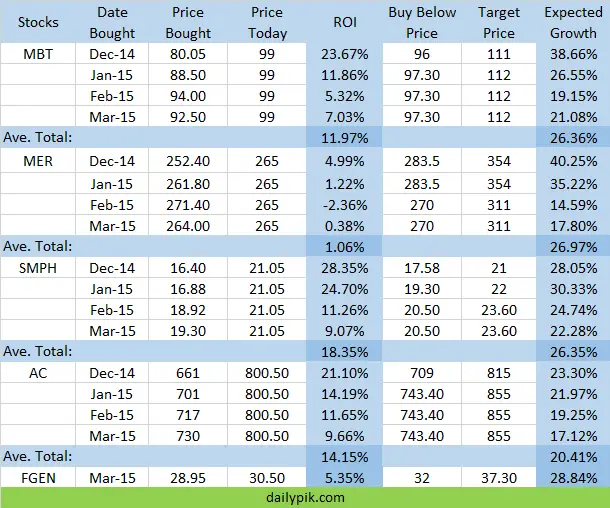

Here’s our earnings report for our Magic 10 stocks last March 2015. I was very busy but I did not forget to do this for those who follow Magic 10.

Highlights of the stock market these days is that it came back and recovered and some got the bulls.

Charts are going green again and portfolios of many are very much green too which I’m sure are making many people here happy or smiling right now.

While that is making some of us smile, the momentum is also a reminder that the market would go on red again.

After a few months here, if you’re not yet used to the roller coaster ride, then there is something wrong with your mantra.

PSEI is positively on its 8,098.68, so close to what we all expect, 8,200.

This month we added FGEN on our Fantastic 5 stocks list as we sold our RLC shares.

Many from our F5 picks are coming closer to their Targets.

While MBT had stock rights offering, its price didn’t yet decline despite of many people’s expectations.

It did the opposite. It climbed up slowly.

We’re waiting for the stocks from the SRO to finally be listed in the Exchange and let’s see how MBT would go.

While MBT’s mother holdings, GTCAP, had a fantastic jump recent days ago, it looks like MBT would retain its elevated position.

I just love the dividends they rewarded to shareholders two weeks ago 🙂

Our Fantastic 5 stocks made average gains of 10.18% in the last 4 months.

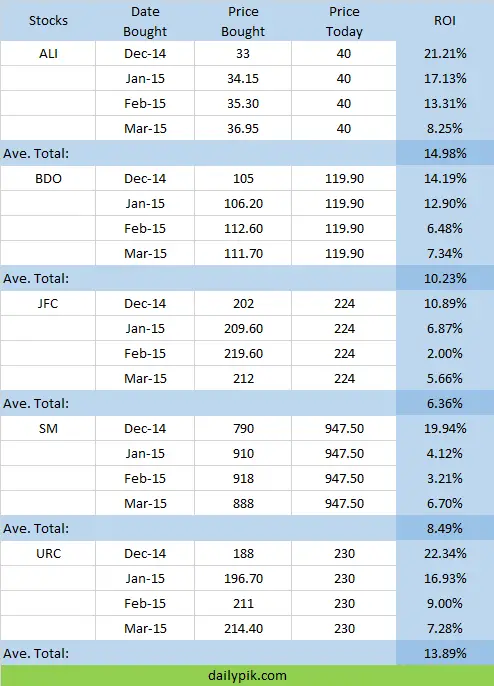

Our Big 5 stocks are all doing great scoring average gains of 10.79% in the last 4 months.

By the way, we made a special page for our Stock Winners. Go check it out!

Hi Ms. Fehl salamat po sa mga advice nyu malakeng tulong po ito sa mga baguhan tulad ko..ask kolang po kung diba kayo maniningil ng membership d2 in the near future? or for free lahat ng adivise nyo..tnx po

hi, do you preffered DD for short term?

hi Maam! thank you po coz i’ve learned a lot from your articles..am opening an account very soon through COL EIP, am just preparing some docs needed..i just have some questions Maam, am an OFW po,

-how many products or stocks will you recommend to buy, do i need to follow your F5 strategy po ba or is it ok if i just choose 2 products and buy more shares?

-what will gonna happen if i cant monitor my account everyday?

-what if after a few months of investing, i decided to withdraw my investment for some reasons, is it possible po to withdraw my investment without any hassle and questioning from the COL?

hope you can help me, thanks po and more power!

Hi, Al. The stocks I recommend are on our Stock Picks page here and if you’re like me, I’m following Magic 10. Yes, you can choose 2 companies if that is what suits you. There is no need to monitor your account everyday as long as you are following your strategy or target. You need to sell your stocks if you want your cash. If you sold your stocks and want to withdraw your funds from your COL account, made a withdraw request and follow COL’s instructions in withdrawing.

Hi Ms. Fehl,

Based on your illustration above for F5, can you recommend that on a monthly basis we shall sell our stock even though it didn’t reach our desired TP as long as the ROI is reasonable?

Really need your expertise here. Thanks a lot.

The final decision is up to you, you can do that but I still recommend following the target price to gain 20% or more for each stock

thank you ms. Fehl

Hi ms fehl,

I just have a follow up question, medyo nalilito lang po, as mentioned I’m still a rookie and your website really help me to understand the world of stocks.

As I am trying to analyze, based on your recommendation to sell the stocks on its TP then how can I buy the same stocks if the stocks bidding price is almost same. (as I have noticed, bidding and asking price have almost same leve in price) so if I will sel the stcksin its TP, meaning I cannot buy th same stocks during the month since it has a higher value compared to BBP.

Like in your example above: The figures are ahowing ona monthly basis, you have the price you had bought the stocks compared to price today and target price. If you buy the stocks on Dec 2014 and reached the Target Price on Jan 2015 and sell it, how can I buy the same stocks if the price is more than the BBP (as it was reached the TP) or shall I say the price might be too high to purchase.

Like, you might need to wait the price of the stocks to go down before buying it again? So, if that will be the case, the records will not probably shows consecutively or consistently monthly.

Please enlighten me Ms. Fehl.

Thanks.

Hi. You have the choice to buy the stocks again under F5 even if we sold them already at one time or when their prices are lower again or we have listed them again in the F5. That means they may be undervalued. We call it FLIPPING here. To understand it more, please read our post about Magic 10 stocks and Flipping stocks (separate articles). Cheers! God bless.

Good day po… noob question po ulit ms.Fehl..using my col broker, possible po ba magg.buy ng whole pse?sinubukan ko iquote…P300 something ang price…alin po mas recmended kpg new investor, buying whole pse or buying some companies inside pse?

Thank you so much sensei!…very helpful ng blog nyo…

Yes, you can also buy shares of PSE (ticker PSE), it is a company listed in the market too. As a new investor, you must know your risk appetite, goal and strategy before you buy shares from companies.

Hi fehl! im losing on my lri stocks and im planning to just sell it and put it in other stocks..do you have any feedback about lri?thanks

I’ve already sold my LRI few months ago when the market was up coz I’m seeing it to remain idle and I already have gains so I sold my shares and just bought MER. Luckily, MER issued dividends 🙂

noob question lang po..curious lang din..yung equity value po ba na naka-labas sa home screen sa COL Financial account ko, yun po yung value na pwde kong i-withdraw para maging cash?

THanks! 🙂

Equity value is actually your Networth. It’s the Total VALUE of your Stocks Value + available Cash (buying power). If you want to convert it all to cash, sell your stocks

Thanks sa answer ms.fehl…..after selling my stocks, san po sya mapupunta?..sa BANK ACCOUNT ko po ba na nilink ko or dun sa ACTUAL BUYING PRICE?

THANKS AND GOD BLESS!

It will go to your Cash Balance in your COL account. You have to request Withdrawal if you want to withdraw funds from your COL account

Hi Fehl,

Why is it the you reduce the target price for MER?

Yes, there are some reasonable adjustments and it’s not only MER. I also adjusted EDC, MBT, GTCAP and FGEN. That is why I recommend checking out our Stock Picks regularly to be updated.

hi Fehl! i have Col acct. already. is it possible to have a second acct under my name? actually that will be my mothers acct who is in the US. she also wants to invest her money and she wants it under my name since shes away most of the time.

Also im losing 30% fr STI and LTG. Im planning to just sell this 2 and buy URC and BDO. What would you suggest?

Hi, why not make a joint account for your mother and yourself 🙂 I don’t know so much bout STI and LTG coz I don’t follow them in the moment but maybe you can wait for a while, maybe STI would recover on the coming school year enrollment even if not much. URC and BDO are really good to invest with regularly for long term (5 years or so)

Great report! Good thing I was able find this website on a Stock Market group on Facebook. It’s nice to see MBT didn’t went down.

Thank you. MBT is a strong company. We’re waiting for it to reach our Target Price 🙂

Miss felh I wanna ask about this crown asia chem offers. Do you think it is OK to buy ?

Thanks.

It’s a chem company so I can only speculate for now as it’s in the IPO. I like the offer and I bought 1000 shares. Speculative stocks could give 5x or lose as much but sometimes we have to take risks 🙂

Hi Fehl.

CA is oversubscribed at COL how do we know if we got the raffle of shares for COL?

Go to your Portfolio then select View IPO request Status. You’ll also receive confirmation email from COL

Hi Ms. Fel,

Were you able to get crown asia? i didnt :(.

Just wanted to ask if you would consider including date blog was posted? just my 2cents since we are dealing with stocks : )

Thanks

I’m not always lucky with IPO shares raffle LOL I don’t put the dates coz WordPress’ default would put them to all pages once I set that up and that would ruin my SEO

Miss felh this 15th gonna buy 25k fgen stock in buy and hold strategy until tp reached.would you suggest it rather than flipping strategy?.

Thanks.

COL has mentioned positive projection with FGEN and I like its Fundamentals so I listed it in our F5 stocks. I don’t see a problem with one-time buying and selling at the TP. 🙂 It’s up to you