SMPH (SM Prime Holdings, Inc.) just became the first one to hit the 1 Trillion pesos Market Valuation in the Philippines on June 5. I’m here to share with you why you should invest SMPH stocks.

If this giant company hit its trillion cap (I repeat, in Trillion), what does it say about you as an investor and your future investments with SMPH? Read on…

SMPH Hit 1 Trillion Capitalization! Why Does It Matter?

Now that SMPH hit 1 Trillion cap, what does it say about the company and you as an investor?

Why huge market cap matters?

Market Cap is simply the market value of a company in the stock market. The larger the market cap, the larger the company’s asset, revenue and capital.

However, it does not necessarily mean the company is better than the other companies in the market.

Perhaps you’re wondering why SMPH stock price is only around 34 while having a close-to-trillion cap, does that mean it’s cheaper than other companies like AC whose stock price is around 840?

Lower stock price does not indicate cheaper value per se.

Market cap is the total number of outstanding shares multiplied by the value of one single stock.

SMPH’s stock price is lower because it has more shares outstanding than AC. Having a large market cap is beneficial because investors tend to be more confident to invest.

Large market cap companies are known to be less volatile. Stability is their home. The downside of having a huge market capitalization though is usually the slow paced of growth.

But investors like it slowly but surely. They win in the end, that is what always matters.

SMPH is one of my favorite property giant companies in the Philippines. Not only it makes excellent recurring income, SMPH is also one of the premium stocks we recommend here as one of our blue-chip stock picks.

I’m gonna lay out the cards here as to the reasons why you should invest in this powerhouse.

Why You Should Invest SMPH Stocks?

- Recurring Income

- Long Term Growth

- Best Equity

- Outstanding Management

- Generous Dividends

- Passive Income Potential

Recurring Income

SMPH is currently the biggest shopping center developer and mall operator not only in the Philippines but also in South East Asia.

How many SM malls have you been to? According to their corporate profile, it has 61 malls in and outside Metro Manila and 7 shopping in malls in China, totaling 9.0 million square meters of Gross Floor Area (GFA).

In the Philippines, they have a total of 17,076 tenants and 1,635 tenants in China.

Just imagine the recurring rental revenue SMPH makes every month from these malls alone.

SMPH reported a net income growth of 13% this First Quarter of 2017, to PHP6.6 billion from PHP5.8 billion last year. 62% of the revenue was from malls, 29% from residences, 4% from commercial properties and 5% was from hotels and convention centers.

Long Term Growth

SMPH is not only into mall development, it also operates and develops the following:

Residences:

- SMDC properties

- Hamilo Coast

- Tagaytay Highlands

Commercial Offices:

- SM Makati Cyber One

- SM Makati Cyber Two

- Cyber West

- TwoE-com Center

- ThreeE-com Center

- FourE-com Center

- FiveE-com Center

Hotels and Convention Centers:

- Conrad Manila

- Park Inn by Radisson in Clark, Pampanga

- Park Inn by Radisson in Davao

- Pico Sands Hotel in Hamilo Coast

- Radisson Blu Hotel in Cebu

- Taal Vista Hotel in Tagaytay

- SMX Convention Center (Manila, Taguig, Davao and Bacolod)

Best Equity

You probably know this already, SMPH is among the top 30 companies joining the PSE Index.

Why that matters?

Read the article I wrote about PSEI Companies.

If you’re looking for an equity with immense potential, SMPH is one of those you should have shares with.

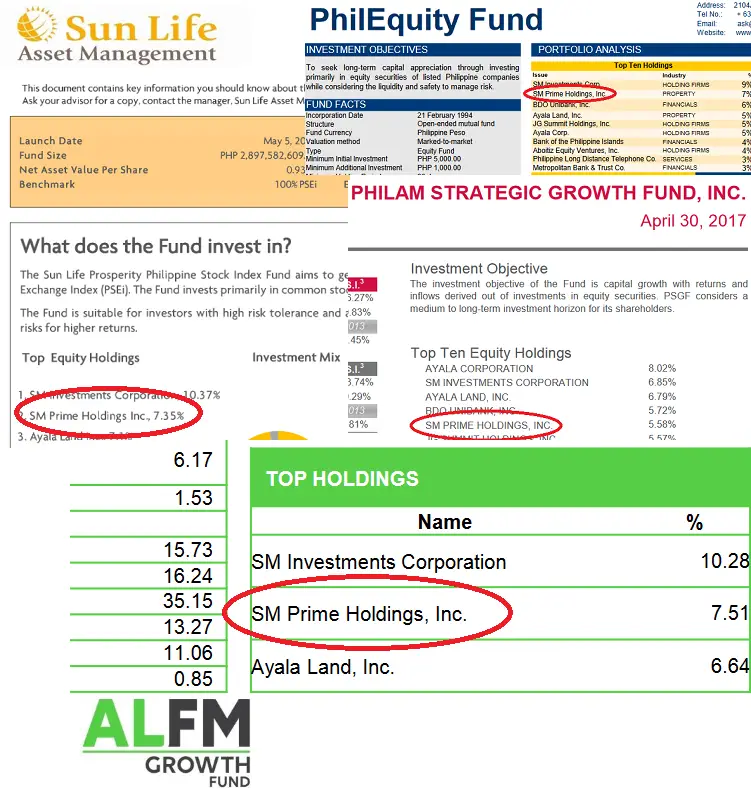

Even the most excellent financial houses of Mutual Funds and UITFs allocate their investments for SMPH.

See some portfolio allocation below from the best Equity Funds and Equity Index Funds in the market.

SMPH is always one of the their top holdings.

Outstanding Management

No doubt about the exceptional management of the Sy family and the SM Group.

SMPH remains its focus on their success-driven management strategies.

SMPH makes every Filipino proud not just from winning prestigious awards but also for giving the Philippines a world-class brand recognition.

Generous Dividends

A huge and stable company like SMPH always rewards cash dividends every year. From my observation, they always declare them every April of each year. So keep them shares coming to enjoy more dividends.

Passive Income Potential

SMPH was incorporated in 1994. SMPH IPO price (Initial Public Offering) at the time was at P2.0669 per share. As I write this post, the value of SMPH per share is now P34.05.

For instance, if your Mom bought you 10,000 shares on the IPO back in 1994 and you kept your shares until now, your 10,000 shares would now be valued at 340,500. You gained 1547% without much effort. That is passive income!

Income potential of a brilliant property company like SMPH could grow your money amazingly because properties and lands grow in value over time.

My Strategy Investing SMPH Stocks

Wondering how I invest SMPH stocks and what’s my strategy for it? Currently, SMPH is one of the blue-chip companies that I invest every month.

I usually buy 100 shares of SMPH monthly and then 200 or 300 shares when the market is down or when the stocks are fair or cheap to buy or when SMPH is included on the Undervalued Stock picks.

I follow the stock picks data here in Dailypik to decide when I should add more shares to buy for a stock like SMPH.

Since SMPH is more on real estate and properties, I know it will really take a couple of years or more for the stock price to climb the charts further.

My goal for my SMPH stocks is to remain invested until 10 years. For now, I am focused on growing my business and traveling some countries I want to visit.

Hey, follow me on Instagram and DM me if you want to be my next travel buddy 🙂

Are you also an investor of SMPH? Share your views in the comments. I’d like to hear from you 🙂

Do not miss my next posts. SUBSCRIBE NOW! It’s free! Or connect with us on FACEBOOK!