Sun Life has some great Prosperity Funds for both short term and long term investors. In this page, I’m making a review about one of my favorite Mutual Funds, Sun Life Prosperity Equity Fund.

Who should have it and why should you invest with it?

Do you know that you can make your child a multimillionaire at age 10 just by investing in an Equity Fund like Sun Life?

It may sound too good to be true but investors find great potential with equity funds as most of the funds beat the main Philippine Stock Exchange Index.

How? Read on to learn the concepts here.

Sun Life Equity Mutual Fund Review

Sun Life Equity Fund is suitable for aggressive investors with very high risk tolerance and for those investors with long term investment goal (7 years or so).

This fund is designed that way because it aims to maximize its capacity to earn through long-term capital appreciation with excellent stocks listed in the PSE with a few mix of government bonds, corporate loans, cash and other liquid assets.

Who should Invest in Sun Life Equity Fund?

This is for you if you have money that you won’t be using anytime soon and you want to invest it for long term being aware of the risk involved with stocks and the global market, you would like to grow your money anyway.

Why should you Invest Sun Life Prosperity Equity Fund?

Because the potential of equity funds are excellent and proven to make money in the long run. Sun Life Equity Fund is composed of diversified portfolio of Philippine common stocks, preferred stocks, cash and other liquid assets.

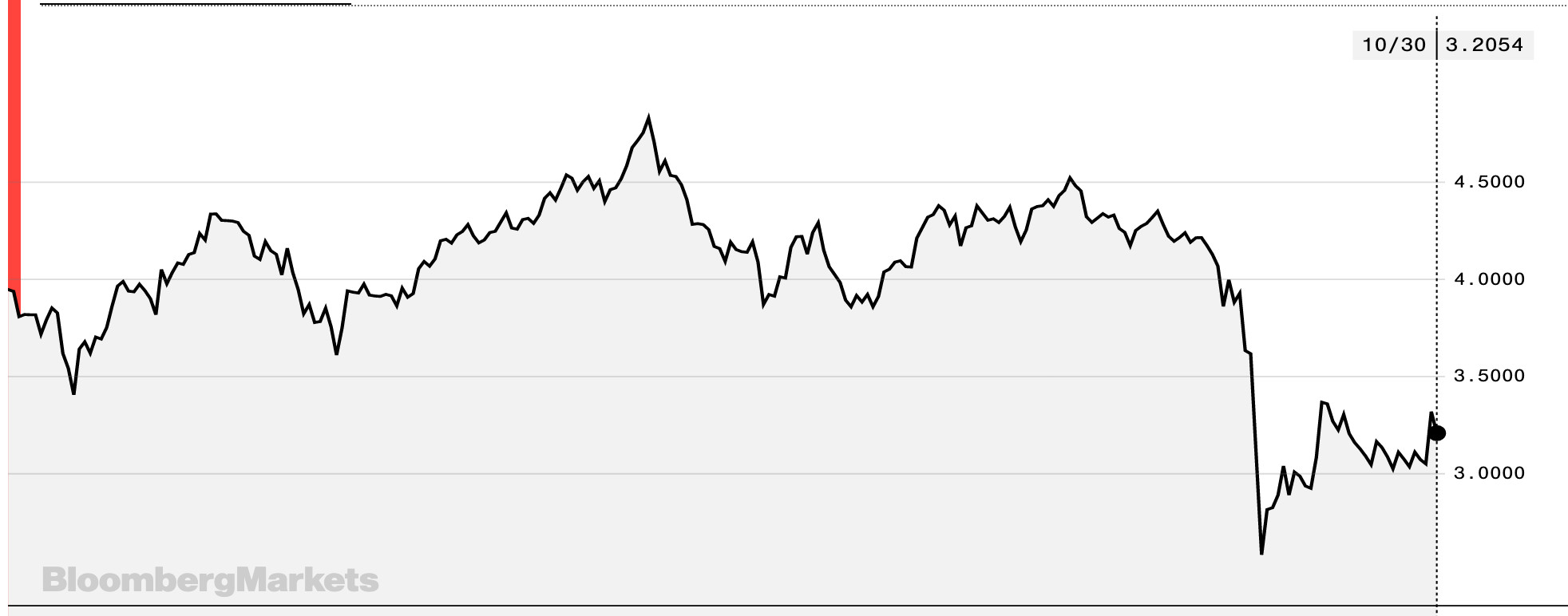

Like many investments, Sun Life Prosperity Equity Fund is affected by the pandemic. Its a very good opportunity to enter and invest in this mutual fund while the price is lower. It’s just a matter of time when it will reach its all-time-high again.

Really time makes money if you won’t waste it.”

Top 10 Holdings of Sun Life Equity Fund:

Sun Life Equity Mutual Fund is mostly composed of stocks listed below:

- SM Investments Corporation

- SM Prime Holdings Inc.

- Ayala Land Inc.

- Ayala Corporation

- BDO Unibank Inc.

- Bank of the Philippine Islands

- Universal Robina Corporation

- PLDT Inc.

- International Container Terminal Services Inc.

- JG Summit Holdings Inc.

Minimum Fund to Open Sun Life Equity Mutual Fund Account

The minimum amount to open an account for Sun Life Equity Fund is P5,000 and the minimum additional contribution is P1,000.

That means, for as low as P5,000, you can start investing with this mutual fund.

Tips to Grow your Millions from a Mutual Fund

The most effective way to grow millions of money with equity funds is investing periodically until your long term goal.

Start by putting 100K and add up funds every month to your Equity Fund.

With Sun Life Prosperity Equity Fund, follow the objective and aim of the fund which is from 7 years and above.

With this time horizon, you can achieve high capital appreciation every month that your fund grows itself and you can generate tremendous return as you reach your goal.

In 10 years’ time, if you kept on investing 5,000 and above every month and this fund always makes 15% return, you can be making more than a million of money.

Risk of Investing in Equity Funds

Equity Funds have the highest risk compared to other money investments. But higher the risk may also give higher rewards. Investors must always consider huge risk when investing in equity funds and the stock market.

It is recommended to invest only 10% to 20% of capital in equities to minimize the risk of losing much money. It is also important to choose the appropriate mutual fund that match your risk profile and objectives.

Want to invest mutual funds? Read our guides below:

Hey, don’t forget to SUBSCRIBE (it’s free) to receive the latest posts from us and never miss a thing!

Disclaimer: Everything shared in this website is for information purpose only and should not be considered as professional advice. Every investor has a different risk tolerance and goal. Always do your own research before investing your money.

What is the difference if I invest in Sun Life Equity using COL or directly sa Sun life?

Hi, Naomi. The first one is investing via COL Financial which is a broker that offers Mutual Funds. The second one is opening the mutual fund at Sun Life office or through Sun Life advisor

Hi ma’am. tanong ko lang po. i have sunlife equity fund. pano po ako makakaearn dun? ive been depositing monthly. may mga dividends po bang mtatanggap like in the stocks? nalilito kasi ako how money would have interest every yr kung kelangan hindi galawin ang pera long term

Hi Cherry. Equity Funds are suited for 5 years or more so long term talaga siya mag-aappreciate in value. Do not expect earnings in just a year or two. Yes, MF could generate dividends, depends on the MF company.

Hi ms fehl im interested in investments I open my moneymarket fund in bdo last january but seems it is not moving.im planning to reinvest it to equity fund.what else would you advice me when it comes to aggrrssive investor? And about COL how can open an account for the first timer. im from cavite.thanks more power

Hi, Money Market won’t give so much earnings although they are less risky compared to Equity Funds. As an aggressive investor, you may switch to Equity Funds but remember EF are suited for 5 years or so and are the riskiest investments for BDO UITF.

If you want to open an account on COL online, I shared this guide here: https://philpad.com/how-to-open-col-financial-account-online/

ms. Fehl, ano po disadvantages ng VUL?

last question ko po si off course lahat po tau natatakot mawala un nilagay natin pera sa isang bagay its possible youre capital loss??? or possible kant malugi pero hindi totally mawawala ung pera mo ? sana po masagot nio ung tanung ko

Hi, when it comes to investing any loss is possible but as an investor you must know that the higher the risk, the higher the earning potential 🙂 If you are conservative (takot sa high risk) you should invest on Money Market Funds instead.

hi i dont have any idea about mutual funds or about sun life pero interesado ako mg open ng account pero ang tanung how? kailangan ko bang mg kaaccount muna COl or kahit direct ko pumunta sa nearest branch of sun life? thanks sana po masagot nia

Hi, you can open Mutual Funds directly sa Sun Life. But I prefer via COL kasi pwede kang mag-add ng different mutual funds aside from Sun Life. Hope that helps.

Thanks for your insights Fehl. Been following for a while and resumed reading for a week now. I have opened an account in COL and chose Sunlife Prosperity Balanced Fund with an initial of 5000, then PCA for 1000 a month. Would that be ok for 5 years if I also add some more from time to time? and pweding magpa rough estimate after 5 years? Thanks

Honestly, 5 years is kinda short especially right now with equities. The Index is likely not going that far in 5 years so do not expect for 25% gain or so. Make it 10 years and up

What is the minimum age possible to open mutual funds? or can I open a mutual funds to my children?

18. Yes, you can open Mutual Funds for your children. Open ITF (In-Trust-For) account for them if they are still minors. When they turned 18 or above, you can turn the account into their name and leave the ITF

Hello fehl. Im a seafarer and I want to invest and to start now. Could u pls advice me what is best for me?

I want to start but Im afraid Im not able to minotor what will I invest due to nature of my work. Sometimes a month at sea and no internet onboard.

And how will I able to start since Im now onboard? Got money on pocket but just sleeping.

Visitor Rating: 5 Stars

Visitor Rating: 5 Stars

sunlife/fami/philequity? which is the best for equity MF?

Hi Mam Fehl,

Could you recommend blue chip stocks with low starting amount?

Thank you.

Regards,,

Ryan

Visitor Rating: 5 Stars

Visitor Rating: 5 Stars

hi ms. fehl

pki xplain po ung front and back load & ung other fees po.

thanks

pag front end fee base on my experience this is the less than 5 yrs na holding period in short may mga tax deduction and other deduction pa pag nilabas mo na ung money mo. unlike sa back end this is the 5 yrs holding period and after 5 yrs if hindi mo sya nilabas is. kada exit mo . wala ka anng exit fee. correct me if im wrong . thank you

Insurance in sun life is different. I’m not connected to sunlife but I am one of its customers. Every Filipino who wants to invests should also consider getting an insurance first that that is NOT from a pre need company. And besides, a part of your yearly premium is invested as well in MF you can choose from (VUL). Sun life is proven true to its coverage depends on the riders you availed. Same principle applies in getting an insurance and in investing in stock market, start as early as possible so the premium would be lesser. I started when I was 22, and I can say that a part of my premium is also compounding in just 4 years. No one can predict when will a person die even if he/she is young, but the burden of leaving monetary help in the family is a great relief to think while living.

As with all transactions, read the paperwork carefully, such as words called, disclosures…Be extra careful with fund loads, in front or back, especially with insurance companies, some of their fees can be as high as 6% just at the front end, called a commission, there can also be annual management fees, make sure they are under 1.5% a year plus other fees and taxes you could be liable for or deducted in advance…When I see insurance, I run, because I know someone will make a lot of money and in all cases it is never you…Think…Why would an insurance company want to sell equities? Be super careful, maybe stick with Miss Fehl’s stocks choices, make sure you diversify, 20 or more different ones, or UITF which are already packaged in a desertification manor…Also, make sure you, personally check out Sun Life…Who owned the company, how long they in business, talk to your banker, or investment institution…Insurance companies often go into receivership because of bad investments, which equities in this way can be because of volatility, ask sun life, what are all fees, do they charge you for flipping, since they will be managing your fund for you…UITF’s do not have hidden fees it is all spelled out for you

Hi ms Fehl! Which one is better in terms of annual growth (return) – sunlife equity fund or philequity fund? Thanks po.

They are very close in the race but the past years, it’s Philequity

ohhh okay thanks so much il buy philequity then…

Hello po Ms Fehl i want to start investing where shoul i open an account

Ms. Fehl, I heard about equity funds from bdo and metrobank. What is the specific fund that I can buy for short or long term?

There are many equity funds to choose from and I am a newbie.

Please help by giving your advice what to buy?

Thank you very much.

Hi. Metrobank and BDO have some equity funds to choose from. Equity Funds are suitable for 3yrs or more. If you prefer 1 yr placement, you may like Balanced Funds. For short term I recommend Bond Funds, Money Market Funds and Fixed Income Funds. Those are the terms you need and you can then select the specific fund Metrobank and BDO offer 🙂 I personally have BDO Equity Fund (EPCIB EF) and so far I’m liking its performance.

Hi Ms. Fehl,

Thanks for this article.

Question only: why does this MF receive a higher rating than Philequity Fund when the Philequity Fund has a higher return for 1, 3 and 5 years based on this another article of yours:

http://philpad.com/best-mutual-funds-in-the-philippines-2015/

Thanks again.

Exactly, “rating” is different from “performance.” 🙂

hi ms fehl, how can i apply for sunlife equity fund? thanks….

Hi, Sam. If you have an account with COL Financial, it’s so easy to have mutual funds like Sun Life because COL also offers Mutual Funds. Another way is to go to any Sun Life branch near you and open an account.

thanks so much ms. fehl…Godbless us.

My old beef with insurance anything is high commissions…Now, with the addition of MF packaging, is the high fees, in the form of broker fees, and/or commissions, which in the US, can be 7 to 8%…

What would any costs be, both long term and up front, for the investor?

This is needed to know, so he or she can calculate the true net loss or profit.

Example is, if it is 7% up front, and the growth, over 7 years is 20%, one should remove first, the 7% broker fee, or commission, or both, then divide the 20% by 7 years…This does not leave much, when more conventional funds such as MMF MF Stocks, maybe bonds, depends on the fed, and much better, which i love, UITF.

Insurance companies, who do anything other than insurance, scares me…What if they default? Do they go into government guaranteed receivership, to protect the investor which happens a lot.

What protections from insurance company skulduggery do we have?

Am I wrong? Close? Far off?

To be profitable, they would need to show me, a minimum of 12% growth a year, or 80% over 7 years, divided by 7, less commissions

In fairness to Sun Life, it is a very well established international company. They started in the Philippines in 1895. There’s a zero front end if you got your MF via COL. If you opened in Sun Life directly, they remove the back end fees if you stay up to 5 years. 5-Year Return I think is around 65% but now you know the performance of stocks went down so it’s around 50%ish and I’m sure annual growth won’t reach 12% at this recent status

hello po mam saan po ako mag open na account to invest

Most insurance policy favors the insurance company. My sister had Manulife Insurance with Accidental Benefits. The agent told her that she just needs to pay it for 5years and the succeeding years will be coming from the dividends accumulated through out the years but on the 7th or 8th year we received a letter and a statement that the dividend is not enough to pay the premium. So in short my sister paid the premium again. On the 9th and 11th year we received another letter and statement that she needs to pay the premium and that the dividends are not enough plus the interest.When my sister came for vacation, the agent told my sister that she needs to pay the premium whenever the dividend is insufficient. Seriously? It’s a life insurance meaning she needs to pay the premium habang nabubuhay sya. So she decided to withdraw and just surrender the policy. The problem is she will only get 28k from almost 150k she paid for the premium. She just surrendered the policy even she lost almost 120k than losing more money. We just learned that there are so many complaints from Manulife. You need to research the company and their offered plans, read reviews and join the forum.

Thanks again Ms Fehl