Which is better Stocks Investment or Mutual Funds Investment? I know this question has crossed your mind if not many times when you were still trying to figure things out as you open your first investments.

Many of our readers here have been asking the same question that is why I’m sharing this page.

Stocks Investment vs Mutual Funds Investment

Both investments are great and have potentials but knowing which is better for you depends on the following factors:

Knowledge

Not knowing about stocks or mutual funds means not knowing if you will profit or not. Knowledge is power.

Before you open a mutual fund, there are questionnaires involved although there are no right or wrong answers, the assessment will let you know what type of mutual fund suits you. Knowledge adds confidence. The more you know, the confident you are to succeed with your investments.

Before you buy stocks you can profit with, you must know how to trade, what type of strategy you will follow and what your objective is.

The answer:

If you don’t know anything yet, invest some knowledge first. No worries, this website will help you.

If you believe you know enough then you can have either or both Mutual Funds and Stocks.

Experience

It is true that experience is the best teacher. As you invest, you learn a lot of things, not only lessons about how to manage your money or how the market works, you learn how to be rational and logical. You would no longer decide according to your emotions.

The answer:

Experience teaches us it’s always better to diversify so having different investment is better and it minimizes risk. Thus, do not put all your money or more than 30% of it on one investment.

Risk

Every investment has risk. There is never a guarantee of income or gains.

The answer:

If you are very conservative, go for mutual funds like Money Market Funds or Bond Funds. If you can take risks or you’re aggressive, having Equity Funds or investing on stocks would work for you.

Management

Mutual Funds are managed by experts (fund managers). The allocation of funds would be invested on different money instruments and securities. Thus, joining a mutual fund means you mutually believe on the mutual fund’s strategy and objective that could mutually benefit all the investors of “the fund.”

On the other hand, when you invest stocks in the PSE, you are the one in control or the one who manages your investments.

The answer:

If you can’t managed your funds well, join a mutual fund. If you want to be independent and in control of your stocks, invest in the PSE yourself. You can also have both which is amazing.

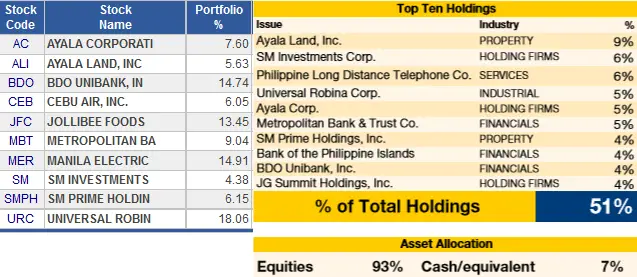

Portfolio

Mutual Funds are diversified investments already because the fund is allocated on different securities and money instruments. With stocks, you usually buy shares from a specific company and you can also buy from other companies, thus building your own portfolio.

Answer:

If you want to easily diversify, go for mutual funds. If you want to have direct ownership from companies, go for stocks.

Profit

The higher the risk, the higher the earning potential. Thus, Equity Funds from mutual funds have the highest earning potential compared to the other types of mutual funds like money market, bond fund and balanced funds.

Stocks investment are rewarding as well and gives dividends. In the long run, you’ll grow your investments happily.

The answer:

Equity Funds and stocks are winners in terms of profit even though they are involved with huge risks.

Share you views about mutual funds vs stocks investments in the comments below. What do you prefer and why?

Hi Ms. Fehl

Gusto ko po talaga ..kasi panganay ako and maliliit pa mga kapatid ko. i preferred mutual fund..

sobrang ngayun lng ako nagkaron ng knowledge dito, so i realy dont know how and where to start..

Please help me

Hi Ms Fhel,

thanks for your post. im a newbie in investing. meron po ako investment sa COL but my friend says its not wise because i just deposit stocks and leave it there , stocks from.different industry naman po. sabi nya mag mutual funds nlng daw ako.. what do you think about it?

Hi Fehl,

Investing long term on regular basis. Thus the result on MF allocated on equities vs. Direct stocks will result to same or close returns. Investing in direct stocks is more tasking assuming you have a budget of 5000 per month having hard time allocating while MF you will just place orders and it will be invested on your chosen equity funds right away.. For your comment.

Thanks….Joe

Yes, that is why we discussed the factors above. Every investor has its own preference, risk appetite, financial status, strategy, and objective.

miss fehl nakapag invest na po ako ng equity fund sa bpi.

Pwede ba mg invest na rin me sa mutual fund?

hi miss fehl,

gusto ko maginvest pero wala talaga aqong alam. maganda ba magopen sa col financial? iguguide ba nila aq sa investing?

pls reply……..thanks

If you are a Premium client, you have a Relationship Manager. I think they will guide you more. If you’re not a Premium client, you can learn more through stock market guides, tips such as those we share here.

How about the costs when buying/topping-up mutual funds in COL Financial, are the fees for executing stock trades (0.25% commission, 12% VAT, 0.005% PSE trans fee, 0.01% SCCP fee) still applicable when buying/selling MFs?

Thanks.

No, they are completely different in terms of fees.

Hi Ms. Fehl,

Thanks for your previous response, appreciate it that. The trust person there in BDO didn’t further explain why do I need to have EIP or if it is a regular UITF. So obviously I am registered for regular UITF. Am I right? But I can still change the set up to periodical investment to add funds to y acct? Right?

Hi. Yes, you are free to make UITF though it won’t be automatic unlike with EIP, things are done easily and automatically

Hi Ms.Fehl.

Pls. answer the question above. Really confuse about it.

Thanks.

Hi Ms. Fehl,

Ask ko lng poh. Nag open poh ako equity fund sa BDO Nov 25.. 10k initial investment. Pano poh processn nung placement. Every month poh ba 10k ang ihuhulog ko.?

Hi, depende po iyan if Regular UITF po ang inopen nyo or EIP (Easy Investment Plan). You’ll know naman po upon your UITF Application procedure how much money you will be placing if you opted for the EIP.

hi miss fehl

gusto ko lng po sana itanong mutual funds equity ba mayroon dividents. let say nag invest po ako ng 100k after 5 yrs nag reedem ako same navps,may kita pa din po ba ung 100k ko.

thank u po.

Hi Ms. Fehl,

I already have UITF and just opened a COL account recently. I’m contemplating whether to open a Mutual Funds as well. However I realized, most of my investments right now are in equity. If ever I’ll open a mutual fund, is it better to make it as a balanced fund? Para diversified? Kasi if ever mag-open ako ng mutual fund tapos yung mga iniinvest ko din sa stocks is same lang din sa mga iniinvest (kunwari) ng MF ko so doble yung nangyayari. For long-term investment naman po yung plan ko so okay lang kaya na MF equity din yung i-open ko?

Gd day mam fehl seaman po ako, pwd po pa ang tulad nmin maging full time sa stocks ska ano ma advice m skin hbang nag iipon ng pang starting capital

Hi Ms.Fehl,

Is there any chance that the capital that i invest on the mutual fund will loss?

Yes, if you redeem when the market is down or when NAVPS are lower. That is why there are suited time-frame with the type of mutual funds any investor takes

SHORT REPLY: As you know, I prefer Equity Funds, UITF style, because I have the patience to let them sit and earn me money. Not much different than stocks, which both will pay you a profit over time, meaning, if it is a good UITF, 3 to 5 years, or if the market is crazy, 5 to 10 years, doing nothing, and the money made me money, not me.

LONGER ANSWER: When I am not financially lazy, I prefer to graph market trends, listen to Bloomberg News, read Miss Fehl’s Blog, and take control of the rise and fall of the market from market morons, who are controlling the trends, actually creating them, and I do what stock holders call “Flip them…” So I try to buy low and sell high…With UITF’s, it is really easy to see the trends…I mean, they are seriously obvious, and if I am wrong, and sell a little low, meaning below the peek, or what I call, a pimple, mistaking it for a peek, so what, it will go up again…I just wait to buy in again, at an actual low, or valley, or below what I sold them for…I lost nothing and gained something…To me, it is the game, the playing of the game, not the actual profit gained. I just love to see if I can beat the monetary system…It is just like a professional sports player, who gets paid for playing football, or baseball…No matter what, he gets paid, just like we do, if we sit and wait, but if the ball player plays the game and plays the game well, they win games, and if they win enough games, there are bonuses for all to have…Same with investing in anything, but more so in my opinion, in UITF’s So, in closing, I love to be able to sit and wait, study, learn, and I love the ability to be able to play the game, and flip them for a profit…And remember..You do not need to sell too high to make a killer profit, because, you make money also, buying low and the lower you buy, the higher your mountain peek will be…EXAMPLE: The difference between August 24th and August 28th…Like day and night

Very well said. I love this part “it is the game, the playing of the game, not the actual profit gained. I just love to see if I can beat the monetary system…” Cheers!

Hi Fehl,

Thank you for sharing your knowledge to us. I must say that I am addicted to reading your blog since I discovered it about 9 weeks ago when I was looking for information relating to MF (how to invest in MF for dummies to be exact!). 9 weeks may not be enough to fully understand everything but I took the plunge , created an account with COL Financial and invested in stocks and MF (Philequity Fund ). I have been working for 16 years and I admit my savings account is a bit of a tragedy (thanks to my love for nice shoes). So, it is now or never.

Anyway, I wanted your opinion regarding investing the money I owe from my dad which I am ready to pay him back. It made me think that he should invest it in MF than letting it sit in his account. Or, God forbid that he constantly dips into it with an excuse that his little apos would love to have a new toy haha. I would like to suggest to him that he open an account with COL and invest what I owe him in Philequity Funds. He is now 63 so do you think that this is a wise thing to do or should he stick to Bond Funds instead? Many thanks in advance! xxx

Hi Tiffany. Thank you so much for the warm message here. Congrats with opening your COL account. Regarding your dad’s mutual fund, I think going for bond funds would work since he’s now 63 and the availability of the funds is needed anytime. He has you, that is what matters most 🙂 God bless!

Thank you Fehl. Abundant blessings to you! xxx

God bless you, too. All the best to your family 🙂

Hi Ma’am fehl,

Isang mapag palang araw sa iyo!

Pwede po ba malaman kung meron narin kayong suggested list or TOP PICS of Mutual fund company according to the risk appetite ng mga clients?

Maraming salamat sa blog mo….marami akong natututunan sayo.

More power and God bless

Coming up 🙂

Thanks for this! And you’re right! I’ve been wondering about this all along. I’ve been from one blog to another, trying my best to learn about investing and so far, yours is the best! Thank you so much! You have no idea how much I’ve learned already.

Glad you find it helpful. God bless!