This guide is about how to use Magic 10 method investing in the stock market. If you’re already a follower here in DailyPik, you have all the access to everything we share not only the Best 10 stocks but also to stock updates and some easy guides including this one.

I assume you already have the following before you start investing in the stock market:

- Trade Platform – COL Financial, BDO Nomura, BPI Trade, Philstocks, FirstMetroSec, WealthSec, etc. You can find the rest here and you can also choose one.

- Fund in your Trading Platform – have enough money to buy stocks.

- Strategy – if you’re like us, our strategy is passive long term investing in the stock market.

How to Use Magic 10 Method

Allocate your budget.

Decide how much you want to set aside every month for your stocks investment.

Some people prefer 20% of their monthly income while others 30%.

It really depends upon on every individual’s status.

Remember, investing in the stock market is very risky that is why you should never put all your money on it alone.

Some people set aside 5,000, 8,000, 10,000, 15,000, 20,000, 25,000 or more for their monthly stocks investment.

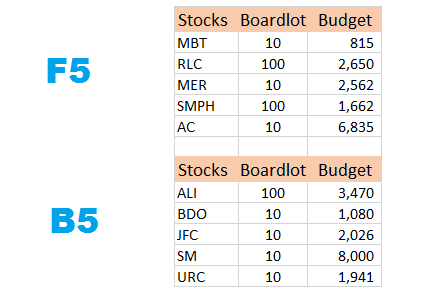

- Consider the Boardlot of the stocks listed on our Magic 10 list to know how you can allocate your monthly budget.

Example: Budget = Current Price X Min. Boardlot for each stock

You can also allocate your monthly budget by buying stocks alternately every month or allocating certain percentage to the stocks.

If you’re a beginner and your budget is below 10K, you can buy 2 F5 and 2 B5 or 3 F5 and 2 B5 if you can.

Eventually, you will build up more money as you invest. Thus, you can buy more stocks.

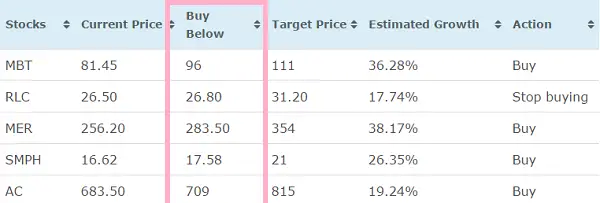

- It is also helpful to give priority buying the stocks according to Estimated Growth (you can sort the table) or when the Current Price is too far from the BBP.

- BUY when the Current Price of the stock is below the Buy Below Price.

- Take note of the ACTION to know if you must BUY, SELL, and STOP BUYING the stock.

- Also take note when there is HOLD action from any of the Big 5 stocks. That means, you must hold the stocks and pause buying for a while as it likely overvalued or would go cheaper anytime soon.

- Sell the stocks and reap profit when there is a SELL call-action. We usually send alerts too.

- Use your profit to buy another stocks. Money rolling is money growing.

Wait for the stocks to grow.

They can’t make a flower or a fruit in 24 hours.

It usually takes few weeks or some months especially for the F5 but usually faster for the B5.

Our Stock Updates can also help us to know what’s happening in the stock market.

Invest slowly and continuously every month and you will become multi-millionaire soon.

Hello where have you been, I’ve been following daily picks 🙂

Hi there! Happy investing! 🙂

Hi Ms Fehl, is it advisable to sell all stocks if target is met? Especially if it’s blue chip stocks?

Hello Fehl,

This blog is the one I’m looking for. Easy to use, good points and especially free.

We hope you’ll continue this to bless more people.

Hi, Pedro. Thank you so much. God bless you. too 🙂

Hi Fehl

Like mentioned above how can i get update on like when to sell stocks!

Thanks for all your help!

God bless u

applicable po ba ang PCA kung once a year lang ang funding ko sa account ko?lump sum naman po for the whole year.. seaman po ako at mahirap internet onboard kaya pag bakasyon ko lang maaasikaso..any advise po..thank you

It will still apply cost-averaging but you cannot enjoy the less risk opportunity compared to buying monthly

Hello Ms Fehl, Where in dailypik can I monitor the f5 and b5? 🙂

Hi, Pam. They are at this page: http://dailypik.com/stocks-picks/

Hello Ms. Fehl, new to your website. What is F5 and B5? Thanks

Welcome Anne 🙂 Fantastic 5 and Big 5. You can learn more about them at https://dailypik.com/stocks-picks/

Hi Fehl,

Thank you so much for this blog. Hope you’d continue to help more people. God bless you and your family..

Newbie investor here..

Vast information and easy to understand for beginners like me 🙂 I will make sure to subscribe here and view daily updates.

Excited to try the Magic 10 method 🙂

what is f5 and b5?

F5 = Fantastic 5

B5 = Big 5

newbie here. just started with COL.. Would gladlt be needing guidance and your input is really helpful.

Hello Miss Feui,

How do you set up the BPP for your strategy?

Regards,

ms

Hi Ms. Fehl thank u so much for ur blog. It really helps newbie like me. I already have a beginning investment right now let’s say 200k and also have a stable job what’s ur advice? TIA and godbless!

Hello ma’am. What can we anticipate on pre, during and post Christmas and election season I correlation with stock marke t trend? Thanks

what is TP?

Target Price

Hi Fehl! I and the rest of the stock market newbies truly thank you for this awesome article and daily updates. I actually have a plan but not sure it would work, im planning to buy 2 B5 and 2F5 stocks. All of them will be funded monthly, 2k/month for the F5 and 3k/Month for the B5. Not sure if it will work, would love to hear your thoughts about this. TIA!

I mean, do I get better results if I fund the B5 higher? which is which. Thanks Ms. Fehl.

Hi. Sure you can execute that strategy and stick to it if you want to gain profit. It would take time but be patient

Very helpful site! I can’t afford yet to pay for similar stock recommendations as this. Thank you very much for making this FREE. God bless you all

hi fhel,how can i get email updates regarding selling alerts?where can i subscribe or register?

If you visit everyday, you’ll see the SELL alert just beside the stocks we update everyday. We also post alert in our FB page. New posts are also sent to subscribers emails

Miss Fehl, Anyare sa Jollibee? all time low this year.. woohooo bilihan na!! wait muna ko ng reversal pattern.. what’s ur take miss Fehl? bababa pa or buy na?..d sure pero. anu take mo? Thanks

Hi. It’s a great time to buy big time and take this opportunity 🙂 Since our objective following Magic 10 stocks is investing than trading, we recommend BUYING more shares. JFC is not the only stock that declined this much. Actually, PSEI has declined, US dollar indices declined, Gold declined, Euro has been upset as well and Asian markets suffered as well. I think the market would not jump anytime so soon but I don’t think it would go down any worse. Cheers!

What is F5 and B5 means? What’s the difference?

Thanks

You can read the article and visit our Magic 10 stocks page to know more 🙂 God bless!

ask ko lang po kung mag pe peso cost averaging ba no need na yung f5 and stay na lang sa b5?

Big 5 stocks are recommended for 5 years or more (depende sa goal ng investor) so yes, ok sya sa PCA but there are also stocks in the F5 that are good for PCA, again, depended yan sa company preference ng investor

Thank so much for your blog!

So informative!

I’m still in the leArning process and studying atleast 3blue chip companies for longterm investment(10 years up).

Any recommendations?

Very much appreciated!

If you ask me, I invest for URC, BDO, JFC, ALI

Hi Ms. Fehl,

Tanong lang po kung halimbawa monthly yun gagawin kong investment, required or ideal po na same date ko gagawin yun regardless po sa price nun date na yun? o okay lang po na kahit anong date basta monthly kasi nagwait po ako ng pinakamababang price ng stock sa month na yun?

Salamat po at God bless you!

Hi. You can buy regardless of the date as long as you do it monthly

Thank You Ms. Fehl.! This helps me to choose which stocks to buy.

Thank You again and God Bless.!

hi fehl what is the meaning of F5 and B5 ? thanks.

F5 aka Fantastic 5 stocks are premium stocks that we use to flip while B5 aka Big 5 stocks are also premium stocks we invest for long term.

Hi Fehl, I’m a newbie and I stumbled upon your site. Just to share with you, I’m currently using a bpitrade account, and unfortunately it doesn’t have the “buy below” column. I’m not sure though when would be the best time to buy stocks. Need your help on this please.

Hi, Kit. I have no BPITrade so I have no idea what their extra features are. In COL Financial, they share updates and news about certain stocks and sometimes they share BBP and TP as well.

If you are “investing” it’s always best to buy stocks now than next year 🙂 Time is money.

Our BBP and TP are always posted in this page and we update them everyday. You can use them if you are following same strategy like ours.

hi Ms. Fehl, thank you so much for this blog. it helps a lot of newbie investors like me. 🙂 just want to ask, col has an additional premium stock called FMETF, is it ok to invest for long term on this as well?

thank you very much.

Hi Rey. FMETF is an Exchange Traded Fund and I recommend investing it because it mimics composition of PSEi. That being said, when you invest with FMETF, your fund is technically participating with PSEi thus letting you diversify and hitting different securities with 1 fund. 🙂 Yes, suitable to invest for 3 years or so.

Thank you so much Ms. Fehl. 🙂

Hi miss Fhel. Thank you so much for the info I’ve learned a lot from all your posts. I’m just wondering why is it that the globe telecom is not included in the big 5?

Globe Telecom is a good company too but we prefer investing it when it’s included among the undervalued stocks (flipping strategy) here.

Ms fehl good day… Ask ko Lang bkit nakasam ang mer s choices nyo eh ang Baba Ng ROI nya s Bloomberg… Almost 5 months n ung meralco stocks ko s cOL for 50k amount never ko p cya nkita mag green… Slamat po… Advice nman po… Do I need to wait n mag green or I benta ko n,cya at bumili Ng IBA?…slamat… I’m waiting for your reply

I included MER because of its status when I made the list and I just cant remove it there without a significant reason. MER is the biggest power company in the Philippines. Give it time as it’s slow to move. I’m holding my shares too although they’re in red right now like you. You can wait for it and sell at 300 if you can’t wait any longer for TP 311 and buy other worthy stocks. Bless ya!

Hi Ms. Fehl,

Thank you for your blog. I am planning to invest in stock market at the end of the month. And I am looking for a blog site where can I get stock updates and advice if it is to sell/buy/hold because as I’ve seen TRC has a monthly subscription for this stuff. So thank you so much big time. I will continue reading in your blog and suggesting it to my friends.

Hi Goldie. My pleasure. I used to be a member of TRC too. Their stocks are great and I love their Spiritual lessons. Thanks for visiting here! Bless ya!

Newbie here.Very informative…. thank you.

hi … how will i dwtermine the BPP and TP of other stocks?? thanks

Other stocks are posted in this page: http://dailypik.com/undervalued-stocks-in-the-philippines-latest-list/