Do you invest BDO stocks? If you do, I’m sure you agree with me that it’s one of the best stocks to invest with for long term.

I know BDO belongs to our Magic 10 strategy here which is under the Big 5 stocks suitable for long term investing.

BDO was also listed among our Flipping Stocks because it was currently undervalued.

In this page, I discuss our earnings both when you invest BDO using Flipping method and long term method (Magic 10).

Before that, let me share some facts about BDO.

Table of Contents:

Brief info about BDO:

- BDO, (Banco de Oro), is currently the biggest bank in the Philippines and has been noted as the number 1 bank in terms of assets, capital, trust assets, loans and deposits for some years.

- As of 31 December 2014, BDO had 875 domestic operating branches and one overseas branch in Hong Kong. These are complemented by 2,591 ATMs nationwide according to BDO’s corporate website.

- BDO was listed in the PSE on May 21, 2002.

- BDO is owned by the SM Group, one of the largest conglomerates in the Philippines.

Why should we invest BDO stocks?

Even though we hate the long queues at some BDO banks we visit, it’s no secret the Sy family has an excellent management team.

We cannot miss the opportunity to be investing with the biggest bank in the country.

SM group is the biggest conglomerate in the country, just imagine how many employees it has, I’m sure those employees are getting paid through BDO banking as well.

BDO started the weekend banking hours and it has opened many branches since then. It even went ahead with BPI and Metrobank.

No matter how many of some of our friends hate BDO banking service, we simply cannot hate the company because we are part of it 🙂 We are shareholders of BDO and investing stocks of it for long term will give us so much money.

Why BDO is among our Big 5 stocks? Simply because if there should be a banking sector in our portfolio, BDO should be the first one.

BDO Stocks Investment Earnings

191% Returns in 5 years:

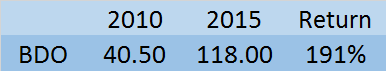

If you bought 1000 shares of BDO 5 years ago, March 2010, you gained 191% this March 2015.

BDO Stocks Earnings Report from our Flipping Strategy:

Since BDO was undervalued from the previous months, we included it among the stocks we flip.

So to those who applied the flipping method instead of long term investing, here’s the earnings report for that.

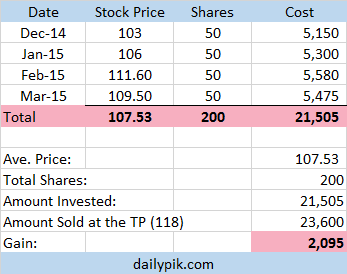

Assuming you invest 50 shares of BDO every month, you earned around 2,095 in just investing 4 months if you sold them at our TP of 118.

That is 9.74% gains from the total money you put. Of course you have to less the small fees your broker collects. Note that you can also get more if BDO price increased higher than 188.

If you followed our RLC recommendation too, you had a total 4,325 gains this March alone. Wow! Your money worked so well in the past months. Congrats with sticking to your stocks and following our picks!

Big Bonus:

No amount of money can be worth the experience you learn from investing.

As time goes by, you get to know about patterns involving stocks.

You get to know more skills and you get to be more patient and more disciplined.

As time goes by, you may not only earn money, you also earn respect from the people you share these techniques with.

Like your friends or family. Sharing good things will give you more blessings.

If you’re curious what I do with my profit with BDO, my answer is nothing. Coz I don’t sell them yet.

Yes, I follow Magic 10’s Big 5 stocks. The banking slice in my portfolio belongs to BDO.

I’m quite positive it will climb up the charts continuously until I have to redeem in 10 years’ time.

Want to learn more about investing stocks? Go to our easy guides page:

Let us hear your experience with BDO. Share it with us in the comment below. Cheers!

Good pm! Ms Fehl i wan to start investing but i only have P 5,000 to start with. What investment move or where should i invest it.

Thanks and God bless!

Hi, depending on your financial status, risk profile and goal – if you have a regular job and you can take risk and you plan to invest long term, I recommend either 1-2 blue chip stocks or a an equity fund from a mutual fund.

hi Miss Fehl

Pano po ba mag invest? gusto ko sana mag invest peo hindi ko alam kung saan ako magsisimula?

check out the Guides on the Menu above. Follow the guides for stocks

Miss F,

aggressive po ako but baguhan pa some tips po miss F? Salamat ng marami sa reply. .

God bless

Hello Ms. Fehl

Salamat sa magandang pag share knowledge about sa pag invest and like top

company like BDO.Tanong ko lang po sana kng ano po ng formula how to get BBP and TP.

Thanks and Best Regards

Im glad nakapasok ako sa page na to sana po di po kayo magsawa magshare ng inputs sa amin na mga baguhan.

God Bless you more

Good evening Ms. Fhel,

I just want to ask someting. Can a teenager invest stocks in BDO? And how much is the minimum investment in buying shares? I’m kind of interested kasi but I’m sure that there will be lot of critics saying that I’m just a teenager and I don’t know a lot in terms of banking. I have savings not that big, but I’m sure it’s not yet enough. So may I ask for capable answers bacause I really want to invest.

I will be looking forward for your response. Thank you and May God be with you.

-Dami

Hi, you can ask your parent to open ITF (In-Trust-For) account for you. You can use it to invest even if the account is not yet under your name. Your parent can turn it on your name when you turned 18

Ms Dungo, Great answer to Dami’s inquiry. Encouragement to try while learning a sound method puts young market students on the correct path for the future. We have read a decent number of articles about teens who began investing with the help of parents or neighbours in my home country (USA). Some have excelled to a point where they could be considered wealthy. Keep up the fine work you do!

Maam gusto ku po bumuli ng stocks sa sm at bdo papa anu po anu po gagawin kc baguhan lng po ako

check out our Stock Guides on the menu

Hi goodmorning! may i ask po if how much yung starting fee pag invest sa bdo stock investment?

BDO stocks are on the 100ish, now below 100. Since min. boardlot is 10, you can buy in the range of P1000 and above

hi Ms. Fehl,

advise naman po if need to sell or hold sbs shares na.. I bought it 5.94, and still a loss position, do you think this is not good even if to hold it six months or a year?

thank you

Hi, Jam. I already commented about SBS. It’s very new and we don’t have enough data to include it here. If you have loss right now with SBS, you must have reasons why you bought it, find more reasons why you should keep it and follow that. God bless!

thank you so much Ms. Fehl…. 🙂

hi miss fehl! I just started buying stocks of bdo but all i see in my portfolio is red 🙁 do you think it’ll turn green anytime soon?

BDO is the number 1 bank in the country. Stick to your plan. It will take time to grow stocks. Be patient 🙂

Hi miss F. . Ask ko lang po if ok lang po ba magbili ng share khit di parepariho ilang shares na binili sa isang companya? Kunyari nbili ako ng share sa isang company ng 50 ngayong buwan taz nxt month 70 taz 30 etc. Ok lng po ba yon?

Yes, you can buy more or different shares every month. You can do that with BDO. It’s a very good company

She is right!!!!!! HOLD ON TO IT…All of the UITF AND BDO stocks, are on, what is called a “FEAR FACTOR,” BASED ON GREECE AND CHINA’S TROUBLES, WHICH IS STUPID, it will all correct, or a “CORRECTION,” triggered by larger and communicative inverters, meaning they talk, meet, eat, go places together, and or, to prevent arrest, for inside trading, know when to sell of their, “SHARES,” or as UITF call them, NAV per unit, which is a number to take money invested, creating it into shares, OR UNITS, if you will, who, 1. Create fear, downturns, and what we all know of as corrections…(There is no such thing as a correction)…Investments never correct, they have no brain…CORRECT WHAT?…2. These people also create the sell low and buy high, investor mistake…After THEY CREATED THE HIGHS, along with sales, taxes, time, and fear, they sold a lot of money, shares, or UTIF=NAV pu, to cause the crash, if you will…If you look close, they will go up, just a little, then down, just a little, inching up, just a little…Why, just a little? So NO ONE KNOWS WHAT HAPPEND ANDDDDDD you will freak out and sell, then they buy your shares, or NAV’s, low and then the shares go back up, and they will sell them later, on the high…No millionaire, will sell high, or out of fear, unless he or she received the money unfairly, or inherited it, or did not work for it…If you worked hard for your money, blood sweat and tears, earning free money from stocks and/or UTIF’s with no work of your own, should warrant patience…Don’t be a coward…Stay in until it goes back up, which it will…These power brokers have humungous ROCKY MOUNTAIN OYSTERS, do not eat balut, and IF YOU HAVE NOT BEEN WATCHING DONALD TRUMP’S SPEECHES, FACIAL EXPRESSIONS, AND HOW HE WALKS AND STANDS, you will go broke…Hang on, or get out and stay out, because you will go broke

Hi Ms. Fehl,

any insights about JFC? they are very aggressive and expading globally? may i ask why you did not put JFC in our BIG 5?

Thanks.

JFC is indeed among our Big 5 stocks here 🙂 Our Big 5 stocks include ALI, BDO, JFC, SM and URC

Apologies if i missed it. Anyways may i ask for your inputs also with regards to investing in MF specifically equity fund. will it be redundant since i am now investing in Stock market? is it advisable? or should i invest on more safer type of MF which is the balance fund (combination of bond and stocks) Thank you very much.

We’re cool. 🙂 It’s always better to have different investments especially if you can afford it or you have extra money. Diversification will help you minimize risks or losses in case one of your investments didn’t perform well. MF + stocks is not redundant because they are different. It’s a good thing having both actually 🙂

Hi ms fehl last na po. Ask lang po how about investing both in jfc and urc although consumer sla pero different industry for me ung isa foodchain and resto ung isa naman manufacutirng d sla competing diversified pdn investment for your kind inputs please

Hi. Investing JFC and URC is very good. We discussed why from the posts about them. Check them out. Thanks!

thanks for sharing ur wisdom about investing….its really a big help for a newbie like me…..keep it up..at sana wag kng mgsaswang mgbigay ng wisdom…godbless

Hi fehl, your generous info helped newbies like us, thanks for that. Though I still need to learn how to get away from emotional investing…seems like my mind is too tied up with all the bad experiences I had when I was lured into networking that turned up to be scams. Your assurance and guidance somewhat netralizes that urge to withdraw too soon when I see red flags in my portfolio. 🙂

Networking about what? I hope they are not some MLM networking 🙂

That was 10 years ago…i have no idea about MLM, i totally closed my doors to networking. Left me empty handed. 🙁 My aggresiveness took the best of me…learning from my mistakes…i should have invested the money in stocks instead and reap good results.

Experience is the best teacher 🙂

hi miss fhel

i wanted to invest for a long term…

i just wanted some advice from you because you’re the one who is knowledgeable on this kind of thing…

just wanted to have a heads up or advice from the right person.. 🙂

Hi. I’m not an expert with these things but I can give advice based from personal experience 🙂 If you want to invest for long term, our Big 5 stocks from Magic 10 are very good to invest for 5 years or so

Hi Maam Fhel,

How about DNL?

Not spot for DNL as of now, maybe soon 🙂

Hi Ms Fehl, you said BDO is on your B5, I don’t actually getting the advantage of magic10 against flipping, since you seemed like an active trader, opposite to those passive who just sitting away from their computer and unable to observe the market time by time. Why cant you just sell your shares today while in TP and just buy back the same number of shares when the price dive down again. See, by selling your shares now, you’ll be able to buy more stocks, check my computation below using your example above for long term investment (5yrs ROI)

assumed no. of shares = 1000 (from 2010-2015)

average price = (50.5 + 118/2) = 84.25

earn/shares = 118 – 84.25 = 33.75

profit = 1000share x 33.75php = 33,750php (gross earns, charges/fee must be still deducted)

so now, use your profit to buy more shares

additional share = 33,750 / 118 = 286shares

so total share you’d have is 1,286 if you buy sell & buy now.

This is the power of compounding. You’ll take the opportunity of TP because when the price bounced back to lower you did not take the opportunity right? that’s why I stick to your flipping method, and I loved you for that hehe..

Well above is just my thought. This question might be so casual and sound practical but if you share your ideas and thoughts (I wish) perhaps my mindset would change also.

I’m active trader by the way.

That’s more of flipping and thank you for sharing. I’m a passive investor, not an active like you. I choose to follow what I’ve started and stick to it. For B5 I follow Target Term rather than Target Price. I only use some flipping when I can. I’m a very busy girl and I just stick to my original rule unless there is a tsunami coming LOL I salute active traders like you! Man, I wish I’ve got more time to do that. Cheers!

Thank you Ms Fehl . Appreciated so much your passion of sharing your thoughts about investment…

Regarding BDO the price is almost hit the TP..

Is it recommended to buy at this moment?

It actually reached the TP of 118 earlier this morning that is why I posted this article already. If you’re flipping BDO rather than investing for long term, sell at the TP but if you’re using Magic 10, buy it every month.

Thank you again for your reply.

Gob bless!

Hi Ms. Fehl,

Good day!

“As time goes by, you may not only earn money, you also earn respect from the people you share these techniques with. Like your friends or family. Sharing good things will give you more blessings.”

Thank you for sharing and the blessing. Thank you my friend. I am doing my part in sharing all the things I’ve learned from you…

Have a nice day! God Bless!

V/R,

AJ

Thank you AJ. Cheers my friend!

hi ms. Fehl

Kamusta po? Hingi po sana aq ng guidance aat advice sau, kung panu mkag simula sa pag invest.. nbbsa q mga post m at nttuwa po aq kc share m po ung mga personal experience m. Gusto q rin sana na kht ppanu po lumago ipon q meron po aq savings kabayan savings ng BDO. Isa po akung OFW. Maraming Salamat. GODBLESS

hi. Thank you for visiting my pages. Choosing the right investment will depend upon your status, risk appetite and goal. If you know those 3, you can then read about Mutual Funds, UITFs, Stocks at Philpad to decide which investment suits you 🙂 God bless!