Winning stocks from the previous months until present, 2019 – Philippine Stock Market. This page compiles all our best performing stocks following Magic 10 strategy and following our BPPI (Bank, Power, Property, Infrastructure) recommendation.

We gather all the earnings, reports and updates regularly why not gather and compile a list of our winners.

DailyPik has just begun last December, 2014 and from that humble beginning, we started sharing our stock picks to exclusive members for only a cup of coffee and eventually we decided to offer everything for free.

We believe true success is more meaningful when it’s free. The more we spread success, the more we create winners.

Table of Contents:

How to Win from your Stock Investments?

Have a Plan and Strategy.

Every success has a roadmap. This is very different from winning the lotto. Plan your investment and decide about your goal.

In Dailypik, we shared about Magic 10 and Flipping stocks strategies. Both are for passive and long term investing.

We continue to share other strategies here as well. Like I said, we only just begun.

Follow your Plan and stick to it.

Execute your plan and strategy until you reached your target.

Do not consume your time watching your stocks every hour or every day. They will grow themselves up.

Spend your time to your family, your loved ones and your passion. Money cannot buy those precious times.

Don’t lose focus.

Do not be affected by sudden drop of stock prices or seeing red amounts in your Portfolio.

The truth is, there will always be up and down in prices of stocks. That is quite normal.

Being so affected will make you emotional and being emotional will confuse you about everything.

Time is money.

The earlier you started this all, the higher your stocks value will grow.

Never invest your whole money in the stock market.

20% of your regular income will do. Give yourself a chance to other opportunities like business, real estate, bank products, ETFs, UITFS, and Mutual Funds.

Be fast and be furious if you are flipping stocks.

If you noticed that your stocks barely ‘move’ in 6 months or so (depending on the economic status), sell them or lock in gains when you gained money already and just buy other well worthy stocks.

You are not losing money nor opportunity by doing this. You are actually investing your money giving chances for better stocks.

Pick the right winning stocks for you.

Only you should decide and nobody else because only you know your preference, your goal, and your financial status.

Sell, profit and buy again.

Sell your stocks when you reached the target and use your profit to buy other great stocks. We always like to say this, “money rolling is money growing.”

Have a Goal and Exit Plan. Your goal is your Target. Exit plan is your plan when there is a crash or massive market drop. Maintain your sanity and be rational.

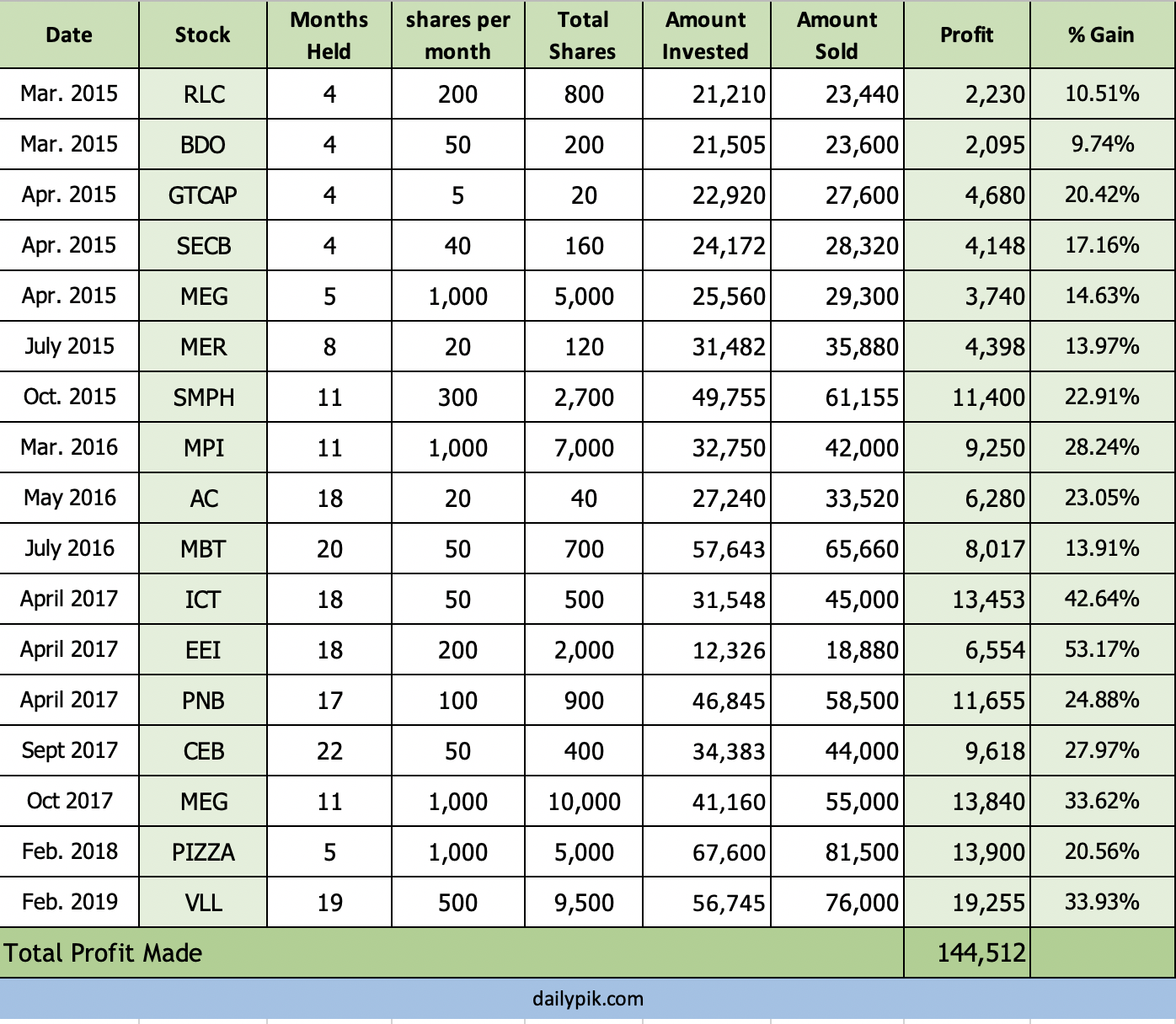

Our Winning Stocks for 2015 – 2019

Our winners so far. We will add more stocks on the following table as we sell them.

Every stock from the list also has a separate article discussing why we chose that company, the potentials of the stocks and how we earned that profit.

You can visit the post corresponding to the stock you’re interested with. They are posted on our Watchlist menu.

Note that the computation did not include Dividends. If you add the dividends for each stock, you can receive more profit.

We also didn’t less the fees as they differ every month. They are small fees anyway.

The list will be updated continuously as new stocks were sold following our stock picks and their target.

Bookmark this page to see the updated list everyday.

Cheers to making your dreams come true!

If you want to see our recommended picks, check out the Stock Picks menu.

Hey, don’t forget to SUBSCRIBE (it’s free) to receive the latest posts from us and never miss a thing!

Hi Fehl,

I’m a newbie and would like to start investing soon. If I have 5,000, do you advise to buy just one stock for a start like SMPH? Thanks

hello ms fehl. ano po sa tingin nyo ang mas mgandang unang bilhin? SM or SMPH? Thank you 🙂

From my experience, I got SM first, medyo mura pa kasi noon hehe pero now, SMPH most of the time kasi 1000 na ang SM. Gusto ko kasi 3 stocks or more ang binibili ko as much as possible para diversified portfolio ko. Medyo mahal na kasi si SM. 🙂 Pero both SM and SMPH are excellent choices

thank you Ma’am Fehl

hello po Ma’am Fehl, am a newbie on COL. i have read all the reviews with your sound advices, would it be possible you can hold a seminar for starters like me?

thank you.

Hi,Nigel 🙂 Thank you for your message. I don’t hold seminar coz brokers are the one who do that. I just post in this site regularly to discuss tips and tutorials for free. You can see the guides and tutorials on the menu above. Cheers! 🙂

amazing day Ma’am Fehl, thank you for the tips, i have bought different portfolios around 7. some ups and downs. but average is positive to to this date. i divide my investment to a small amounts for security reasons.

Thank you, Nigel 🙂 Your strategy is very good

hai,

May I ask if ever I will buy stock that issues dividend, how does it works? like how i will be notified that I will have dividend, How I can get the dividend and other details. Thank you

Hi Miss Fehl,

I found your blog very helpful. Just want to ask for a piece of advice for a newbie like me. Plan to open COL Plus account this Friday June 2,2017. I will put some of my investment in Philequity fund and the remaining fund will be on EIP program. Do you think it is still okay to invest in Philequity?

Thanks in advance.

Hi, Carmelo 🙂 As long as you know the risks and the benefit of it, it’s ok to invest Philequity and EIP at the same time. I have Philequity shares and I’m impressed with its performance 🙂 Honestly, I find it to be the best Equity Fund for Mutual Funds right now.

Thanks for the response miss Fehl..

Another question, what exactly the difference between the COL Starter and COL Plus? Is it okay for a newbie like me to choose the COL starter? I’m planning to take the Plus account but confused about the advantage of the said account.

Thank you and God bless.

COL Starter is for beginners and you need just 5000 for initial funding, suitable for long term investing. Provides access to basic research reports, standard market information, and end-of-day charting data. COL Plus requires 25,000 initial funding. You will be able to have streaming quotes, comprehensive research reports and live chart data with some customization features.

Thanks miss Fehl.

I already open an account this morning and choose the Starter account 🙂

Congrats and happy investing!

Hi Ms Fehl!

Thank you for doing this. We are new to investing, and learning a lot with your posts.

Few months ago, my husband and I started investing with ALI and just added MBT (today) in our portfolio. We are hoping to be able to invest regularly and plan to do so minimum of 5 years (hopefully and in God’s guidance). We intend to use Peso cost averaging. How does this sound to you? You think we are at the right track?

I would love to hear your thoughts.

Thank you and may you be blessed even more!

Hi, Liz. Thank you for visiting. ALI and MBT are good for 5 years using PCA method. Just continue your strategy and see your earnings grow. 10 years is very good as well.

Thank you mam fehl…all your Blogs are really informative and Big help to us who new in Investing.I satrted investing last month and following your fantastic 5 and 1 mutual fund.

Godbless!

Happy New Year Jcel! Glad you find our blogs here helpful. I’ll do my best to keep adding more. God bless!

Hi ma’am Fehl…ask ko lang kung ilang stocks o company ba ang ideal sa isang portfolio? Thanks

Depends on the investor. Every investor has his own financial status, risk appetite and objective. Once you know those 3, you’d know how your portfolio will be

kailan nag uumpisa ang 52 weeks ng bawat stocks?

Hello po Ms Fehl,

Tanong ko lang po kung ano ang pagkaiba ng par value of stock and price per stock.

May kakilala ako na bumili ng stock niya noon 1990s pa, ranging from 7 to 9 pesos ang par value na nakuha nun sa petron. Ang price per stock ng petron ngayon ay mga 8.75 pesos.

Panu po malalaman kung magkanu na po ang ung pera niya sa Petron?

HI avid reader ako dito and amazed ako and I want to know kung kailan ung bagong update ng winning stocks of 2016?

Hi Ms. Fehl,

“Never invest your whole money in the stock market. 20% of your regular income will do. Give yourself a chance to other opportunities like business, real estate, bank products, ETFs and Mutual Funds.”

Is ETF also for long-term or just for flipping? We only have FMETF right now?

Thanks.

Ms Fehl,i’ve been hearing about this Fed rate hike this december, anu po magiging effect neto sa Pilipinas and stocks? anu pong mga sectors ang mostly maaapektuhan po neto?

Mostly investors would tighten their belt, businesses would slow down, stocks would fall. Major adjustments but eventually things will pick up.

helo po, pwd po ba bumili ng stocks kunware tatlong beses sa 1month sa isang company na magkakaiba na ang price, ok lang po ba yun? mag aadjust na lang ba un sa computation? salamat

Hi Fehl,

Newbie po ako sa investment, nag open ako ng account sa Philstocks. Pwede ba na dagdagan yung shares na nabili ko na? Nakabili na kasi ako ng shares sa BDO at JFC, pwede ba iting dagdagan kahit iba na ang presyo nya?

Thanks,

Roger

Yes. Make sure you have a plan and strategy for BDO and JFC to know what, how and when you will buy and sell your shares

Fehl, Thank you so much. I believe, you are a blessing to everyone who are into investing. God bless……everything will be given back to you a hundred folds.

Thanks Mike. God bless us all

My pleasure Ms. Fehl. God bless us all…Happy investing

how much is the lowest amount that i could invest??

Depends on the price per share, check them out

Hi Ms. Fhel, what is your view for SMC. Thanks

hello author how about ICT and PNB good pick b yan ask lang thanks

Which is more advantageous? the Fantastic 5 or the Big 5? TIA

Thank you po sa pgshare for free nitong website d kagaya ng iba na meron membership. Marami kang matulungan nito.

Hi Ms. Fehl,

pede b mg p lecture sayo one on one? hehe.. kung pede lng nmn po. TIA… 🙂

Hi. That is why this website is here now, to share to many people like you about investing 🙂

Just want to know what is your view on Xurpas? Im looking at it for a couple of days now and its seem it gaining…

Not attractive right now. We’ll add it in our picks once we see potential. Majority of stocks are going up again

Hi Ms. Fehl,

I just want to thank you for providing knowledgeable and very informative blog regarding the stock market.

I’m also into investing and doing COL on-line stocks for about a year now and i’m following your “Magic 10”

God bless po.

Thank you as well. Cheers and happy investing!

good morning po! ask ko lang po kung saan pwede umattend ng seminar o lecture about investing, trading stocks po, intresado po kasi ako at gusto ko talaga mag invest, thanks po!

Yes, most stockbroker companies offer free seminars for their clients

hi gud eve i’ve just attended financial literacy last seminar week..and it happened that i browse for best mutual funds in the phil as one investment schemes lectured to us which led me in your blog..I read all comments whenever i visit links..I am praying for your support thru this scheme in my journey in investment.

Hi. Thank you for the visit. We will add more Mutual Fund guides here and more reviews about each fund soon. Please subscribe so you won’t miss any new post. Cheers!

very informative…

Hi ms fhel,

I am following this blog of yours as information’s are very useful to us newbies.I just want to know your insights regarding COSCO if its a good buy for long term say 5 years above? And in addition what’s your insights about bloom is it also a good buy for short term or long term? Thanks.more power and GOd bless.

very infromative

Hi. Just want to ask why do you not invest in DNL. Any insights? Thanks.

It’s not on our picks right now but we’ll definitely include DNL if it’s worth buying. Right now, it isn’t

I just want to know how to start investing in the stock market. I am an OFW and I want my money to be secured at the same time earning.

Follow our Stock Guides by going to the GUIDES menu

Thank you for the pointers/reminders Fehl. I started trading just last month and I find myself monitoring my stocks everyday! And instead of investing steadily/slowly, I feel compelled (and I usually give in to the feeling hahaha) to buy additional shares when they’re in the red. Because of this, the money I put into stock trading is now 3x the initial amount in just a span of one month. Not that it grew because the stocks performed well, but because I keep funding my COL account so that I can expand my portfolio. My portfolio consists of a mix of Big 5 and Fantastic 5. Am I doing this the wrong way?

Hi Christine. There is really nothing wrong with checking them out everyday but some people consume too much time 🙂 I’m happy you earned 3x already, that means you are doing good and you know how it goes 🙂 I’d say yes, you’re doing it right girl 🙂 Keep it up and don’t worry when the market goes down again coz our stocks in the Magic 10 are premium stocks. I try not to buy some stocks right now coz the market is up and I know the typhoon months are coming.

Hi Fehl. Actually I did not earn 3x, rather the amount of money I put into stock trading thru COL is now 3x the initial amount I put in a month ago. In a span of 1 month, dagdag ako ng dagdag ng puhunan so that I could buy shares/stocks amonng the B5 and F5 whenever I saw that their prices seemed to drop.

I kept thinking it would be better to add in funds and buy now rather than later because by then prices will most likely be higher.

I will now try to control myself from buying since as you said,the typhoon months are coming (which would then be the better time to buy I assume)…

I feel you coz that happened to me after 3 months of investing. I went beyond my original budget and I realized I had to calm down and just use the profit I make from flipping instead of funding my account again. Yes, typhoon months are coming and we must take that opportunity to buy more.

Thank you Fehl. I will keep in mind: “slow and steady”. 🙂

Yes, me too 🙂 Thanks!

Hi po sa lahat! Newbie din ako last week lang nagstart. Ganyan din po ako in 2 weeks naka 50k na ako. Nakakaadik po pala mag invest. Pwede po bang maging Puregold yung isang BIG 5 ko?

Hi. PGOLD is good to flip but in my personal preference, it’s not yet too good to include in the Big 5.

gained na po nyo 50k ms lovely?

Thank you miss felh for the updates. God bless you!!!!

Thank you so much Fehl!! You are a channel of blessing 🙂

Thank you Gwen and Andrew 🙂

Hi Fehl,

Very informative, as always. More blessings to you Mentor.

Thanks so much. 🙂

Leah

Thanks Leah. 🙂 More blessings to everyone!

Hi Fehl,

Thanks Thanks as always!

Salamat Friend! 🙂

AJ

My pleasure, friend 🙂

Hi Fehl,

How to recv dailypik regular recco? Thanks…

Just visit our site everyday to see daily updates from our Stock Picks and subscribe to receive new articles posted in your email

but it’s much better experience once will hold seminars, heheh