COL Fund Source is finally live and active. Now we can make, open, add, redeem, mutual funds account online via COL Financial. And here’s the step by step ways how to do it.

The most convenient way to invest different mutual funds online has finally happened and made possible by COL Financial with the top mutual funds in the country.

As a happy investor, I want to share here my experience so far opening a mutual fund via COL. It’s actually easy and it would only take few minutes of your time.

Table of Contents:

How to Open Mutual Funds Online

Requirements:

- COL Financial active account

- Enough money in your account (or enough buying power)

Steps by Steps Procedures in Opening Mutual Fund Online:

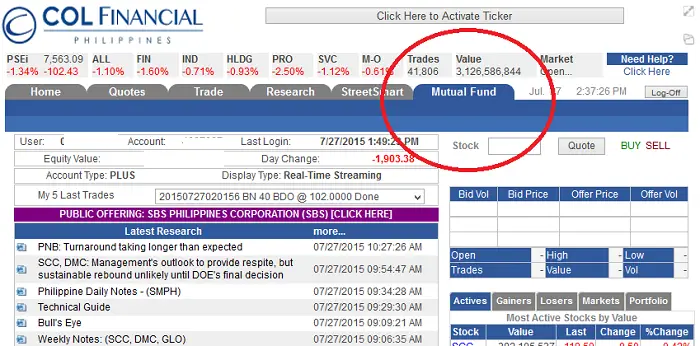

- Log in to your COL Financial account

- Tap the Mutual Fund tab

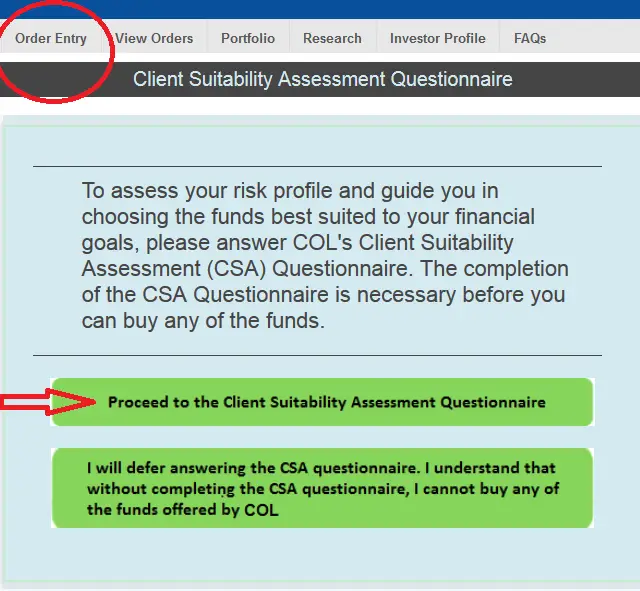

- Select Order Entry

- If you are a first time investor of mutual fund via COL, you have to answer the Client Suitability Assessment (CSA). It is part of the mutual fund account opening process. It is an important way to assess your risk profile as an investor.

- After you answered the CSA, you’ll be able to see your Investor Risk Profile (ie: Moderately Aggressive, conservative, etc.). You will also be able to know the available Mutual Funds that suit your risk profile.

- You can then start to invest. Make sure you have enough funds (buying power) before you execute an investment order.

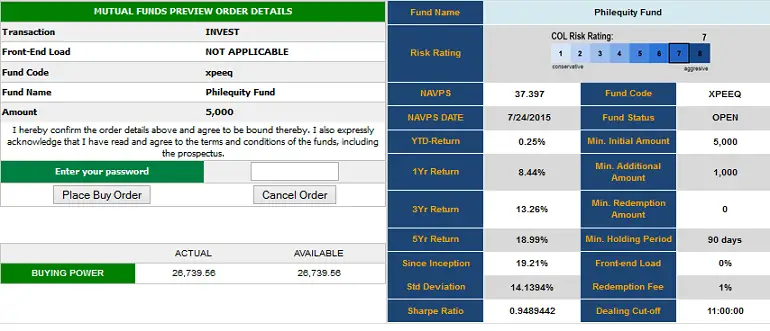

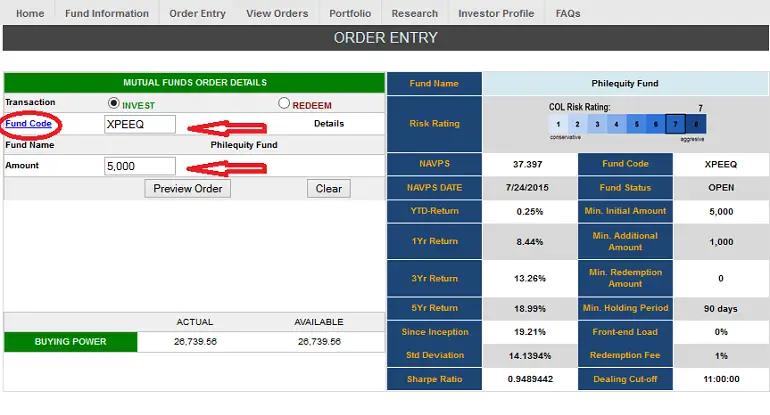

- Go to Order Entry and type the code of the MF you want to invest. Select the Fund Code (in blue link) to know all the codes associated the MF of your interest.

In this example, I want to invest Philequity Fund and I need to type the code XPEEQ.

- Type the amount of your investment and select Preview Order.

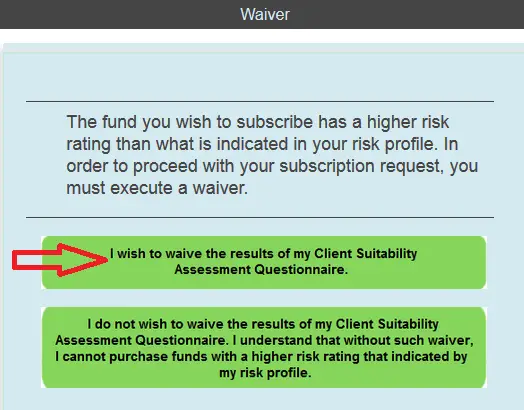

- In case you are investing a fund not suitable for your Risk Profile, confirm the Waiver that would appear.

- Preview your order and enter your COL account password to confirm your order.

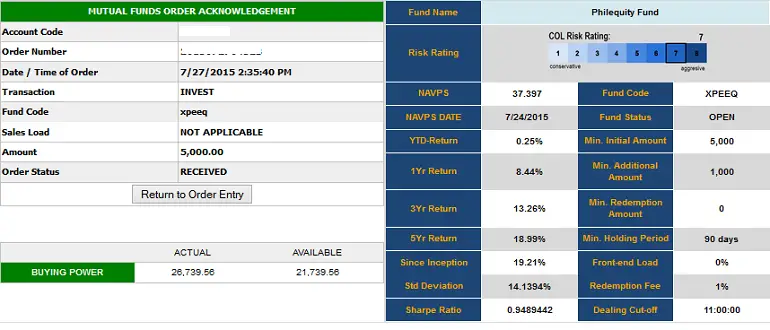

- Congratulations! You just made a mutual fund investment online! You’ll receive an acknowledgement like this and an email confirming your new investment.

What’s next? Well depending on your objective as an investor, every one of us has his own goal.

Follow your goal and appreciate your portfolio as it grows more and more. All the helpful guides are available in your COL Fund Source and all reviews of Mutual Funds are available in this website as well.

And here’s the video of how to invest mutual fund online using COL Financial.

Cheers! Happy investing! Have questions, share them in the thread below.

Ms Fehl,

Thank you for this.

I wanted to invest in COL Financial.

How to open an account with COL po?

Thank you for this. Btw, can you do a post on real estate investment? I’d like to know your assessment on it compared to other passive investments. I have read that it’s one of the fastest ways to grow money.

My pleasure 🙂 Just came back from a trip to London so apologies for my late reply. 🙂 Sure, I will do it. I need more experience about that before I make the post. Cheers!

Hi Ms. Fehl! I am a newbie and I have just started reading posts about funds. Can you tell me how do you get enough funds (buying power)? Does it mean that I need to have a bank account? Thank you so much in advance.

Hi Fhel!

thanks to this website for giving us know how and courage to invest. I already have an account with Col and everthing seems alright except mutual fund. It doesnt have sub menu to do my transactions when I click its tab. Other tabs works fine. Do I need to do something?

already got it. haha. thanks.

Yay! Happy investing, Alan 🙂

Hi Fehl! Just want to ask something..if i am investing 5000 monthly on a mutual fund..then for example the NAVS is at 38/share..so the maximum shares that i can buy is 131 which the total cost is 4978..then where will the excess php22 go?? Thanks to advise!

Take not of the fees involved. If there is no entry fee, then the 22 will go in your pocket coz you will only need to pay 4978. Also take note of the redemption fee when you will redeem your shares. Every mutual fund has different holding period requirement. To avoid early redemption fees, do not redeem before or on the holding period

Thanks a lot Ms. Fehl for this wonderdul info! Great blogs very informative.

My pleasure Allain 🙂 Bless ya!

Hello Ma’am Fehl, I now enrolled to mutual fund my question is. Do I need to sell my shares so I would earn money? Or Is it like of UITF on banks, Fund manager will do for us We will just have to invest and they will do the work for us… Still its not clear for me. Please help.

Hi, Nelson 🙂 Mutual Funds are also managed investments like UITF. Fund managers manage your MF but you have the control when to redeem / sell your shares. Cheers!

Is it ok to do buy stocks and sell stocks in COL aside from doing long term investment? kasi sa COL minsan nakikita ko ang laki ng gain ok lang ba mag benta at ibili ng bagong stocks para mabilis lumaki ang investment?

HI Ms Fehl,

nice blog very informative. just want to ask about themamanagement fee in COL mutual funds. how is it deducted? (1) is it annual deduction? (2) is it initially when you start with the MF you bought? (3) is it deducted to the total investment of your MF? or the invested money only? or the earnings?

Appreciate if you can help me with this. Thanks!! 🙂

Hi, Ronald. Thank you 🙂 COL’s MF does not charge sales load fees and front-end fees. The management fees and other fees however are already computed before deriving the NAVPS (Net Asset Value per Share) of each MF. We will not be deducted of those fees anymore. Take note though of the redemption fee, you must follow the holding period required for the Mutual Fund to avoid early redemption fees. Cheers!

Hi mam, what about in my case, i have already an existing mf thru phil equity. i want to incorporate it to my col account. thanks in advance

Hello! I want to open an account at COL because it’s convenient but their starter account is 5k. The 5k goes directly to COL or it’s just a requirement where I can invest that into other funds, like PhilEquity?

For example, I put in 5k to open an account at COL, I can still use that 5k to invest or wala na? Thank you!

Ung 5k po ay gagamitin nyo din pang buy ng stocks or pang invest.

Hi, Kay. The 5K is yours not COL’s. It is just an initial fund required to open an account just like when you open a bank account you need funds to start it right? 🙂 You can use the 5K to buy stocks or buy shares of mutual funds. It’s your choice. Cheers!

Good day po may question lang po ako regarding sa Mutual Fund…

Scenario: nag invest ako nang 10K sa MF let’s say MF XYZ @ current NAVPS nya is 2 pesos den after 1 month nag invest ulit ako nnag 10K pero ang NAVPS na nya is 8 pesos..eto na ngaun yung question sa 2 beses ko na pag bili nang MF un bang average price ko nung una eh mababago.?kasi db 2 pesos lang sya nung una…thank’s in advance

miss Fehl , this march i want to invest in mutual fund, thru COL, but i dont know mutual i will buy, pls help ne, thank you so much.

Hi, depending on your investor profile, risk tolerance and financial goal, you can choose the mutual fund that suits you. Follow the guides here: http://dailypik.com/mutual-funds-philippines-guides-tutorials-tips/

Hi Fehl. Thanks for this article.

I want to know if i can use COL EIP in investing in Mutual Funds. If I invest in COL MF, can I also shell out a fixed amount every month like in EIP?

I am going to open a COL account and this is one of the things that confusing me 🙂

Thanks and hope to hear form you soon.

Hi, I don’t see any MF yet available for EIP however, you can use the strategy of EIP for Mutual Funds by buying shares of Mutual Funds every month with a fixed amount. It will also work as PCA method. Let me know if you have any more question 🙂 Cheers!

Hi Maam, Im a new to investment and started COL EIP. I encourage my two children to invest also and both of them started in Mutual Funds. Can you please explain how they can tap-up or add there existing fund.

Hi Ben. Great investment for your kids! Congrats! You can add up shares to your existing Mutual Funds buy buying more shares whenever you wish. Just check out the details for the MF you want. You can use our guide above or the guides on the menu above in buying mutual funds.

ms fhel, i wish to transfer my Philequity and FAMI MF to COL Financial Platform. How I do I go about doing this. Is there an existing service in COL. Or do I have to withdraw them and deposit to COL which I feel is too complicated for me. Thanks

Mam Fhel. Ano po ang pagkkaiba ng Mutual Fund at Philequity? Di ko pa po masyadong naiintindihan. Ty po

A Mutual Fund is what you call about the investment. Philequity is a specific type of Mutual Fund.

Nagdecide ako mag-invest just a while ago habang na sa work ako. Bali beginner talaga ako and medjo naguguluhan pa ko. I’m 22 years old. Mas maganda ba na mag-invest na sa stock o sa mutual funds? I’m really worried about taxes. I really want to do this but so confused at the same time.

Salamat sa tips and guides~

I recommend having both mutual fund and stocks to mix and diversify your portfolio. As they say, “do not put all your eggs in one basket”

Hi, would this mean that I do not need to submit forms to Philequity anymore because I have already bought shares on the website? Thanks.

Yes, no need to submit forms at Philequity anymore 🙂

what is the ideal mutual fund to invest that you can recommend

Hi Ms Fehl,

I am interested in investing in mutual fund. My only question is, how will I earn from it? For example, if I invest my 5k to a bond fund and hold it for 1 year period of time..what will happen next? Is it like stocks that you’ll just buy and sell it when the price goes up? Thanks

Hi. Who manages this? Does COL have a fund manager? Thanks

COL is only the broker. Mutual Funds are managed by their own fund managers. You can find out about their present fund manager at their site

Thanks Fehl. More wisdom for you. Thanks for sharing your experiences. I’ll share it too.

Thanks to this Fehl, very informative for us small investors. God Bless.

Hi Ms Fehl,Thank for your Informative page..I would like to ask the ff

1. I have 100K and I invested all at once in PhilEquity and 5K monthly would u think its good decision or Il divide into 5 and continue 5K monthly?

2. Hows the Redeeming will it be Via COL or u will contact PhilEquity as an option?

3. Would u still recommend getiing a UITF Equity link if u have PhilEquity already?

Thanks Again…

Hi Miss Fehl. I really like ur articles. Very helpful and understandable. GOD bless you! 🙂

hi! whats the difference between going out to the respective mutual funds to put in money, versus using colfinancial’s mf supermarket? does col charge management fees over the transactions above what wed normally encounter with dealing directly with the respective mutual funds?

i want to start investing in mutual funds. which one do you recommend? planning to invest 5k monthly for 2yrs. thanks and more power.

Hi. It depends on your Risk Tolerance and Objective as an investor. Tell me about those and I can suggest some for you

Thanks for the reply. I’m working abroad and I want to start something when I home already. What’s your bet for High Risk and medium risk? Why? More power and May the Lord shower you with a lot of blessings.

High Risk bit with great return, go for Equity Funds. Medium Risk go for balanced Funds. God bless!

I think after my 6 month subscription at TRC which I just started this month I”ll be going to stop the subscription because you are here already… 🙂

Clarification lang po, during shareholders meeting ng mga MF na eto via COL, are we entitled to join? Though di naman tlga ako umaattend, just to clarify things up?

Ty sa info dito Ms. Fehl. Very helpful.

Papatulong lang po kunti. Management fee is lower po sa sales load fee pag direct MF company. Do you recommend po top-up sa fund monthly or in lump-sum amount yearly in relation sa management fee?

Tsaka, may waiving of management fee ba COL pag more than 5 years investment like dorect MF funds na waived na ang back-end fee pag nag redeem?

TY po.

COL didn’t mention about the waive of fee like that of some MF companies that allow that if you keep your investments for 5 years or so. Sun Life allows that. Maybe you must contact COL about their rules with that

Hi ms fehl. Anu po magandang strategy s mutual funds? Can u share yours in a future article in Dailypik? Tnx

coming up soon 🙂

Hi Ms. Fehl! Thank you so much, your site is very informative! Just want to ask, in MF once I made my initial investment when can I make my additional? Do I have to wait for the holding period or can I buy shares monthly like in the Stocks?

Hi, you can make an additional as long as you want. It’s the same with stocks, you must have a goal and strategy considering your Risk Tolerance, too.

How to start an investment fund po mam?

Hi Miss Fehl,

I love your site!

Newbie lang din ako and i subscribe to TRC just to checkout what is in there. But parang same lang naman ng reco, and also sa COL stock picks. So do you think worth it pa rin ang pag subscribe dun (i am not into their wealth or powertalks and ebooks, ok na ako sa stock picks) when i can get it for free (thanks to you).

Now, i would like to check out the PinoyInvestor, i think dun mas detailed and they provide analysis from different stock brokers. Have you tried to subscribe from PinoyInvestor?

Thanks

Hi, Char. I was also a member of TRC before and I loved their Powertalks. Didn’t yet join PI because I get some stuff already from other brokers and financial groups which I also share here. Cheers!

Hi Fehl, in the COL video, they said we need to fill out a waiver form. But in your tutorial, we only have to click a waiver button. No need to print, fill out, scan, and email a waiver form? Please confirm, thanks.

You only need to waive IF you are investing MF that is not recommended in your Risk Profile. You just need to click the Waiver to Confirm. Yes, no need to print, scan or email

Mam Fehl thanks dito sa post mo. just wanna ask regarding sa mga fees. may account na kc ako sa philequity (pefi) mismo at meron dn ako sa col, anu po bng difference sa mga fees between pemi at col fund source. san po ba mas mababa ang fees, pemi or col fund source.

Thank po ulit. God bless

There is no entry fee with COL (as of this date) so you save a Sales Load here already 🙂 Seeing all our investments portfolio in one platform is very nifty

Hi, is there any minimum amount we can add on top of the initial investment? Thank you for this very helpful blog! ^_^

Usually the minimum additional is 1,000 but each MF has their own requirement. You’ll see the details once you type the code for the MF. We’ll add more review of each MF here soon

Salamat Ms Fehl. 🙂 sana po magpost din kayo ng topic about sample of a well balanced portfolio of stocks and funds. Saka kung anong fund ang pinakamaganda for example sa lahat ng index funds, alin doon masmagandang bilhin. Nakaka-inspire basahin and mga posts ninyo at parati kong inaabangan ang mga ito. Naeexcite ako parati tuwing may bago. More power to you po.

We’ll tackle those one at a time 🙂 Thank you!

Thank you so much fehl…godbless you always..helpful and easy to understand blogs as always.. 🙂