

|---|---|---|

| Minimum Investment | PHP 100,000 | PHP 100,000 |

| Tenor | 91 to 364 days | 2 to 25 years |

| Rate | Prevailing Market Rates | Prevailing Market Rates |

| Settlement | Next banking day | Next banking day |

How to Earn Fixed Income in the Philippines?

Step 1: Know your investment goal and risk profile

Define your financial objective. Do you plan to preserve capital and earn interest for short or long term? Once you know your primary investment goal, you can decide which fixed-income products suit you. Use this article as a guide to acquaint yourself with the types of fixed income securities to open.

You must evaluate your risk tolerance and how comfortable you are in investing your money. While most fixed income guarantees sure returns, your investment goal, and risk profile are crucial factors to consider.

Step 2: Access the market

You should do three things to get access to fixed-income investments.

Connect with your bank manager

Most commercial banks in the Philippines, like UnionBank, PNB, Landbank, BDO, Metrobank, BPI, and Chinabank, offer investment products like T-bills, RTB, bonds, and long-term negotiable certificates of deposits. Approach your bank manager and ask them for any upcoming offerings. Let the bank manager know you are keen to invest in any available fixed income securities.

Bookmark the Bureau of Treasury Offerings

Bookmark the Bureau of Treasury’s official website and make it a point to visit it regularly. The Bureau of Treasury posts the latest investment offerings that provide fixed income. It’s wise to stay ahead.

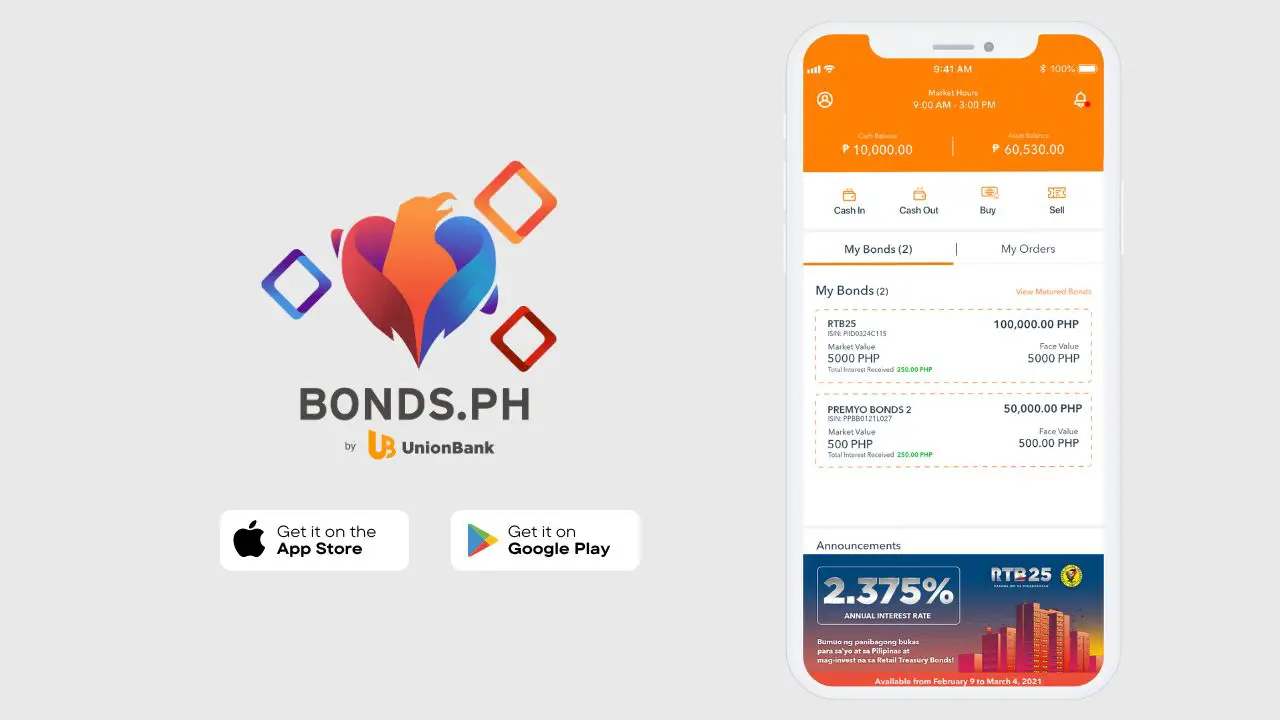

Download the Bonds.ph App

Sign up for Bonds.ph account. It’s genius to use this and it’s one of the best investing platforms in the Philippines. We recommend this app for investors looking for a quick way to save and invest in low-risk securities like bonds. This online platform is licensed by the BSP (Bangko Sentral ng Pilipinas) and brought to all Filipino investors by UnionBank.

You can start building your portfolio with Bonds.ph for as little as PHP5,000. When you invest in bonds, you also help our country’s government projects.

Step 3: Consider investing in short-duration bonds

Based on key facts, short-term investment grade bonds with maturities of 1-3 years are frequently recommended for investors seeking to achieve total return goals. This technique can help you reduce risk, especially for new investors. After that, you can reinvest your capital in another fixed-income product.

Step 4: Diversify your portfolio

Diversification is one of the best methods of effective investing strategy. Diversifying your money reduces the risk by spreading your capital across various assets and sectors. That way, your fund is not affected entirely when one investment performs poorly.

Step 5: Re-balance your portfolio

Monitor and adjust your portfolio constantly. Close the fund on maturity and reinvest your money in other assets. Don’t forget to evaluate your investments’ performance against market changes to keep up with your financial goals.

Common Types of Risks Associated with Fixed Income Instruments

Credit risk occurs when the issuer fails to make payments, causing the investor to lose his principal and interest payments.

Unlike stocks, fixed income securities may have less liquidity because they can be difficult to sell quickly, especially during times of market crashes. That results in potential losses if an investor needs to close their investment.

Changes in interest rates can have an impact on the value of fixed income securities. Bond prices typically fall when interest rates rise, and vice versa.

We always look for investment products that can beat inflation. But inflation in the Philippines can always change over time and there is no guarantee our investments can beat it.

A “call risk” happens when some fixed income investments include call features that allow issuers to redeem the funds prior to maturity. As a result, the investor may receive lower-than-expected returns or potentially lower interest rates.

Investing in foreign fixed income securities exposes investors to FOREX fluctuations, which can have a negative impact on returns when converted back into the Philippine peso.

Final Thoughts:

The Philippines offers investors a reliable source of passive income through fixed income securities. You can effectively generate steady returns by choosing the right fixed income product that suits your financial objective and risk profile. Market trends and common types of risks can guide you to develop a solid strategy to achieve capital growth.

Keep in mind though that there is risk involved when investing, so getting an expert advice and doing thorough research are essential steps to success in the Philippine fixed-income investment market.