One of the best advice I share with people asking about the best mutual fund to invest in is “get to know first your risk appetite and goal.”

You cannot just invest right away, you must first decide these 3 things: your financial status, your risk appetite and your objective (goal) as an investor.

In this post, I’m gonna talk about choosing the best mutual funds according to risk appetite and objective.

Table of Contents:

Why is Risk Appetite Important in Choosing Mutual Funds?

Risk appetite is important in choosing any type of money investment, not just with mutual funds because every investor is different.

Every investor takes risks differently. Some investors are very conservative, others are very aggressive while some are in between.

Risk appetite is knowing how far you’re willing to invest your money knowing it’s uncertain if you will gain or lose.”

Therefore, you need to know it before you make an investment.

The most common mistake people do is investing their money without considering their risk tolerance.

Many people invest big money to the wrong mutual funds expecting big returns while others invest in equities without being aware of the big risks.

I remember someone who messaged me recently, “OMG, it’s been six months and I’m losing 20% of my money I invested in equity fund. What should I do now? Should I redeem my shares?”

It didn’t sound like that investor was aggressive. Surely, she invested in the wrong fund because she did not follow her risk appetite.

Why is Objective Important in Choosing Mutual Funds?

Because your objective is your goal. It’s the reason why you are investing in the first place.

You are investing because you want to earn more money through mutual funds.

Your goal is usually your target. You have this target period (short term or long term) on how long you want to invest your fund.

Best Mutual Funds According to Risk Appetite and Objective

Before opening a mutual fund, there are questionnaires to be answered to assess an individual what kind of investor he or she is.

The result will be kept as his or her investor profile.

Different types of mutual funds will then be recommended for the investor. He or she has the freedom to choose his or her investment choice.

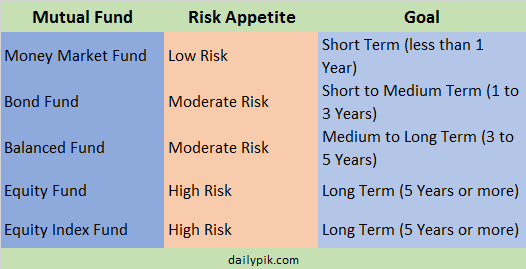

To guide us investors, here are the most common mutual funds that are available according to the risk appetite and goal of each person. Bookmark this page to use it any time.

If you are conservative, it means you can only take small risks. Then, you can start investing on Money Market Funds.

Money Market Funds are usually short-term government and corporate securities including SDA (Special Deposit Account) and Time Deposits.

These mutual funds are suitable for short term goal as you have the objective to preserve capital with small risk.

If you moderately conservative and can take moderate risk, you can invest on Bond Funds as these funds make money from bonds or fixed income instruments such as government and corporate debt securities.

Bond Funds are suitable for 1 to 3 year-term.

If you are in between conservative and aggressive, you can invest on Balanced Funds.

These funds are a mixed of fixed income instruments and shares of various companies listed on the stock market.

This means, Balanced Funds are suitable for Long Term (3-5 years) as it take time for them to appreciate in capital.

If you are aggressive, it means you are brave enough to take big risks and uncertainties. You can invest on Equity Funds or Equity Index Funds.

These funds are invested on various companies listed on the stock market.

Equity Index Funds are invested on shares of companies listed in the Stock Index (PSEi in our case).

These funds are suitable for long term goal (5 years or so) as it will take time for them to grow and appreciate in value.

Want to invest in mutual funds?

Head on the page below:

Mutual Funds Tutorials and Guides

Have any question about mutual funds? Share them in the comments.

Disclaimer: This content is for information purposes only and should never be considered as professional advice. Every investor has a different risk tolerance and goal. Always do your own research. All investments have risks. Risk only the money you’re not afraid to lose.

Ever since I came across DailyPik, i have been a fan. I’ve read your Mutual Fund Guide and I found it to be comprehensive. I would like to ask about what the Annual compounded growth rates are for Mutual funds. Thank you for making investing a lot simpler!

Hi, Ruel 🙂 Thank you for the feedback. I will share the growth rates in a separate page here soon.