Philequity Fund Review. Why you should invest Philequity Fund? We are sharing here a review about Philequity Fund, one of the best mutual funds to invest with.

Check out the important details here including some tips to maximize your earnings and everything you need to know about Philequity Fund.

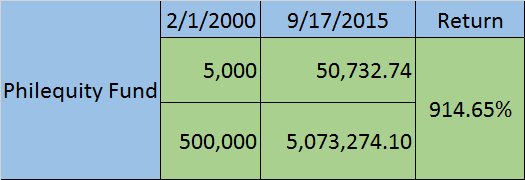

If you have 5,000 invested with Philequity Fund on February, 2000 and you left it untouched without adding any more funds to it, guess what is the value of that 5,000 now?

It’s a whopping 50,732! Your 5,000 grew at exactly 914.65% effortlessly. How would you like to do that again? I’m sure very likely. 🙂

If you have invested 500,000 you would have made 5,073,274.10. Your half million just made 5 million. Time can make money.

Table of Contents:

Philequity Fund Review

Philequity Fund (XPEEQ) or PHILEQT:PM (Bloomberg Ticker) is an Equity Mutual Fund managed by Philequity Management, Inc. (PEMI).

Philequity has been cited as the best performing equity mutual fund in the Philippines because of its excellent performance and numerous awards by ICAP (Investment Company Association of the Philippines).

The biggest pride of PEFI is winning the best performing equity fund for the 5-year and 10-year categories 3 years in a row. It also won 1st Place for the 1-year Return category.

Why should you invest with Philequity Fund?

I get asked of that question too many times and my answers are not always based from the numerous awards of PEFI although they matter, my first answer is simply this:

PEFI has outperformed PSEI many times already and it is still rocking.

I just love their fund allocation; it’s 88% equities and 12% cash/receivables (as of August 2015). Their equity composition is solid.

If you have been an equity investor for quite some time now, you know UITF and mutual funds don’t differ so much in terms of their holding companies.

The blue chips are always there but the allocation and strategy are what differs. Philequity’s aggressiveness and management are beyond impressive.

Philequity Fund’s Top 10 Holdings:

- ALI

- SM

- TEL

- SMPH

- URC

- AC

- MBT

- BPI

- JGS

- DNL

Philequity Fund Minimum Requirements:

Minimum Initial Investment for this mutual fund is P5,000 and minimum additional investment is P1,000. Annual management fee is 1.5% per annum. Exit fees will be waived if you keep your funds for more than 2 years.

If you’re investing with COL Financial as a broker, sales load is zero.

Tips to Maximize your Earnings:

Philequity Fund is suitable for investors with high risk appetite and with long-term investment horizon. The fund aims to provide long-term capital appreciation by investing primarily in equity securities listed in the Philippine Stock Exchange.

Given that you are aggressive and you can accept risks, keep on investing regularly until you reached your Target Period.

Since equity funds are suitable for 5 years and above, your Target Period must also be within that time frame.

Always remember that Philequity always selects the creme of the crop companies, there may be bumps and drops of stocks but your regular investment will help you minimize risks, same with your long term goal, it will help your fund grow more money.

Want to invest on mutual funds? Read our guides below:

Hey, don’t forget to SUBSCRIBE (it’s free) to receive the latest posts from us and never miss a thing!

Visitor Rating: 4 Stars

Visitor Rating: 1 Stars

Hi ms. Fehl, I’ve read na ang Philequity Fund holds blue chip companies does it mean Philequity fund also provide dividends from the earnings I’ll get?

Thanks!

Diana

Hi Diana 🙂 Philequity Fund is a Mutual Fund and yes, Mutual Funds also give out dividends. Note though that dividends from MF are different from the dividends from common stocks. Cheers!

Hello Mam Fehl. I learned so much from your blog. Question lang po, yung “how long” po ba sa investment sa equity funds is kahit 20-30 years? Naisip ko lang is if magiinvest ako periodically sa philequity up to 30 years okay lang ba yun? Or is there a certain time na magiging adviseable na ibenta na? Thank you!

Visitor Rating: 5 Stars

Visitor Rating: 4 Stars

Visitor Rating: 5 Stars

Good am Ms Fehl….ive learned from financial gurus in the US that the index funds are a lot better than mutual funds because of the low cost fees…how can i invest in index funds here in the philippines? Pls help…thanks po

Hi, Maria. You can invest on index funds on some mutual fund companies here. I recommend opening an account at COL Financial because of the availability of different mutual funds. You can then invest on different mutual funds as long as you want

Hello Miss Fehl,

I have been following your blog for couple of weeks now, And have decided to get MF with Philequity PSE Index Fund (XPEIF). via COL. I just got confused if I made the right choice vs Phileqe uity Fund (XPEEQ). I made some comparisons – aside from fees, company compositions and NAVPS, XPPEQ is higher that XPEIF. Miss Fehl, for you, alin sa kanila ang mas betterr? I will do Long term – min of 5 years. Newbie here. Thank you!

OR do you recommend me to get both?

What is the difference between IMG and COL Financial? anyone please.. 🙂

COL Financial is a broker while IMG is a company that assists people for financial advice.

Hi! Pagsa COL po ba kumuha ng mutual fund, may management fee din? Kasi ang nababasa ko lang lagi, ang waive is yung front end load, etc. Wala po ako makita na waive din yung management fee.

First time ko lang nabasa itong PhilEquity.Iilan po ang percent ng income ng PhilEquity? Sa tatlo, ano yung less risky s maglagay ng capital at ano din yung may mataas na income? Ano po ang ibig sabihin ng sales load? Thanks po in advance.

bakit parang bagsak lahat ng equity MF ngayon?

If you have started last year or this year, do not expect impressive results with equities kasi the season before that period, equities had good performance. Sept. is also expected for the Fed decision, holiday season is also coming. The only good thing about such season is to buy more premium stocks

I have funds save up for purchasing MF, specifically bond and equity funds. I am convinced that Philequity is a good choice for an equity fund. I do not plan to invest periodically but to save money and invest when the time is right.

How do I know the time is right? Isn’t this fund too expensive right now?

Philequity is composed of premium stocks with good allocation. It not safe to give a certain time when to invest because nobody can time the market. Even banks do not advise investors regarding certain time when to invest, it is your choice. Only they can advise you about the risk. To minimize risk, it is recommended to invest periodically and for long term.

Hi fehl,

Dami ko natutunan sa pagbabasa ng blog mo????thank you

May tanong lng, yung mutual fund ng philequity mabibili ko xa pede s Col financial, so ibig sabihin magopen ako ng account s Col,then maglalagay ako ng pera sknya?

kpg magplace n aq first initial s philequity let say 5k min. Dun ko kukunin sa Col at yung susunod n pang Monthly place ko… Tama po b?

Tama po kasi yun ang broker mo

Ms. Fehl,

I’ve been reading your blog and seriously researching about UITF and MF. Is it good to invest in both UITF and MF pero Equity Fund lahat? Or mas ok if magkaiba? My plan is to invest minimum of 10 years on both accounts. Hope to hear from a pro. Thanks!

Hi! Is it still worth it to invest in Philequity MF despite of the high NAVPS value?

Yes, if you are investing shares periodically or regularly (ie: monthly or quarterly)

Visitor Rating: 4 Stars

Visitor Rating: 5 Stars

Hi Maam Fehl,

Ive been following your blog for couple of months now, And have decided to get MF with philequity, kaya lang po mali po ata ang timing ko maam, bullish po ang market now, Ok lang po b n kumuha n ako kahit po mataas ang market, kung invest ko po cya ng 5 to 10 years. Newbie po ako sa investing at pinag aaralan ko p rin po, nalilito rin po kasi ako on how to start. Marami pong salamat,

Philequity is an Equity Fund and it is suited for 5 years and up. This type of fund is very risky but to minimize risks, I recommend investing (buying shares) periodically or monthly. That means too you won’t mind if you buy on bullish market or not because in the long run, you will make money

anung mga banks or fund houses na ideal or good performance to invest equity funds..tnx

Hi Ms. Fehl,

What if I’m doing a monthly cost-averaging in Philequity and I redeem my shares after 2 years, will I still pay an exit fee?

Thanks

Hi Ms. Fehl,

As usual, great read!

I’m a newbie to all of this and I just want to take advantage of the falling prices in the stock market and planning to open a MF or UITF (haven’t decided yet) focusing on equities.

At first I was thinking of trading myself (COL Financial) but I came across the idea of MF/UITF which made sense to me since I only have basic ideas re. trading/the stock market. What I do know is that right now is the best time to buy in years, that’s why I’m here.

From the research I’ve done the past few days from thinking of starting trading on my own, to having discovered MF/UITFs thanks to your site, finally having found PH’s best Equity Funds.

Basing from another topic here:

http://philpad.com/best-mutual-funds-in-the-philippines-2015/,

I’m choosing b/w 3 equity funds with the highest returns across 1,3,5 year horizons: Philequity Fund, Philequity PSE Index Fund, and Philippine Stock Index Fund.

It should be obvious that my risk profile is risky. Now my outlook is around 2-3 years. Could you please help me pick the best one?

Thank you so much!

Hi Micky. All Equity Funds are risky and it’s tough to pick the perfect one because there is no perfect one. You must consider about their past performance and their present fund managers. Philequity is also one of my choices with MF. With UITF, I have chosen BDO Equity Fund and I’m still maintaining my investment with them 3 years now.

I see. Well based on past performance it seems Philequity is indeed the best one out there topping out well known brokers such as PAMI and PSE.

Alrighty then I’ll open an account with them ASAP before the prices go up 😀

Thanks Ms. Fehl!

Geez yeah I was happy when added more 20K when Philequity Fund dropped to 30ish. 🙂

ask ko lng po plan to open an account sa mutual fund pero me problem po ung TIN number paano po ba kunin yun coz i am self employed

Ms Shenna, if you bought the BDO Equity Fund, last month, meaning, September, 2015, you paid a lower price, than I did, and I am holding, so hang on to it, even if it goes down, because it will go down, but back up again…If it does not go back up, it is the end of the world, and money has no value, so don’t sweat it…Anyways, it is an equity fund, so hold on to it and it is a good one…The only way you can lose capital, is to sell on the wrong day, meaning selling low…It will go down, once in early November, after peaking, first week, and again, in early December, or late November, and creep up, slowly, around first of the year. (If everyone does not freak out about the USA fed rate hike, again…My guess March 2016 ) BDO Equity Fund, has a 5 year earning AVERAGE of 65%, which is its cycle of peak earning (3 TO 5 YEARS) which means 13% a year, AVERAGE, even with the valleys…What I am saying, is, if you are thinking about selling an Equity Fund, in 30 days, you should not be investing in Equities, and should invest in Bonds, 35% or money market funds, 45%, rest in cash reserve, so you will have less stress, but lower yield…BDO’s Equity Fund, is one wild and crazy ride, ever since it was launched in 2005, and the word volatile, is an understatement…If you check the past earnings, you will see, it does pay, but you need to wait, or if you not feel comfortable, sell it, and promise me you will hold on to the money, in a savings account, until after the holidays, which is hard to do, and jump back in, in late December, early January lows…Stay in and watch trends, until the election in both the USA and the Philippines, (get out in March 2016) gets cranking, or you know for a fact, the USA FED will pull the trigger, then pull out again, and in a savings account, until the dust settles…BDO, Equity Fund, well, all Equity Funds, pay well, but it is not a type of fund you can treat like a money market, or bond fund account,by jumping in and jumping out, just because you get investors LBM, and back in again, unless you can read treads..Investing like this, with Equities, is a full-time job, 12 hours a day, 7 days a week…Equity Funds pay you for sitting tight, holding on, having courage, and screaming, for 3 to 5 years, 10 is better, but you still need to watch trends, and sell high, buy back when in lower, during your 3 to 5 year sell off. Also, just because a fund goes down, does not mean you lost money, it was their money, because funds always go back up, unless, as I said, it is Armageddon, then who needs money? Miss Fehl? How did I do?

I very much agree with you, King 🙂

Super salamat po and sorry to add but I know how she feels, and I am still hurting from buying on August 3rd 2015 which was a good time to buy, normally, but who, or what is normal? I was certain, the down tern, was down, or almost down and I should have known about the FED…So, as I said, before, all of my funds tanked, on the 24th and I waited to late, well my wife was too polite, and we bought more funds on the cut off date of the 28th not the 27th, and if you peaky-boo and look, there is a big difference, between the 25th to the 27th and then the 28th..Should have bought the day after, like the 25th, if it is a weekday. WHY you ask? I am so glad you did…Because everyone, as I was, buying low, even if they bought back their own stocks, bonds, and funds, which they sold high, causing the downturn valley in the first place and now buy back, low…what I am saying here, sideways is, Miss Fehl, cannot predict, a market that is controlled by a bunch of greedy morons…Sure, she can suggest hot stocks, but you should have known they were hot, also…Miss Fehl, is not here to make your investment for you, but to give you information she finds, through research, research you should have done, before she did, and she is to moderates chubby long winded Americans like me, who make suggestions…Even though I follow trends, 12 hours a day, 9 days per week, and watch the Bloomberg report, in TV and internet, 12 hours a day, I will never tell you to sell on an exact date..LOOK how I suffered from the 24th? I can tell you, if I have the time, if the ABC Equity Fund at the bank of King Kano, will drop down 12 pesos a unit, sometime during the week of December 3rd until December 14 but nothing more, based on past performance, not a crystal ball…Something fun and will help you grow your portfolio, is to form a group of investors, who meet once a week and follow treads, and invest and pull out, or stay in for long term, and enjoy the ride…Miss Fehl has a good example of doing this and she uses the words WE, meaning 2 or more people…They invested in something and it went through the roof and they jumped out, I believe..Read the article, but never depend on someone’s word for a buy or sell, but performance yes…Investing in stocks, funds and bonds is like a religion…Everyone has a name for God, but none of them are the same…If you wish more ask, but I talked to o much ere sorry Miss Fehl

hi po.. bago lang po ako sa pagiinvest. Last month po nag-invest po ako sa BDO equity fund, now i am affraid to sell my shares, because the market might fall, can you give some tips or indications that the market will rise or fall? thank you po.

Hello, I wish i’d researched more about Phil equity MF as i just opened SunLife as my first mutual fund account. My question is, do I continue investing in Sunlife since it is locked in at 180 days to avoid early exit fees, or should I invest on phil equity this month meaning i will have two MF but the sunlife will just be stagnant until the grace period. I think sunlife is also good but xpeeq seems to have higher returns in the long term.

Hi Good day,

I plan to invest in Philequity with 5,000 investment plus add’l monthly of 1,000 for 5 yrs. May I know the projected amount of return.

How about in 10-yr term? 15-yr term?, so on…

This is to determine my option to choose better long term investment package.

Appreciate feedback. Thanks

Dan, the short answer is: You will or should double your investment, in 10 years and you should, or will earn more than CD rates, passbook, or other banking promises…THE NOSE BLEED ANSWER… First off, she cannot predict the future…She went to college and as soon as you enter the doors of learning, the professor takes away your crystal ball, so it is unfair to ask her this, but you did, and I will add my 2 pesos worth, as well…When YOU buy any mobile investment, or liquidity investment, which is market and or investor dependent, or driven, (SAVE THESE WORDS ALSO) you will soon find out what the word, or terms mean, (THAT’S WHY) the most important of which is, “Trend,” or “following the trends…”( WRITE THESE DOWN AND SAVE THEM ALL)…The best person, who can predict something like this, is only you, because you should have done your homework…Before you invest, in any Unit, or Stock, or bond, or Money Market, or Shares portfolio, (DID I FORGET ANY?) you need to get on the web and check the trends, MEANINGM GRAPHS, PAST PERFORMANCES…Here is an actual example, without naming names…Let’s say, The Bank Of Pinoy, in Cebu, offers you UITF’s portfolios and the names are called, Unbalanced Fund, Liquidity Fund, Incorruptible Government Securities fund, you need to use their website and check the graphs, of the past 3 years…OR, as far back as it will go, based on time of inception…If inception was, March 20th, 2013, this will be as far back as you can go, then enter, today’s date…Print them, then take a ruler and draw lines, across the mountain peeks, then the lowest valleys…Next, very small lines, at all other highs and lows…NOW, back to your computer, touch your mouse, on the marked highs and lows, on the computer graph, of the same graph you printed, and write down the dates for all of this…Yes, of all of the Stocks and or UTIF’s you wish to purchase…I smile here, because it works…You will notice, in all of the portfolios, there were peeks and Valleys right around the same time, of each year…Even non portfolio packages…EXAMPLE: March 12th to March 19th August 22nd to August 24th, to save time, you will see them in September, October is busy, early and late October, then calm down in November, but still look, they go south early December, because everyone needs holiday money, late December they go up, and so on…Now, I am not saying, there is insider trading, but there is in all investments, and you need to get off the bus before they dump their stock, to scare you into selling low, then they buy back your stock, at the low, and you sold high…Now wait, yes, I am answering your question…No volatile or balanced investment will always go up steadily, with no valleys, period, because of group insider trading, panic buying, paper tantrums, panic selling, smart people like you, who ask good questions, but make mistakes, as I did, all affects the market…Even the change of a President..Like me, I will sell all of my UTIF’s, soon, before the Philippine elections, because everyone else will and push the value of my UTIF’s down, then, I will need to wait until they go up, AGAIN…For the 4th time…Also, if you have a computer or laptop, or think pad, watch the Asian broadband of Bloomberg, TV live, use Google Chrome, it has flash built in, and keep an ear to the actions of the USA Fed, other FEDS, such as European Union, individual FEDS, the International Monetary Fund, The World Bank, who actually owns everyone’s soul and money…The rise and fall of the USD not the Peso, sorry, problems such as China, Volkswagen, Brazil, and yes, the trends, and you will see the valleys form in everything invest-able, at almost the same time, each year, for 3 to 5 years straight…Get in low, it could still drop, but get it low, jump out, before the trending highs, so you not get burned, and get out, and wait, for after the election low..You asked, about not touching, I will guess, in 10 years, from 12% to 100%, over all growth…Did that help? And, remember, your interest is compounded, which means, you get interest, on your interest…Check fees, such as early bailout, called a early redemption fee, check management fees, trustee fees, ask to see the investment disclosure statement, for everything you need to know, and find out if the value of units, or shares, is after all fees and taxes have been removed from the figures…Sorry, I hope this helps

Hi Ma’am,

Under Philequity, what if I invest 65,000 today how much estimated money after 5 yrs (by year 2020) considering untouched & no additional investment. In other scenario, invest only 5,000 today but with additional 1,000 monthly also for 5 yrs. (literally total of 65k). What is better option to choose? If possible, please send figures for comparison purposes only.

Thanks,

dan

Hi Ms. Fehl.

I attended the EIP seminar of COL. They teach us to invest regularly, long term in reputable companies by using peso-cost-averaging system. Is there any added advice that you can give us before doing this strategy? It’s simple to follow you just a discipline to do it. What things do we need to study before doing this strategy to maximize our profit in long run? What books,sites and other reference that will help to to be more knowledgeable about investments?

Thanks

Thank you, yes, you are correct, maybe better than waiting, however my fear is, when I bought low, is it still considered low? Meaning below normal value of the portfolios I purchased…I worry it is the new midline, meaning, we start over, from down here, instead of being low….I am concerned I may have bought at the new high, for August 28th 2015, not the unseasonable low, for spring 2015….Yes, my wife is too good to be buying units, LOL, she is very kind and sweet, but she learned a lot…She will not step aside again and will inform the branch manager, she is there to buy units before 2:30 pm….POLITICS: Yes, I wish to totally pull out of the market, around March, 2016, because, regardless of OUR new presidents, in USA and the Philippines, we will still have problems in Brazil, Volkswagen, the rise of the dollar, and the Asian and US federal reserve, with a no balut chairpersons who refuse to just getting it over with by raising the rates a few pennies….To all of us, it is peanuts…It is inevitable, rates need to go up, so why not now? (Frankly, 3 weeks ago, was better) They should just tell the world, “Hey everyone, like it or not, we do it next year, March or April, 2016…” which is my NEW preference, because it is too late in the year, with the holiday season coming…But, the US Federal reserve makes money also, billions, renting yes renting super rich people’s money to governments, businesses, and all of us, and they put that profit back into the US general fund….I believe, our president, who I love, wants to get some cash in their before he leaves office and I understand, I not blame him, we have the best economy in history, but it is too late now…Your economy will always go up, even if just a little, and will do well, because the dollar is going up, for a while longer, and if we get a republican in office, it will come down, and you have more and more overseas workers, each year, sending money home and that money is spent and invested…The old $1.00 loaf of bread…Each peso, which comes in, is sent around and around, over and over again, being taxed, especially the VAT, hence the word CURRENCY…Money is called currency because it is circulated, hence the word, circulation, around and round…Paper money falls apart for a good reason…It is spent, then taxed, over and over again, daily, just like here…Thanks for the feedback I hope we are both right..As of now, I am in the red, if I sell, now, which I will not do, but I want to sell, something, because I did not practice what I preached, about keeping a cash reserve..I invested it all, on August 3rd and August 28 now I am broke LOL..I got greedy, saw the market going down, and I heard about the fed, and thought now, was the time (August 3rd) then it kept going down and down and then the 24th..It is fun, as you can feel from my blogs, but I was too slow, then too fast, to get my wife to the bank..About on line services, I am not sure if BDO allows unit purchasing and selling, due to the margin of human errors…There is countless forms to fill out and sign…My wife set us up on that on line banking, and I will use it, in a day or two and let you know…But I think it is not for UITF’s, I fear, only monitoring your funds and portfolios…GUESSING

Thanks for the compliment Po, but service, at BDO I agree…It is getting better, but still slow and not mabuhay enough for me…They are growing too fast and moving to slow, into the big leagues, but I believe they are doing their best…Remember, in the Mabuhay State, you can be fired at will for any good, or bad reason, so being to good, is not always appreciate..I know, I did say that and it is true…You need smiles, and action, for all people, small and large investors, or passbook..It is the passbook people, when combined, make BDO, who they are…Passbook customers are like unit funds…Everyone puts in a little so no one puts it all in, and we have a portfolio, for under 10K…Cannot do that all over the world, right…They seem secure…I feel Mr and Mrs, BDO/SM, are very aware of world corruption, especially along the Pacific Rim, poor service, which will kill international investments and customers, and they want to be the best and biggest at what they do, and they have done this…They seem to be customer service oriented, for the Philippines, anyways, they are very transparent, paranoid of even being even the slightest but corrupt, whether it is true or not, and will not allow it…I get this feeling, everyone is being watched and double checked and this is good for us…They provide me good service, 89% of the time, which is high marks for the Mabuhay State, because they think I am rich, not understanding, I am not…Not in dollars and cents: Make scene LOL And yes, people should be treated equally, regardless of race and perceived financial levels..Now, having said that, when a big depositor or investor comes in, it is best to pull us aside and handle it all, at the bankers desk, because I will admit, I am a pain in the butt, having special needs, such as large deposits, withdrawals, submitting a General or specific power of attorney document, authenticated by your embassy, and I have units to buy and sell, before 2:30 pm, not 2:32, PM, and lots of documents to fill out and sign, so special treatment is better for the passbook customer, so as not to slow up the line…Some, well, many people give me and my wife, the hard look, but they do not understand it is better for us to be out of everyone’s way, to keep the already too long of a line, moving…By the way, as a side note…If people can find Bloomberg LIVE, on the Internet and use Google Chrome, to have all of the plug ins already installed, watch it…Things to watch for and listen to is Volkswagen troubles, crude oil still going down, the US Fed, reserve still not raising rates and they should, and stop talking about it, and now Asian FEDS want to raise also, to get everything balanced, and the dolor, is getting stronger ( I remember when it was 59 to one) but now for me, it is not good to be at 47…So, we WILL see what THEY CALL, corrections, but it is paper tantrums and stock manipulations from now September 28th for sure, October 12th to 24th, again, then November, and early December, then drop and go flat or sideways until after the first of the year…SOOOO if you know how to predict trends and have your 35% to 40% cash reserve ready, if not sell something when high, not highest, just respectfully high, be ready to buy in when things get ugly again, like the 24th of August, or don’t sell, if you sleep and it tanks again, or sell, when it goes up, because airsick bags for everyone for now and early December…As I may have said, I bought more units, on the 28th, on the actual 27th of August, because my wife gave way to older people, so we lost a lot of unit shares, being sold units on the date of the 28th not 27th..Check your BDO Unit fund, daily sheets and see what happened just from the 27th to the 28th (ALL FUNDS)…Was I mad at my wife? No, I was 2 days late also, should have bought more on the 25th and 26TH but it was still lower than normal…BUT WHAT IS NORMAL NOW? Problem now is, is this new low, August 24th to the 28th our new mid-line? Or is it really, a low? Did I really buy low, or not? Did I buy shares that were over priced and now, called a correction and did I actually pay I call, retail not whole sale, for my additional shares? What do you all think? Is the BDO Unit fund now bouncing around at the CORRECT LEVELS AND WILL GROW SLOWER, MEANING YOU WILL NEED TO WAIT 5 TO 10 YEARS TO MAKE GOOD CASH? Instead of 6 months to 1 year? I would like speculation on this? I am worried that new low, is now the new mid-line, or middle ground from where I thought I would go up and make bigger gains…Did I fall for the so called correction, not really a LOW buy in? (the 24th and 27th of August?) THOUGHTS? Sorry, po, brain freeze I know LOL

Your wife is very kind and considerate. It’s about time BDO make an online feature of adding and opening UITF. Some banks already have that and that can save us big time before the clock hits 11.am. LOL Regarding the market, I think it’s gonna get worse or it will maintain its slow course because of global factors. The only problem I see domestically is the next president. If it was Miriam or Marcos, then I see brighter outlook in the government. I think you did great by buying low on August than not buying at all and letting it pass to September or right now

Hi Miss Fehl, Tanong ko lang magkaiba ba ung sales load at exit fees?

Sales load is entry fee, exit fee is the other way around

Can you make a complete tutorial on how we can apply for Philequity fund?

You can already open Philequity Mutual Fund online. Check this out: http://dailypik.com/how-to-open-mutual-funds-online-via-col-financial/

I cannot comment much on a fund which is both an equity fund and a money market fund..I am assuming, and we know what that means, the portfolio is a mix of money market fund, and equity funds from varies holders…(ASK TO SEE THE PORTFOLIO BREAKDOWN…This seems like a good idea, from a 10 second read here, because your risk is shared, within the portfolio but you still have an aggressive volatile liquid rise and fall of returns, to keep things interesting, WHICH I LOVE, BUT IF YOU HAVE CASH RESERVE, and you have the security of a money market fund, to keep things balanced or stable, if i may use those words, but USUALLY provide slower and smaller returns with higher peace of mind…ONCE you have words such as volatile, liquid, and equity, you are talking not only Imodium AD and Rolaids, 4 times a year, but you need to stay in THE GAME, for a minimum of 5 years, preferably 10 to earn any sort of income well above passbook, or CD accounts with a bank, over the same amount of time…Anything less than 3 years, you COULD LOSE MONEY, even 5, unless you have a cash reserve to add and sell, as the market roller coaster rides you to a level of financial nausea, or a coma…Look at A gust 24 to now? August 24 to 28th? It sounds fun to me, but I learned the hard way to watch market trends and we know what that means, watch for stock manipulation, around the world, and keep an eye on the fear factor of both cowards and hawks, who bail out and kill your shares or units…BUT THIS APPLIES TO ALL FUNDS…THIS IS WHAT WE DO

Yes, the higher the risk, the higher the earning potential 🙂 Investors who are into equities already know this by now

You and I know, and some know, but the market fluctuations are caused by stock manipulation, and investors who not know, and get scared and jump out, meaning they sold low and will buy back in, when high…I knew the market was on way down, because I watch Bloomberg TV and listen to their radio…I am up early to do so…And because of the US Federal Reserve, who was to raise rates and will raise rates, my guess, December, which is stupid, now is better, and there was China, and Brazil, I knew it would go down and it did, so I bought too soon 🙁 3.5 million php assorted Units in BDO funds, then it crashed more, (the 24th,) so I bought more, LOW did not sell, anything, low, out of fear, but will sell, soon, around October if the fed not raised rates, leaving in the lower priced units, over 300K, for longer terms, and not touch it, because it will never drop below the 24th values again (LOL 🙂 ) I hope…So, if this was true, so many people whould not have sold, low, and made the markets drop more, cause paper tantrums on the smart side and panic selling on the dumb side…I am not defending my buys, because buying low is good, not selling low is good, but I did need to wait longer and would have made a killin..When my wife went to BDO bank to buy more units, on the 27th, they were busy and made her wait, so it was now 2:30 pm cut off, and now the business day of the 28th and we did lose some value…I was not happy, so I now taught my wife to be more rude and not allow people to go ahead of her…Anyways Fel, if everyone knew what you knew, and it is a lot, your blog would not have posts? Smart people not need your help, only us who are learning and growing need you, so no, they dont know that equity and other funds are high risk and not know what the words high risk, actually mean…But kee up the good research, I enjoy it

I agree with you, without those people who fear and panic, there can’t be so much movement in the market 🙂 I think the more we stay in this, the more we learn. Wow, you’ve got millions of Units from BDO. Even though many people hate BDO for their banking service, I still think they’re the best in terms of UITF. The only usual problem is they lack bankers who are certified to entertain those investment products. Happy to see you here always and enjoy reading what you share. Cheers!

Yes, I find the UITF’s portfolios, very good, but most are high-risk, portfolios, but if you have time to wait, like 5 to 10 years, it is worth it…But as I said, many times, I bought too much and have no cash reserve