In the last couple of years, the stock market has not been performing very good compared in the what they call the Golden Era of Equities, circa 2012 and 2013.

But then, it’s not a moment of celebration every day, especially not in the stock market and circa 2014. Everything kicked back in momentum as Duterte’s term was approaching.

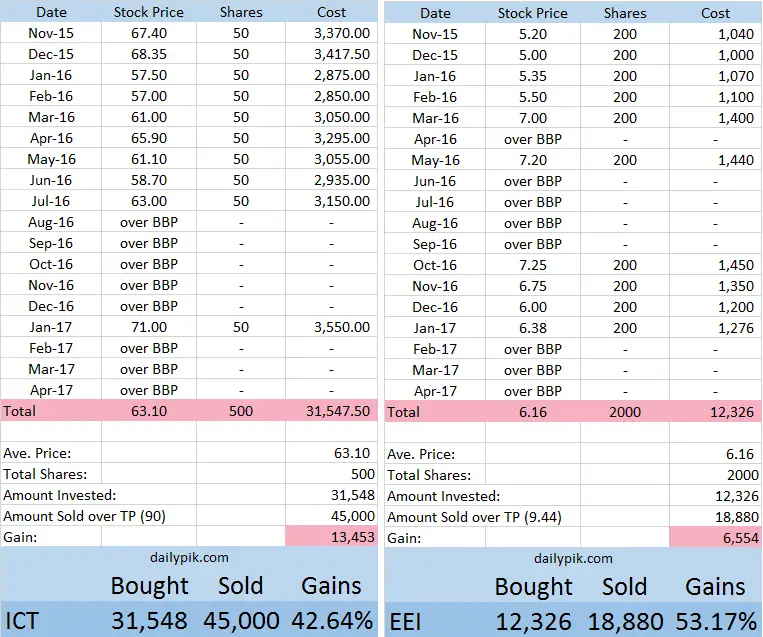

Since stocks were almost idle on those times, we decided to flip ICT and EEI before the Holidays of 2016.

One of the things I always do during Holidays is buy more stocks. Stocks like to dip before the Holidays and they go down before the year ends, come back up slowly as the new year started.

Having read some catalyst reports and market briefings, we took the positive outlook for Duterte’s term following the BBP and TP of the stocks we flip.

We cannot complain waiting for 18 months even if we did not know we would reap the money in 18 months.

20K money earned from ICT and EEI, even my favorite mutual fund did not reach a 42.64% and 53.17% gain yet. Not very much yet.

How We Got 20K Investing ICT and EEI

Following the BBP and TP, you would come close to this as well if you have invested ICT and EEI in 18 months. We did not less the few fees here.

Patience is one of best attitudes that I admire. Surprisingly, patience makes money, too.” – Fehl Dungo

Yeah, you can quote me on that one. 🙂

Hi mam, is it ok to buy EEI, during this COVID months?

Hi new investor here! Anyway, so I just checked out ICT’s stock chart and the 5 yr low is somewhere around 59 but then I guess you waited for the upturn before buying at 67 and those 18 months of uptrend.. that is awesome.. so my question is how to you spot speculative stocks like these ones? Of course, the undervalued stocks changes often over a the course of weeks so how do you decide to invest in such speculative stocks?? Thanks!

Hi, Aljon 🙂 Every person has different “take” on speculative stocks but for me I would count one as speculative if it’s a new one, or has a low price (below 10 on my own scale, again every person has different scale), and if it’s from a start up company. Speculative stocks have high risk so if you are a passive investor like me, I suggest you don’t prioritize them and only invest on them whenever you have spare time to speculate and research about the venture of the company. You ability to manage big risk must also be practiced. I personally hold speculative stocks for a year or less. Cheers!

THANK YOU! Ang bilis mo magreply .. nice! 😀

Haha I try to reply as quick as possible but sometimes life is hectic 🙂

Sorry I have just one more follow up question… I know that speculative stocks are high risk but you know if you have some extra money that you could manage to lose.. so the problem is how do you usually see those stocks is it fine to relay with your broker’s (mine is COL) info or do you like hover through many (like 20 or more) “other” stocks if you have your spare time? Thanks again!

Hi Aljon 🙂 Yes, it’s fine to rely on your broker’s advice or analyze the reports that they share. If you have 2 or more broker’s it’s very helpful. Data from WSJ, Bloomberg, MSN Money are very useful , too.

Hi Fehl, I found your website very useful and informative. As of now, I’m giving a shot to invest in stock market in small amount. What advice can you give as a newbie? I recently read your blog regarding SMPH and I think I go for it and invest for long time, Other than SMPH what stock should I buy with a small amount. Thank you and god bless.

Hi Ms. Fehl,

I’m still holding EEI and currently at 60% gain already. Do you have a new TP for this stock? Don’t know if I should continue to hold or sell it already.

Many thanks!

Hi, Anne 🙂 We already reached the TP for EEI. I recommend checking for any dividend this month, if wala then I recommend selling na and just buy another stocks

Hi mam fehl i do want to learn more about investing. Need your advice. Pls pm me gabriel anthony batucan

Thank you

Hi, Gabriel. You can check out our guides here at the menu above 🙂 Cheers!

I want to say thank you to you, Ms. Fehl! Buying ICT stocks was the best decision I ever made. I admire your list of undervalued stocks. I had a total gain of 27% after ICT hit its TP. May God continue to bless you!

Wow, congrats Arlo! So happy about your gains, too. I’m sure madami pang kasunod yan 🙂

Hi Ms Fehl! I would like to ask if should I wait for the buy below price of blue chips before starting to invest or i can start and buy anytime at the current price even if it’s above BBP? Thank you!

Hi Ms. Fehl, may i know what day you usually buy your stock picks? Is it advisable to buy same day every month? Or do u use any charting tool to check if it is good price to buy?

Thank you for sharing and More Power.

Hi Ms. Fehl, Congratulations, I am impressed!

Thanks Riaz. I’m about to sell CEB soon too 🙂

Hi Ms. Fehl,

Another good read. I am following your blog from quite a while now and got motivated to also invest using the above method and I can say that it really work as long as you follow the strategy. I just want to get your opinion regarding TP and Dividends. Is it wise to still wait for the dividends even if the TP is reach? Or should i disregard the upcoming dividends and sell it? Please share the link if you already have discussed this topic in your previous blog.

Thank you in advance.

Hi, John. There are 2 answers here:

1. If it’s not a blue chip stock – Well you have to consider how much you would get for the dividends. If it’s not much, you can sell your stocks at the TP. Stocks are slow to move up now these days that’s why I suggest that. You can then buy any from the Fantastic 5 stocks (prioritize blue chips) and follow the TP.

2. If it’s a blue chip stock – wait for the dividends and you can then do whatever you want 🙂

Hi Ms. Fehl,

I want to know your opinion regarding TP/FV, My situation is this:

I bought a stocks before with a target price of 5.00 pesos, But now the target price was increase to 5.44. Should I also adjust my TP base on the updated value or should I still follow the old TP? It will soon reach 5.00. I will really appreciate if you can give some advice Ms. Fehl. Thanks again in advance! 😀

Hi John 🙂 If you are following our data here, you must also follow the new adjusted TP

In that case, it means more money for me! Thanks for the guide Fehl! You are heaven sent for a noob investor like me! 😀

Always my pleasure, John 🙂