The stock market performance has been very disappointing in the last few weeks and it may worsen as interest rates threaten to climb.

Who knows what will happen as we come closer to the next election. The risks are immortal but we should never lose our cool.

Keep calm and don’t worry too much. Stick to your stock market strategies.

Our Magic 10 stocks are excellent stocks and we have chosen them carefully.

Focus on the potentials and beat the challenges. Investing slowly every month using our Magic 10 stocks following our long term goal will reward us in the end.

We started 6 months ago here and there will be more challenges that will come along.

If you quit now, this is not for you.

Investing in the stock market doesn’t only require time and money, we need to invest courage, too.

We only just begun and lower prices of stocks must be an opportunity to gain more in the end.

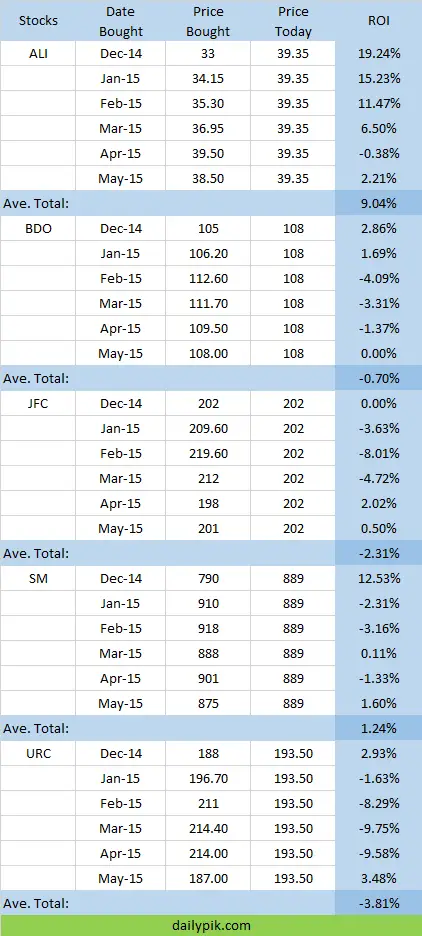

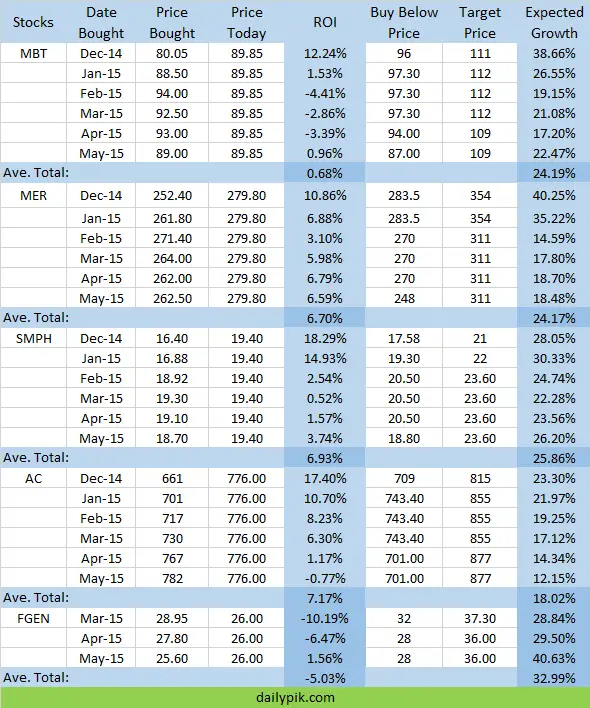

Stocks Earnings Report May 2015

How are our stocks so far today, June 3, 2015.

Fantastic 5 Stocks:

We keep on holding our AC until it reaches its TP although it may not come anytime soon.

Keep on buying FGEN. SMPH, MER and MBT all have positive feedback so we continue keeping them until the bullish period comes back. We made 16.45% gains and an average of 3.29% taken into account the 5 stocks.

Big 5 Stocks:

In spite of the disappointing market, we still made gains and earned from some dividends, too. We gained 3.47% giving us an average of .69% taking into account the B5 stocks.

Cheers! BTW, we will be adding posts about Mutual Funds in the coming days too. You can find them here: Mutual Funds Guides and Tips

Hello Ms Fehl. It’s me again. May I just ask, if my plan for BDO and URC are for long term investing, say 5-10 years, is it still economical or will you still recommend to buy shares monthly eventhough they already exceeded their Fair Market Value Price?

A newbie here.

Thanks for ur reply.

Hi Weendy. If your strategy for them is really long term following PCA method, yes, BDO and URC both have strong potentials in terms of investing for 10 years. Buy regularly, stick to it, let them grow, receive dividends…and sell them after 10 years.

If you are into Flipping method, then flip them shares and lock in gains by selling your shares.

APPEALING pa BA SECB? it is at all time low nanaman im thinking of buying more

“Stick to your Stock Market Strategy for Long Term Goal

BY FEHL” As the title suggests. 🙂

It’s already above our BBP so stop buying or hold your shares

Hi Fehl,

Thanks for the pep talk. We should definitely stick to our long term goals and look at this as an opportunity to buy more stocks.

Hoping things will pick up soon enough!

Thank you Christine. Happy to see your comments. Yes, we must spend our time with other stuff, our stocks will grow eventually 🙂 Cheers!

Hi Fehl. Thanks for your blog. It really helps a lot. I have bought stocks from ALI one month ago but the price seems going down lately. Now it’s getting boring so I want to play a little bit and am thinking of trying scalping/swing trading for a few days, do you think this is advisable? (I have a spare 15K to do this). Thanks

Well if you’re so aggressive and you know how to do it and that’s what you really want, then go for it. It’s your choice 🙂

“In this world we have to take chances, sometimes they’re worth it and sometimes they’re not. But I’m telling you now, you will never know UNTIL YOU TRY!”. Take every risk, drop every fear. by Donald Trump. Good luck! 🙂

Yes 🙂 Thanks for that wonderful quote, Mon.

Hello Ma’am Fehl,

Ask q lng kung ano po ang assessment nyo about sa bagong product ng Sun Life which is

the Sun Life Prosperity Philippine Stock Index Fund?

Plan ko po mag invest sa Philequity Fund but nung makita ko po itong bagong fund, nagdadalawang isip nman po ako. Pls. enlighten me.

Thank you po.

Hi. I like it coz it tracks the PSEI. Philequity also has the same MF called Philequity PSE Index Fund. As long as you would go for 3 years or so, Equity Funds would work for you

Hi fehl,

I read an article before about stocks when the national election is coming. Does it really going down 1 year before the election. Mas bumababa pa sya pag palapit ng palapit. Dahil ba magbabago na ang administration magbabago rin flow ng stocks? Ano ang katotohanan? 🙂 or speculation lang yun? my chart din na nakalagay dun na bumababa nga tuwing election.

Hi. Yes, it usually goes down before the election because there are no new official leaders yet, thus no stability in the government. That would make investors wait before they invest or open new businesses

Hi Fehl,

I love your blogs and thanks a lot for exerting efforts on this because thru this I now learned my lesson in investing Stock Market. Actually, I started investing stocks since 2009. My stocks before are FGEN, MER and MPI. I’ve already gain with FGEN and MPI through flipping method but unfortunately MER stocks I lost something about a thousand pesos due to I was panicked so I sold my stocks in MER but Oh my Gosh after few months it zoomed like a rocket…Halos every month gyod siya tumaas…Actually, I purchased the stocks of MER it was just a 105.00/share and now how much is the price.

Thanks a lot for your effort. May GOD Bless you always!

Thanks MC 🙂 Wow, your emotions got you but at least you learned something from that experience. MER is one of the biggest firms here and it is into expanding its power capacity that could double its earnings in 5-7 years from now. Still waiting to reap our gains here but definitely it won’t be gone from our Watchlist 🙂

Good news MER…