We’re sharing here our Stocks Report as of January 31, 2015. The year has started brightly and the stock market is on a bullish market period right now.

Stocks prices are going up and apparently will continue to climb. If you have been investing monthly, non-stop, following your stocks picks and plan like us, I’m sure you’re celebrating right now.

Here in Dailypik, we have started our stock picks here last month and we are now on our second month report.

We post our monthly reports here to easily monitor our stocks performance and to know how we went so far.

To see all reports, you can go to our Stocks Update page.

Remember when PSEI went nuts last December going slightly lower and then recovered after the holidays?

PSEI continued to impress us since then climbing up the hill of our charts.

Some people went nuts too panicking but for us who knows the drill already, seeing RED and seeing low stock prices is a time to BUY and BUY more shares.

We have nothing much to worry here because our Stock Picks are all giant companies and are included in the index.

Some of them even issued dividends recently.

I don’t want to go any longer coz I’m so thrilled to share our latest report.

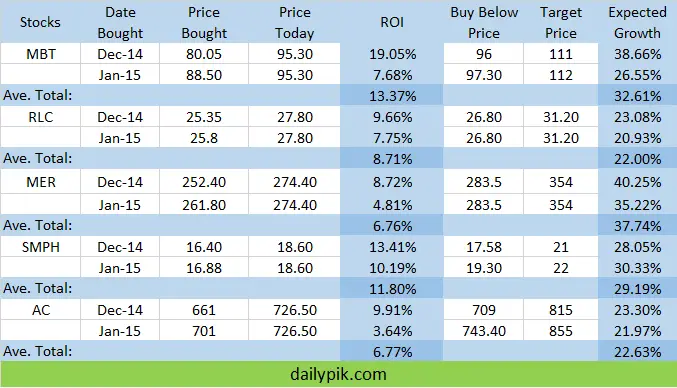

DailyPik January 2015 Stocks Report:

Fantastic 5 Stocks:

What a pleasant way to start 2015 because after 2 months of investing our Fantastic 5 stocks, they gave us excellent gains so far (see average gains below).

This is mainly because we had MBT even before it became the most recommended stocks in the banking sector by COL Financial and other brokers.

MBT is expanding to raise 32 billion in a share sale and if push through, that would become a record breaker after Lucio Tan’s LT Group did the same last 2013 raising around $912 million through a private share placement.

We also had MER which is expected to rise up fast reaching our Target Price.

I expect peak of MER will be on summer. SMPH is also following the lead of SM going up. SMPH is getting closer to our Target Price. RLC and AC have strong balance sheet. The latter we also increased our BBP and TP.

Note that we adjusted BBP and TP of AC, MBT and SMPH as recommended by my sister and COL Financial’s recent update.

Note: The total rate above is only a total of our Average gains from the 2 months. This does not compare on other factors. There are also small fees to be subtracted to derive on real earnings.

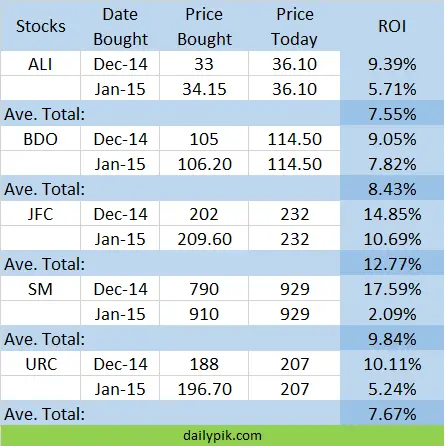

Big 5 Stocks:

Our big 5 stocks had the following average gains in the last 2 months even though we held SM for a while. URC, JFC and BDO have contributed so much performing very well. Our Big 5 stocks are very resilient. I wonder can they be more beautiful 🙂

Our Magic 10 stocks made 93.69% total return in 2 months, making 9.369% average gains taken into account all portfolio. I can’t hide my happiness even though we only just begun here in DailyPik. Cheers and congrats if you’re doing the same.

PSEI went up to 7,689.91 thanks to some of our magical stocks here.

It’s a bullish market but we continue to buy our stocks as long as they don’t reach the BBP.

Some of our stocks are near to our TP and we will alert you when we must SELL them.

Hold on and don’t get too excited unless you really like to sell and need the money or unless you’ve been investing for many years.

BDO was finally able to face the music, unable to blame,GLOBE COMMUNICATIONS, a subsidiary of BDO/SM holdings, they finally allowed investor to view the every so important information about their BDO Unibank, UITF investments…Checking today, they finally allow investors to view, from the 16th of November, up to November 24th, which is not bad…It is almost normal…LOL

Now, there is no excuse for this behavior, except too much balut and not enough Rocky Mountain Oysters…No guts no glory, and just plain cowardliness, since they waited long enough to show an upward trend…Just in time for the annual sell of around the USA Thanksgiving holiday, as predicted by our intelligence group in the Philippines…I would not buy yet, until after the 26th to 29th danger zone, for November and not allow those in the know, to know you invested and cause UITF’s to rise, then they sell off and you are, :Brown Bagged,” holding the bag, as they laugh all the way to the Tiki Bar

Best to buy in, at the annual end of month sell of, sometimes waiting until December 3rd in some years…ALL UITF’S WILL GO BACK UP, until around December 11th then tank again, rising after the holiday…With the FED, terror attracts, corruption in many corruptions, the rest of 2015 will be a tumultuous one…AIR SICK BAGS, ANYONE? Once the FED pull the trigger, I am sorry I still think March, all will improve, since banks, doing business in the USA, will finally make more money, and other FEDS, in the EU will follow

Yes, if you can afford to buy now, buy, it is at historical, or hysterical lows, but they all could and should go down again, so don’t fear, or fear and wait, up to you

Deutsche Bank, is slatted to fire, not lay off, but it is the same here, 26,000 to 35K more employees…This is after already laying off a lot of people…This is the same Deutsche Bank who holds the BDO Trust Funds?

Good day ms fhel. I am waiting for my acct in col to activated. I am interested in ur flipping stocks strategy. I wud lyk to ask how to compute The target price of each stock. Tnx

TP is usually the FV of the stocks. Please read each strategy here to learn more

hi ms fehl, just want to ask what kind of method your using for your big 5 stocks?do you use sam? or peso cost averaging.? what method gives more profit if you i choose long term,like 10 years? thanks and god bless

Hi. It’s not SAM obviously since we have a Target Time rather then Target Price. Big 5 is the same concept as COL EIP. We focus on building these stocks for a long period of time rather than selling and flipping other stocks. God bless you too 🙂

Hi Miss Fehl,

I would like to thank you for this wonderful opportunity. I really like long term investments from BIG 5. and I am planning to add some of JFC stocks pls I need your advise… Thanks GOD bless you!

I personally prioritize long term for URC, JFC and BDO from those Big 5 stocks and add some for SM and ALI when I want. I never sell any of the B5 yet coz my plan is 10 years. I take the opportunity flipping stocks using Fantastic 5 stocks as well and sell them on their TP. God bless you too!

Hi Ms Fehl, thanks for this information. Since you are earning from stock market, do you have to file personally your income tax return in BIR? Ive asked this because our company do this for us, since I have only one company in 1 year.

And also, how much is the tax deduction if you sell your stocks?

Thanks in advance.

Hi, since we are trading in PSE, our stockbroker already collects and pays 1/2 of 1% (or .005) for every sale to the BIR on our behalf. That is why they require our TIN when we open an account. If your stocks transaction is NOT traded in the PSE, you’ll have to file and pay Capital Gains Tax to the BIR yourself. Per BIR, it is a final tax of 5% for gains not exceeding 100K and 10% if over 100K

Hi fehl,

I have a question. What are the possible taxes or fees that can be deduct when dealing with this kind of investment stocks.

Possible that you can itimize and share here or from other page?

Thanks and more power!

Hi, they are little fees like commission, VAT, sales tax (when selling). I think I will have to create a post for the fees and give sample soon. Cheers and more power too!

hi fehl… thank you for imparting the knowledge to us- esp to me, as a beginner i find premium leisure as a good stock… since it sore to 600 percent last year… do u recommend it as long term investment.