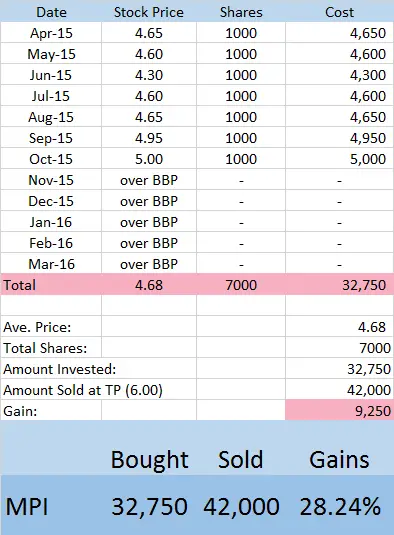

This is how we earned 28.24% by investing MPI stocks. MPI is among our recommended Blue Chip Stocks and was among our Undervalued Stocks here in Dailypik.

We are very happy because we exceeded our expectation for MPI as our estimated revenue for it was only around 20%.

Before we discuss here how we made that profit, let us first have a brief info about why we like MPI.

Table of Contents:

Why we Invest with MPI?

MPI (Metro Pacific Investments Corp.) is headed by billionaire entrepreneur Manny V. Pangilinan.

Right now, MPI is included in the PSEI listed companies.

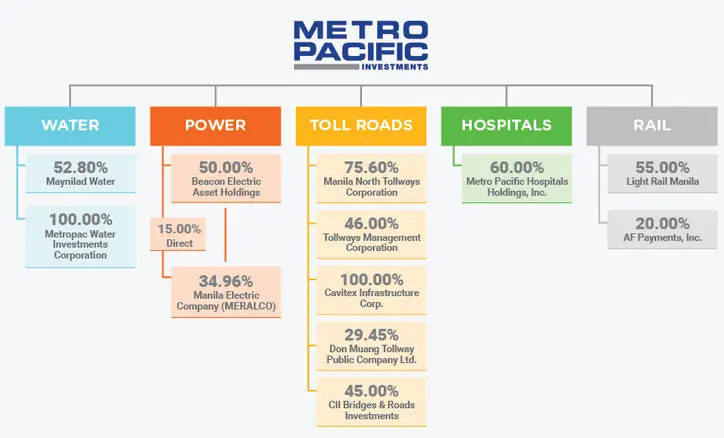

It is a holding company for investments in water utilities, toll roads, electricity, hospitals and light rail.

To sum up, check out below the businesses MPI is involved with:

Reasons Why We Invest MPI Stocks:

- It is among the best blue chip stocks in the Philippines

- It is under our recommendation of BPPI stocks (Bank, Power, Property, Infrastructure)

- It is the leading Infrastructure holding in the country

- We love recurring income, at a 5-quarter trend as of September 2015, MPI had 9.36 billion in Sales Revenue (source: Wall Street Journal)

How We Earned 28.24% Investing with MPI

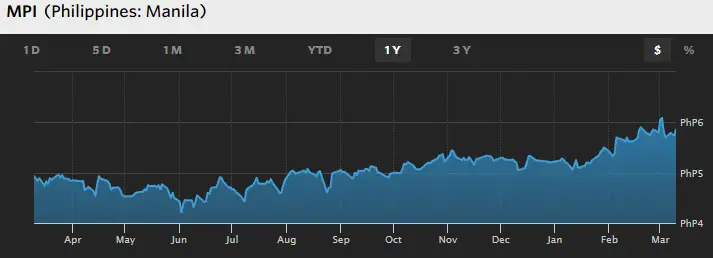

Patience is not only a virtue, it also makes more money. We have started with MPI many months ago and while the stock market was swinging up and down, it was taking so long to reach our target with our stocks.

Many stocks tanked and went below their BBP again.

But with consumer companies like JFC and MPI, the effect is not always tantamount.

MPI Stocks Forecast

Even though we have reached our Target Price of 6 for MPI from our Undervalued Stocks list, we expect it to reach as much as 6.52 this year.

We are still confident with MPI, having recurring income from its businesses, population growth will also contribute to its positive progress.

We are done flipping with MPI for now but we also recommend it for those who do PCA method.

To end this, I’d like to share one of my favorite quotes related to MPI,

Build more bridges instead of walls”

It’s the same with investment and business, you have to expand more opportunities than limit yourself to one.

Happy investing! Don’t forget to subscribe, it’s free!

hi is it okay to try buying shares of MPI using PCA or flipping method… I am a newbie pero based on your posted article i can see a big potential in MPI ..please reply

Both method would work depending on your target or goal 🙂

I bought 30,000 shares of MPI at around 4.87

Planning to Add more if it goes down below 4.50 again. Is it good position for me mam fehl?

hi ma’am fehl? pwede bang iconcentrate ko ang PCS ko sa mpi alone? good way ba to o bad way? in what way? thanks

Good eve miss fehl! I just want to ask why stocks like meg never break their ceiling price or move very slowly? I just invested 500 shares in MEG then before it reached the BBP. Is MEG expected to rise anytime soon? And another thing, are the fantastic 5 good for long term?

Hi ms Fehl,

I just approve my COL account this week, can you help me provide best recommend to buy blue chips company from may to August 2016. Thank you in advance.

Hello Mam fehl i invested at col financial with 24 companies but i decided to focus on the magic ten that you recommend. Please guide me on how to do the flipping on stocks and where to find your current buy below price .on stocks

Hello Ms. Fel,

I am a newbie in buying stocks and one of my initial buy is MPI at 5.81 & CEB at average of 88.7. What would you think is a good TP for selling my purchase and about how long will it take to reach that appropriate TP? Lastly, I would like to ask if it is good to apply PCA for these 2 stocks. Thank you.

good day Ms. Fehl newbie lan po ako dito sa stock market.Madame na po ako nabasa dito and madame ako natutunan. For my first 5k i bought MEG, nalala ko kc c Bro Bo which is a undervalued stock. I want to try flipping first with this stock. As i can see mas mababa ang investment and mas madame akong mabibili na stock mas mabilis and ROI.Kc base on what i observed if meron akong 10,000 na share dito sa MEG, tumas lng ng .10 ang market price kita agad ako ng 1k. Kesa po sa mga stock na 100+ per share which is konti lang mabibili ko mabagal din usad ng pera. Sa tingin mo mis Fehl tama ba ginagawa ko? kc habang inaantay ko bumaba ng husto ang mga presyo ng mga Blue chips stock flipping muna ako at ung kikitain ko dito invest ko dito sa mga big companies. sa tingin mo ms. Fehl am i on the right track?

Hi Fehl, Do traders have a chatbox? may i know if theres any..Nwe as i have observe this past two days. VITA and NOW prices increased enormously. How do traders identify this specific stocks? Is there some kind of group that signals to create demand in a certain stock? tnx.

Hi Ms.Fehl. Am a newbie in investing in the stock market and I really find this site very helpful to me. Thanks to you. I just have to ask your advice though. My fiancé and I decided to invest at least 10k a month to buy stocks starting this month but we’re planning to sell some of it by December as support for our wedding. What do you think is the best strategy we can do and what company stocks is the best to buy today? Your insights will be very much appreciated. Thank you!

if you have a wedding to plan, dont invest since this is for long term. you wont get any high gains especially since you are a newb.

Hi Fehl,

I just started investing using PCA method. I bought URC share but since the price is high, i only got 40 shares with my P10,000. In your opinion, do u think it’s better to buy stocks with lower price like MPI rather than AC, JFC or URC if i plan to hold it for 5 years?

Thanks!

Wow nice pick Ms. Fhel, Sayang at hindi ako nakabili ng stock ng MPI.

Hi miss fehl, among the big 5 companies you suggested(bdo urc,jfc,sm,ali), gusto ko po kasi pumili ng 2 companies lng for peso cost averaging, ano po ba yung suggestion nyo? Thanks po

Hi, all Big 5 stocks are great for PCA method. In my personal approach, I put BDO and URC on my priority then ALI, JFC and SM

Hi Ms. Fehl, thank you for sharing this. I’ve read some of your blogs here and find them very informative. I’m a newbie in stocks investment though I have knowledge about stocks back in college. Now I started investing into 4 different stocks. I just got curios of the PCA method you mentioned. Can you please explain more about this?

Thank you.

Hi, Angel. Thanks for visiting. PCA is Peso-cost-averaging method. It is investing a premium stock or blue chip stock periodically for long term. Here’s the article I shared about PCA: http://philpad.com/what-is-peso-cost-averaging-and-how-does-it-work/