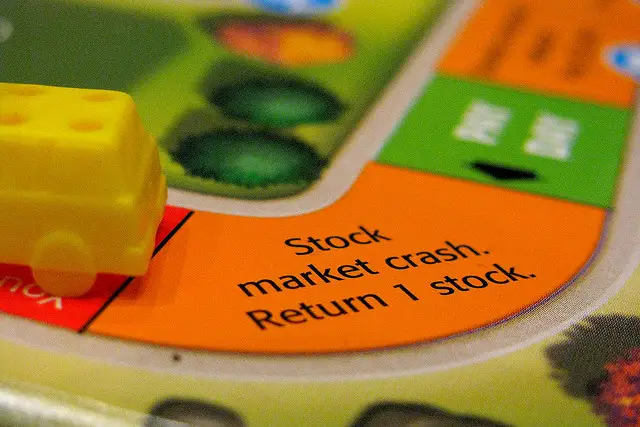

What to do when the stock market crash hits? I’m sure a lot of you have already heard about the Stock Market Crash prediction but it was only a prediction, it could or could not happen or it could happen now, 2019.

I don’t mean to scare you but I just want you guys to be always prepared for it because the only certain thing about the stock market is it goes up and down.

Like what happened recently with China’s stock market, sparked by the devaluation of Yuan. Stocks stumbled, indices fell down. China is the second biggest economy in the world so the correction of its exchange rate in the market affects many businesses and other markets.

It’s like a domino effect, everything that links to it is affected. Even iphones designed in the US are assembled in China. Eventually, things would recover.

China is not the only big player, there are still some like the US. If the stock market crash happened in 2019, are you prepared?

What will you do when the next big economic crisis happens?

Table of Contents:

What to Do When the Stock Market Crash hits?

As a passive investor, here are the things you should do:

Do not panic.

Yes, the first thing you shouldn’t do is panic because you could likely make wrong decisions.

Just because you are seeing huge loss on your portfolio doesn’t mean it will stay that way.

Do not go crazy by selling now.

Remember it’s only around 20% to 30% of your money is invested in the stock market. Do not act like you are losing it all.

Like I always say, do not invest all of your money in the stock market. It is very risky even though it is rewarding.

Take a break.

Forget about the bad news. Things will eventually recover. Even the CEO of the blue chip company you are investing with could be in the Bahamas taking a break right now.

Buy some quality stocks and continue sticking to your PCA (Peso-Cost-Averaging) and investment strategy.

When the market crashes, some people take that opportunity to buy more of their premium stocks as they know stocks would soar like a rocket-ship again after a year or so.

Have other money-making wheels like your business, real estates, gold, and online ventures. Stocks must be just a slice of the pie.

Again, the only certain thing about the stock market is it goes up and down.

If it’s down now, it will eventually come back up sooner or later.

Spend more of your quality time with your loved ones. That is what life should be after all.

Cheer up! Brighter days are coming.

By the way, our monthly reports for Magic 10 will now be posted every quarter so I can have more time to post more investment reviews and articles here.

Hey, don’t forget to SUBSCRIBE (it’s free) to receive the latest posts from us and never miss a thing!

Successful investing often involves contrarian thinking. Many well-known names in finance have suggested “buying when there in blood in the streets.” Warren Buffet said, “be fearful when others are greedy and be greedy when others are fearful.”

When the sky was falling 2008 – 2009, many folks sold out near the bottom. I personally watched as GE (General Electric) dropped below $6.00 USD. Some acquaintances called me foolish as I scraped up every last bit of cash I could spare and purchased additional stocks like a mad-man. Those “foolish” purchases were good to me. Two stocks I bought had dividend cuts. and the masses panicked (GE and PFE) I held those bad boys for years as the dividends slowly increased. I also sold OTM (Out of The Money) call options each month against my holdings for additional income in the short term. To finish my diatribe, I moved to the Republic of the Philippines in December of 2012. After a year and a half, it was time to purchase a home. Thank you to the financial crisis and subsequent crash and a few years of patience, PFE and GE paid for my new three bedroom home in a great subdivision.

A few other things more advanced investors may consider 1. If you have accounts in countries where you may trade options, an investor could consider hedging with put options. 2. many “Pros” buy options on the VIX index when it is cheap and sell those option on volatility spikes. 3.. There are ETFs (Exchange Traded Funds) that are INVERSE funds. That is, they will go UP as the market goes DOWN. These funds are not designed for long-term holding but are a super way to make some coin in a falling market when you have time to watch your investment.

For most folks, the best thing to do is, as Ms Fehl suggests, stay the course, follow your investment plan and your investing discipline. Great trading to all.

Hi, I am reading all the published articles about stocks. I want to invest in the stock market but I’m still searching for a broker. I am very much interested to learn how to invest and to start my investment adventure.

I am planning to choose COL to be my broker. Can someone teach how to open an account in COL? thank you.

Hi, I made an article about that here: http://philpad.com/how-to-open-col-financial-account-online/

YOU CAN’T

This is why you need to prepare for it…There are many reason for a stock market crash, all being cause by people…Even the one ins 1928 to 1932, was caused by people, or they would not have passed banking and financial laws to control financial institutions…This is why I scream 60/40 or 30/70 cash reserve, because you need cash in case it does crash, but remember, it always goes back up

Continue to flip, watch the trends and ride it out, because I do not see a crash in 2016, unless it is Trump pushes the button and if this happens, what crash, it is a Ka-Boom, and there is no money for anyone

Let’s assume there is a crash:

Do not invest more than you can afford to lose

Do not sell, during the crash, watch the news and be ready to buy more

Listen to the new, such as Bloomberg.com on the internet you can watch it all on computer

And, remember, only the big boys know when to crash the market, and I not see it coming, because we are not over 2% annually inflation, no banks have closed, not even one, and the market is not high enough to crash it, since we has suffered from 2008, then August 2015 and so on

You need to decide if you are willing to take the risk, of the crash, which will make the wealthy, wealthier, so do what they do, sell high, buy low

MISS FEHL?

I wish to say, I found Miss Fehl’s article on what about the 2016, market crash of 2016? To be excellent but she was too kind, as always…. LOL

It is a good article and it is simple and to the point…There will be people here who will, “what if it to death…”, Don’t…What if is a way to try and make someone smarter than you, look stupid and all it will do is make you look stupid, she covered it all and did it well.

Read it, believe it, and if you cannot accept what she has to say, steal cell phones and sell them, that is your only way to earn

KING KANO…Well, THE 2016 CRASH ALREADY HIT AND IT HIT THREE TIMES

It already happened, the first time, August 23rd to 25th 2015 and it was a great time to buy.

Next, it got worse, October 2nd and most of all, January 21st 2016

The market as Miss Fehl said, goes up and down and it recovered even in the 1920’s and 2008, and January 21st, it is going up…Slowly, but it is going up and it grow in 2016, even if it hits bottom again?

When the market tanks, and you sell, low, that means someone bought your shares from you and they made money off of you…Is that what you want?

You cannot sell something unless someone wants it yes? So why the heck did you sell it? And, you sold a BMW for the price of a toaster

HUH?

Remember, invest only 60/40 at the worst 70/30 and forget it for a year and miss Fehl agree on most but not the election..If she feels the election will not effect the market, then where is the crash?

There will be a dip in March, towards the end and in June. Check the trends, then be ready to their sell and buy called flipping, or buy some Pepto and ride it out

A trend is what stocks do, on a somewhat regular basis, usually in the same week, for sure, same month, meaning others watch the trends and follow the trend..This keep the trend going, until next year and then there is insider trading and I cannot help you there…These are people who not only sold or sell, millions of dollars of stock at one time, but millions of shares, at the same time, to crash the market, or dip it and buy low, usually your shares at below market price

KING KANO RULE NUMBER 374 Never invest what you are willing to lose

KING KANO RULE NUMBER 1284 Enjoy earning it and enjoy losing it

God bless

I learned a lot from what you said, specially the 30-50% of reserve cash for when the crash hits, it happened many times to me where I bought all of my cash at a stock’s high time only to depress to the point of a crash where buying of stocks is best done and I didn’t have any cash then because I’m keeping hold of the stocks I bought during the high times.

How do you determine when a stock crash will hit again?

Hi maam fel? IS RCBC good to invest??

I am not sure if this will get published, but it is true. Crashes are caused, 100% by some form, of stock, or unit manipulation…Some of this manipulation is intentional, malicious, for financial gain, or as some call it, buyer seller panic, or as in most cases, a combination of all of this insanity. This does not mean your trusties, or financial handlers are to blame, or he or she just feel asleep at the wheel, or it is not practical to sell all of his, or her portfolios, entrusted with her, or him, at one time, before it crashes, (or it corrects, or downturns) then buy it all back, in when it begins to go back up. (See August 18 to 30th) Frankly, it is your problem. On August, 3rd I bought 3.5 million pesos of BDO’s 4 personally selected UITF’s, thinking, the market was already low, or close to low, (since I saw it coming)…Some words might be used; “The bottom of the downturn, or correction, or they were under valued…” all meaning about the same thing. However, low and behold, on August 21th. I should have sold it, even if I need to pay penalties, for early sales, then on August 24th, I should have bought more, not sold a dime of it. But stupid me, since I already bought, the MEDIUM LOW UITF’S of 3.5 million, I no longer have the cash reserves to buy more, on the 24th. So I had my wife find in our budget, around 100K more, and buy in on the 25th, more units, in 3 of our 4 portfolios, and now, up, some down, more up, some down, here we go, on the merry-go-round, AGAIN, until the next spike, or spikes. Never, ever, give up on your cash reserves and this is why…I not care, if you only own the minimum of 10K and want to buy 10K more, wait, watch the trends, and then buy in, when low. And, if you see it coming, sell the first 10K and now, when low buy 20K…You need at the very least, in my opinion, 30 to 50% cash reserve to cash in on the stupidity of cowards…I did not…I only had 100K Now, to you, this may sound like a lot, but think of this? HOW DID I GET THE 3.5 MIL? What percent of my PERSONAL PORTFOLIO WAS BOUGHT IN AND WHAT PERCENTAGE WAS IN HAND CASH? IT IS NOT THE AMOUNT, IT IS THE BALANCE OF CASH, VERSES THE UNITS OR SHARES OWNED. Always, 30% cash, in a savings account, ready and waiting to go to work for you. Just like a fireman, they sit at the station, waiting for that bell to ring, and so does you savings account, then, you now are the bank, and you will need to pay yourself back, once the market goes back up, and it is and it will….Times to watch, if you are a UTIF holder, is September 12th to 24th, October, late, early December, for high and super low peeks, to buy and sell. Never sell low and buy high, unless you want to work at Jolliebee’s for the rest of your life

Fehl, how & where to buy gold & how does this kind of investment go.

We don’t have a trading platform yet in the Philippines for precious metals like gold. If you want to trade gold, you can open an account from international stock markets

I know this reply may be too late, but I feel we here are above the gold standard hype and scams and soon to be off the oil standard, moving over to solar and natural gas, natural Gas being first, then solar will boom…Gold will NEVER have value, when money does not, as they tell us, because both only have value, because people say so…Humans…Humans decided to take all of our gold, at one time, making it illegal to own Gold, wanting it all for themselves, and said well okay, WE will decide for you what money is worth, which is nothing, zero, zippo, and we will decide how and when it is worth more or less, but in reality it is a promissory note, meaning again, people decide if they wish to accept your cash or not as a promise…If miss Fehl gave me a 20USD for let’s say, bread, and I accept it, I accepted it as 20USD worth of promises, but as prices go up, that 20USD is worth less promises…Ask yourself, why are we off the gold standard if it is worth so much to the very rich and powerful? They use money also? Now their money is worthless?? The super elite are very cunning, sneaky, and greedy, but not too smart…You have a friend right, he is super greedy, but how smart is he? How much more money would he have earned, if he did it legally? Morally? Ethically? The super rich, do not read the Bible and see that when nothing has value, nothing, meaning every thing, will have no value, including gold, and this is why they toss it in the streets…We will be back on the barter system when we will triad for what we need and everything of monetary value will have no value, even gold, so if you invest, invest in some something you can keep a good eye on, get to fast, keep 40 to 50% cash reserve, and never invest more than you are willing to lose…A good investor invests, with the possibility all will be lost, but hopes all will go up…REMEMBER, when people say, go here, look here, go there, there he is, or go look, it is not true, because if it was true, they would be there looking, right? It is just like people who know how to buy and sell land then flip it, to earn millions, …Think of this? If you knew how to flip house, buying them low and selling them high, making millions is short time, why would you want to write a book, and sell your secret, trying to make peanut profits from a book that pays you only 86 cents a copy…It is a lot of work to sell books, I know, I am a published author….Sure, he made maybe 800K in like 3 or 4 years, but he is selling books about something that can earn you millions right? Does it make sense to you? Stay in the market, or in savings, because soon money will have no value unless we all decide it does, so plan for the worst and hope for the best…God Bless us all!